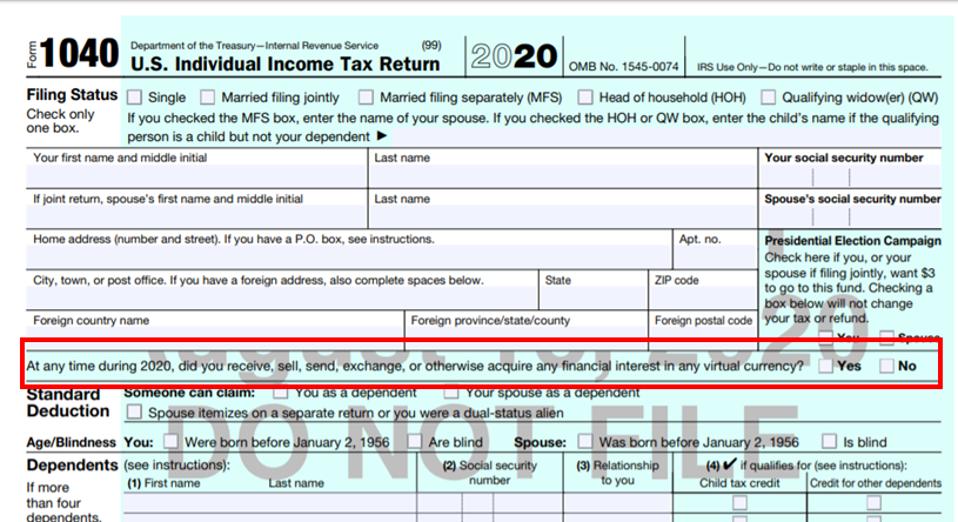

On August 18, 2020, the IRS released the draft Form 1040 for the 2020 tax year. As you can see in the snippet below, the controversial virtual currency question (At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?) the IRS first introduced for the 2019 tax year has been moved from Schedule 1 to the front page of the Form 1040.

2020 Draft Form 1040

Shehan Chandrasekera

2020 draft Schedule 1 no longer has the virtual currency question.

Schedule 1 – 2019 Vs. 2020

Shehan Chandrasekera

Although the IRS has not yet publicly commented about this proposed change, this move shows IRS’s ongoing effort in getting more data on US virtual currency & cryptocurrency users. Currently, not every taxpayer has to file a Schedule 1 with their taxes. Schedule 1 is for taxpayers who have to report additional income (other than W-2 income) and make certain adjustments for that income. Currently, If you don’t file a Schedule 1, you do not have to answer the virtual currency question. However, by adding the virtual currency question on page 1 of the tax return, everyone who files a personal tax return for the 2020 tax year will have to answer the question.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.