IRS privacy coin crackdown

Shehan Chandrasekera

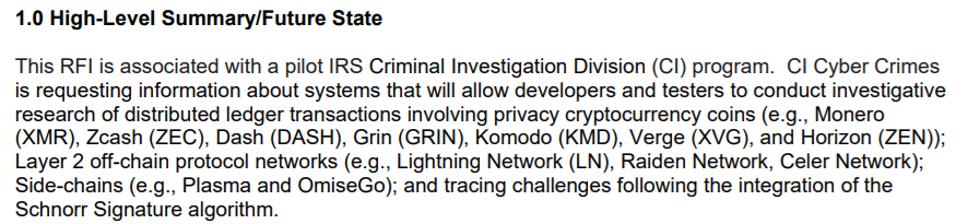

2020 has been a year with a lot of turmoil but regulators’ attempt to crackdown on cryptocurrency has not slowed down whatsoever (350,000 Aussie Crypto Users Are Receiving Tax Warning Letters, The IRS Is Hiring Consultants To Crack Down On Cryptocurrency Tax Evasion). A new listing posted on the government’s official contracting website on June 30, 2020, shows that the Criminal Investigation Division (CID) of the IRS is hiring private contractors to get more visibility into privacy coins transactions used in illicit activities. According to the request for information posted, the CID is looking for technological solutions that will help trace privacy coins, layer 2 off-chain protocol networks, and side chains.

Snippet from RFI – Pilot IRS Cryptocurrency Tracing

Shehan Chandrasekera

What Are Privacy Coins?

Privacy coins like Monero, Zcash, Dash and others allow execution of fully anonymous transactions. This in contrast to cryptocurrencies like Bitcoin, which are not anonymous. Privacy coins achieve varying degrees of anonymity by obfuscating the transacted amount, wallet addresses, identity of both sender and receiver, and the transaction trail. Full anonymity is sometimes abused for illegal activities such as tax evasion, money laundering, and other non-financial crimes. However, it is important to note that these functions are also used in perfectly legitimate activities as well (e.g. anonymous donations to charity, individuals who simply want to transact anonymously, etc.). Remember that cash also is an anonymous method of transacting used at scale every day.

Snippet from RFI – Pilot IRS Cryptocurrency Tracing

Shehan Chandrasekera

Based on the RFI posted, IRS will use software created by private contractors to obtain more information on suspicious activity. The deadline to respond to this RFI is July 14, 2020 and private contractors are encouraged to submit bids through emails.

The language of the RFI suggests that the information is gathered to specifically capture illicit activities and/or test suspicious activity already reported by various agencies. Also, speculators who trade privacy coins should report their gains and losses for tax purposes without being under the false impression that regulators will not know about that activity.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.