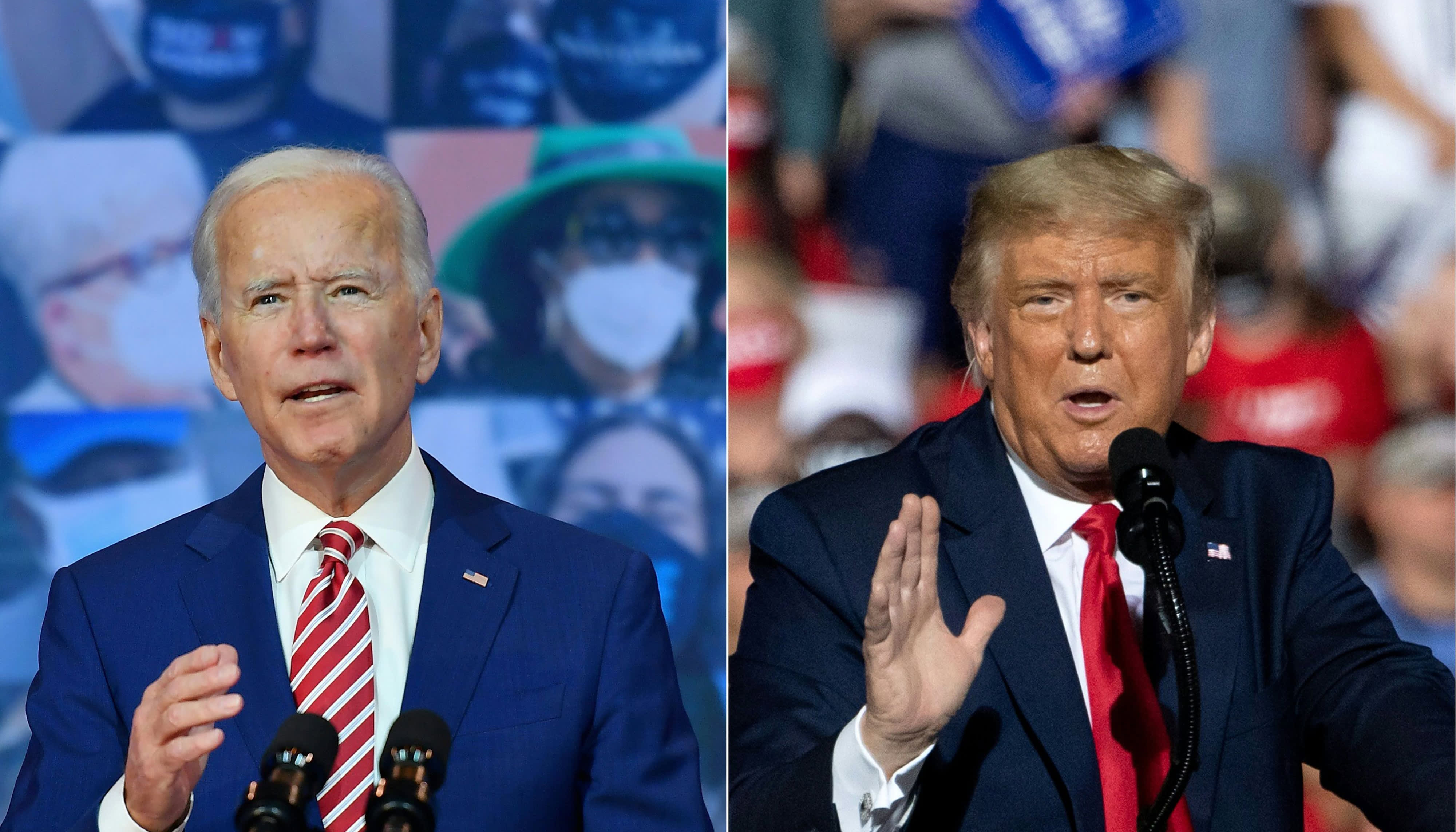

Democratic President-elect Joe Biden delivering remarks on Covid-19 at The Queen theater on Oct. 23, 2020 in Wilmington, Delaware and U.S. President Donald Trump addressing supporters during a Make America Great Again rally in Gastonia, North Carolina, Oct. 21, 2020.

Getty Images

Wall Street investors largely believe a Joe Biden presidency could mean lower stock-market returns, according to a new CNBC survey.

As a part of CNBC’s Quarterly Report, we polled dozens of investors, traders and strategists about where they stood on the upcoming year for stocks under a new administration.

Two-thirds of the respondents said the first four years of Biden will be worse for stocks than Trump’s term.

Since Trump’s inauguration in January 2017, the S&P 500 has rallied more than 60% thanks to the president’s landmark corporate tax cut that led to a surge in profits and a record in share buybacks. The Trump administration has also relaxed many regulations over the last four years, creating a market-friendly environment for oil and other industries.

Many investors worry that a reversal of the tax cut, which Biden has pledged, could take a big bite out of earnings at a time when market valuations are sitting at multi-year highs. Meanwhile, Biden’s tax plan calls for raising capital gains rates for high earners.

While investors believe Biden’s policies could create headwinds for the overall market, some sectors would fare better than others. Consumer discretionary, industrials and financials will perform the best under a Biden administration, according to the survey.

Meanwhile, utilities, consumer staples and energy could have a hard time outperforming during Biden’s presidency, the survey said.

Dow to hit 35,000?

Still, Wall Street is optimistic that the Dow Jones Industrial Average will reach new highs next year.

Two-thirds of the survey respondents said the blue-chip benchmark will most likely finish 2021 at 35,000, which represents a roughly 16% gain from Thursday’s close of 30,199.87. Meanwhile, 5% of the respondents believe the gauge could climb to 40,000 by the end of next year.

Ten percent of the investors said the Dow will fall to 25,000, while 18% of them said it will dip to 30,000.

The 30-stock Dow has wiped out the pandemic-triggered losses and hit new highs before the year-end, but it has lagged significantly behind the Nasdaq Composite tech benchmark, which has soared more than 42% this year.

Buy bitcoin

These investors and strategists were also asked which new investment — options contracts, bitcoin or special purpose acquisition companies — will their clients tap into in 2021. The majority (58%) said SPACs, 33% said bitcoin and 9% said options.

There has been a SPAC craze on Wall Street this year with funds raised via blank-check deals totaling a record $70 billion, a remarkable fivefold increase from last year. The head-turning growth came amid heightened market volatility caused by the pandemic. Involvement from high-profile investors including hedge fund billionaire Bill Ackman also brought more hype to this alternative vehicles.

Bitcoin emerged as 2020’s surprise winner, topping all of the major asset classes from stocks to bonds to commodities. The world’s largest cryptocurrency broke above $20,000 for the first time ever this month, bringing its 2020 advance to more than 180%.

Many attributed the head-turning rally to major involvement in the industry from the likes of Fidelity Investments, Square and PayPal. Interest from high-profile investors such as Paul Tudor Jones and Stanley Druckenmiller also helped boost the digital coin.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.