Pursuing financial literacy is something that should continue beyond traditional school years, according to several state governors.

“We think it’s a lifelong experience,” New Jersey Gov. Phil Murphy told CNBC’s Sharon Epperson during Wednesday’s event, Invest in You: The Governors Strategy Session on Financial Education.

Gov. Steve Sisolak of Nevada agrees about the importance of financial literacy.

“It’s a skill that’s necessary for your entire life,” he said. “We have to approach it more long-term in that regard.”

State of personal finance education

There are no federal guidelines for personal finance education in schools, meaning it’s up to individual states to set their own rules. And there are 23 states that mandate a personal finance course for students, according to the 2022 Survey of the States from the Council for Economic Education.

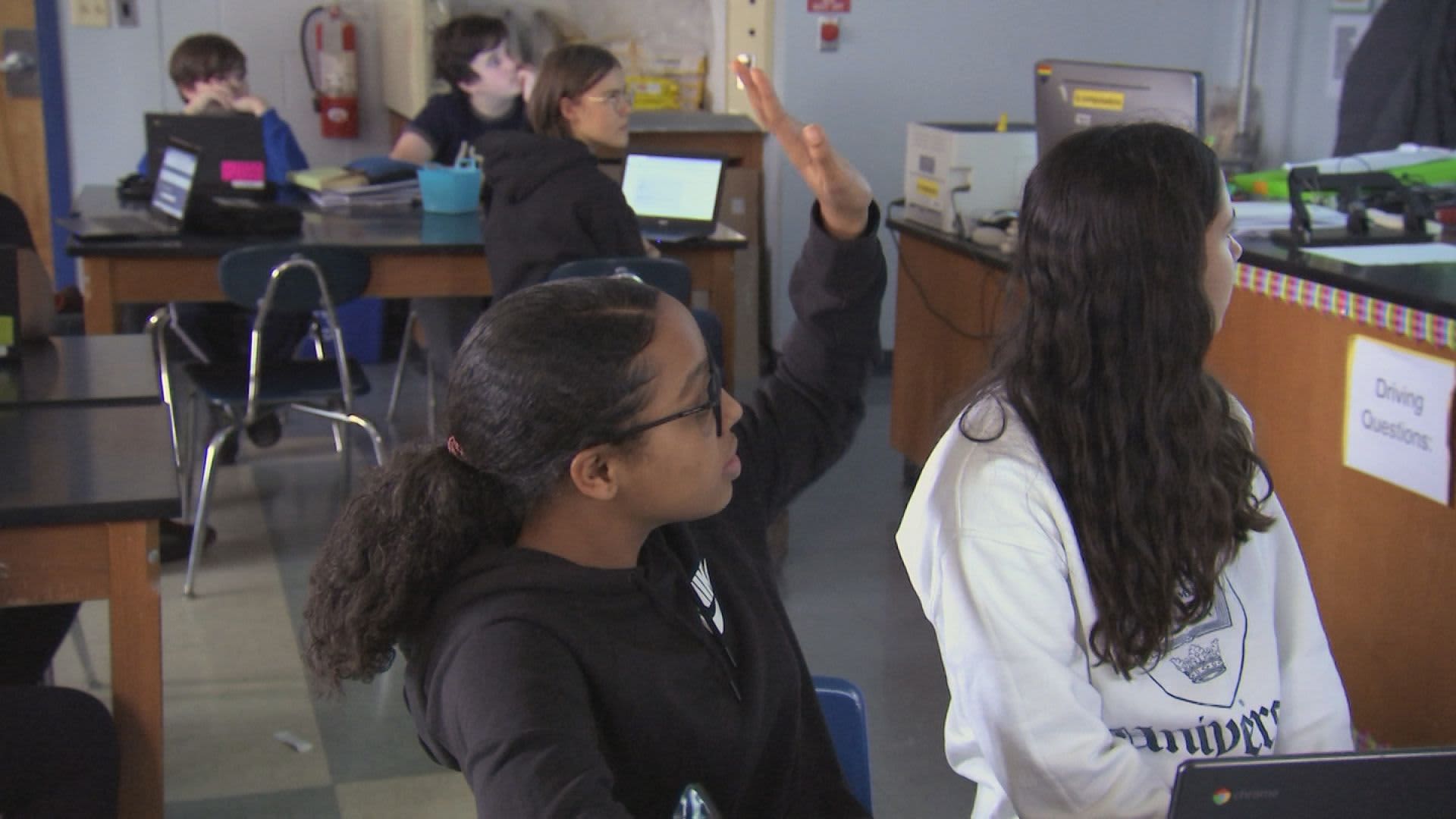

In New Jersey, personal finance education is taught in middle school, and classes in financial, economic business and entrepreneurial business literacy is required to graduate.

“You need to get to folks while they’re young, and that’s the animating reason behind getting financial literacy education into our middle school curriculum,” said Murphy, a Democrat.

More from Invest in You:

Want a fun way to teach your kids about money? Try these games

Inflation fears force Americans to rethink financial choices

Here’s what consumers plan to cut back on if prices continue to surge

Nevada students are taught about personal finance topics as a part of social studies class, generally starting in grade 3 and going through high school. In Mississippi, beginning this year, a college and career readiness class that includes personal financial education is required for high school graduation.

“Each state has to make their own decision and their own priorities as to what classes are most appropriate for their young people,” said Mississippi Gov. Tate Reeves, a Republican. “But I am absolutely convinced that a fundamental understanding of finances is incredibly important to one’s ability to be successful in life.”

That also means that states can change their guidelines as they see fit.

“A mandatory class may be the next step we go to,” said Sisolak, a Democrat. He added that it’s important to have such curriculum in schools because many students can’t get financial education at home from their parents, who may also fall short on financial literacy.

Beyond school

The state governors agree that one of the reasons it’s important to have personal finance curriculum in schools is because many students’ parents can’t teach them about financial literacy at home or simply aren’t talking about money enough.

New Jersey is also offering residents access to more personal financial education outside of school. Murphy announced today, during the CNBC event, that the state has launched NJ FinLit, a financial wellness platform.

“Financial literacy is incredibly important for Americans to secure their personal financial footing, to be better positioned to provide for their families and set themselves up for future success,” Murphy said.

The platform was developed by Enrich and is powered by San Diego-based financial education company iGrad. It includes personal finance courses on several topics, including budgeting, saving, retirement, student loans and has real-time budget tools, as well. It is free for all adult New Jersey residents.

States have also made sure that educators have resources for professional development to keep up with the ever-changing financial environment and field questions about things such as meme stocks and cryptocurrencies.

Mississippi offers a master teacher in personal finance program and coaching.

“The best way for a kid to get a quality education is to have a quality teacher,” Reeves said. “You have to continuously have continuing education for personal finance teachers just like you do for English, math or any other subjects.”

What’s next

Of course, each state has areas in which they could improve their personal finance education offerings for students, training for teachers and resources for adult constituents. And each state will likely come up with individual solutions and offerings for their residents going forward.

Many states are moving forward with legislation mandating personal finance education for their students. There are currently 54 personal finance education bills pending in 26 states, according to Next Gen Personal Finance’s bill tracker.

While various states’ approaches may differ, the governors agreed during Wednesday’s event that personal financial education is an important investment in the future success of residents, especially children.

“We have to get kids in the shallow end of the pool before we drop them into the deep end,” Sisolak said.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

CHECK OUT: 74-year-old retiree is now a model: ‘You don’t have to fade into the background’ with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.