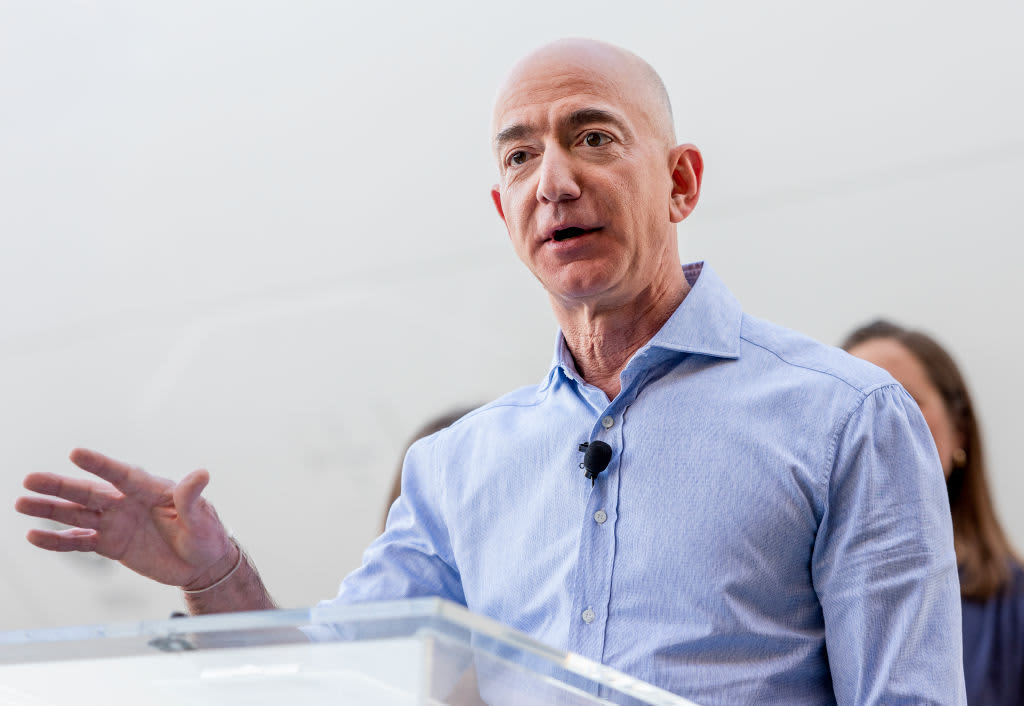

Jeff Bezos, founder and CEO of Amazon, speaks to a group of Amazon employees that are veterans during an Amazon Veterans Day celebration on Monday, November 12, 2018.

Leonard Ortiz | Digital First Media | Getty Images

Jeff Bezos would owe $5.7 billion in taxes for 2020 under the Ultra-Millionaire Tax Act proposed by a group of Senate and House Democrats on Monday.

Sen. Elizabeth Warren, D-Mass.; Sen. Bernie Sanders, I-Vt., and others unveiled their proposed wealth tax Monday, saying it would raise trillions in much needed revenue and help reduce a wealth divide that has only grown wider during the pandemic. The tax would be a 2% annual levy on wealth over $50 million and 3% on wealth over $1 billion.

Warren said the tax would only affect the wealthiest 100,000 American families — or the top 0.05% — and would raise about $3 trillion over 10 years. She said the added revenue would go to help pay for child care, education infrastructure and clean energy. It is essentially the same tax that Warren championed during her campaign, when the slogan “two cents” became a popular rallying cry at her rallies among those who supported the tax. Warren often argues that since the wealth tax rate is 2%, “it’s only two cents on every dollar after $50 million.”

Accelerating wealth gap

Warren said the tax is even more urgent during the Covid crisis as it has exposed and accelerated America’s wealth gap.

“We do understand the direction we’ve been going. This pandemic has created more billionaires. The people at the top are not barely hanging on by their fingernails,” Warren said on CNBC’s “Squawk Box” Tuesday.

Critics say the tax may not be constitutional and would be easily gamed by the wealthy. Most European countries have abandoned wealth taxes since they raised less revenue than expected and were easily avoided by millionaires and billionaires.

“The lesson from other countries’ experiences with wealth taxes should serve as a warning that the U.S. should avoid adopting one in the first place,” said Erica York of the conservative-leaning Tax Foundation. “A wealth tax would be plagued with many administrative and compliance problems as well as avoidance and evasion issues. It would be an enormous administrative challenge to implement, and it is not clear, even with more resources, that the IRS would be able to collect a wealth tax efficiently.”

To combat evasion, the Ultra-Millionaire tax would provide $100 billion to the Internal Revenue Service for stronger enforcement. It would also include a 30% minimum audit rate for households with $50 million or more in assets, as well as new technology tools to help the IRS value hard-to-appraise assets like art or real estate. For those who would seek to move to another country and renounce their citizenship to avoid the tax, the proposal also includes a 40% “exit tax” on those who try to leave.

“The implementation part is really a lot easier than it looks,” Warren said. “We learned from some of the mistakes they made in Europe. This version of the wealth tax covers all of your property. It doesn’t matter if it’s held in stock or in real estate or in racehorses. Everything is covered so there’s no point in moving property around. Also wherever you hold, it is covered, whether you hold it here in the U.S., whether you hold it in the Cayman Islands.”

Billionaire tax bills

About half of the revenue from the tax would come from billionaires, who Warren said had added more than $1 trillion to their wealth during the pandemic. According to calculations from the Institute for Policy Studies, Jeff Bezos, the world’s richest person, would owe $5.7 billion in 2020 under the Ultra-Millionaire tax. He still would have been left with a net worth of more than $185 billion after the tax, according to the analysis.

Elon Musk would owe $4.6 billion in 2020, and would still have a fortune of over $148 billion at the end of the year. Bill Gates would have to pay $3.6 billion for 2020 and Mark Zuckerberg would have to pay $3 billion.

“The wealth tax on billionaires alone would fund almost three-quarters of President Biden’s entire $1.9 trillion pandemic rescue package, currently pending before the Senate,” said Chuck Collins, director of the Program on Inequality of the Institute for Policy Studies.