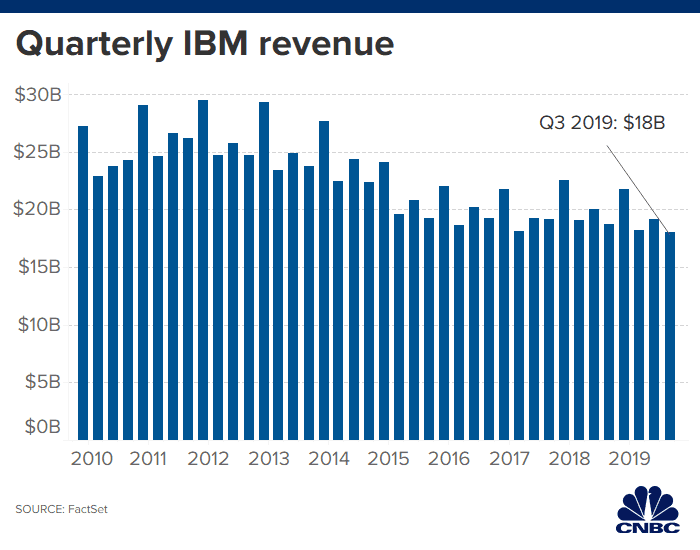

IBM shares moved 5% lower after the company issued weaker-than-expected third-quarter revenue on Wednesday.

Here’s how IBM did:

- Earnings: Excluding certain items, $2.68 per share, vs. $2.67 per share as expected by analysts, according to Refinitiv.

- Revenue: $18.03 billion, vs. $18.22 billion as expected by analysts, according to Refinitiv.

IBM’s revenue has now dropped for five straight quarters as growth in the company’s cloud business hasn’t been able to make up for declining sales in its services, hardware and financing businesses. Revenue in the third quarter fell about 4% on an annualized basis, IBM said in a statement, even with contributions from Red Hat, an acquisition that closed in the third quarter. Red Hat revenue grew 19% in the quarter on a normalized basis, up from the 14.8% growth in Red Hat’s last quarter as an independent company. IBM’s revenue has now gone down for the fifth consecutive quarter.

IBM’s biggest segment, Global Technology Services, which includes technology support services as well as infrastructure and cloud services, came up with $6.70 billion in revenue. That’s down 5.6% from the year ago period and just below the $6.75 billion consensus estimate among analysts surveyed by FactSet.

The GTS segment saw lower customer business volumes than IBM had expected in the quarter, finance chief Jim Kavanaugh told analysts on a conference call with analysts. “That is high-value, high-profit, and when it hurts you at the latter part of the month,” Kavanaugh said, “it definitely falls to the bottom line.” IBM will have to improve its execution, he said.

IBM CEO Ginni Rometty

Andrew Harrer | Bloomberg | Getty Images

The Cloud and Cognitive Software unit — including Red Hat, as well as cloud and data platforms, cognitive applications and transaction processing platforms — had $5.28 billion in revenue, up 6.4% but under the FactSet consensus estimate of $5.43 billion.

The company’s Global Business Services business, comprising includes application management, consulting and global process services, produced revenue of $4.12 billion, up 1% and in line with the FactSet consensus estimate.

Systems revenue came out to $1.48 billion, which is shy of the $1.52 billion mean FactSet estimate and down 14.7%. IBM pointed to the end of the cycle of the z14 mainframe computer.

IBM said cloud revenue, at $5 billion, was up 11% in the quarter. “We are growing value in key high value areas around cloud, around data and AI, around digital, and around security,” Kavanaugh said on CNBC’s “Closing Bell” on Wednesday.

In the third quarter, IBM lowered its full-year earnings estimate to take into account the impact from Red Hat, pointing to the suspension of share buybacks, an adjustment to the balance of deferred Red Hat revenue and equity and retention costs. The company announced deals with AT&T, Avaya and the Bank of China, and it introduced the z15 mainframe.

“We think the combination of new products should enable the company’s Systems segment to revert to growth in CY20 following recent declines (wind down of z14 cycle),” Evercore ISI analyst Amit Daryanani, who has the equivalent of a buy rating on IBM stock, wrote in a note distributed to clients on Monday. “Assuming the z15 will be consistent with prior cycles, we think this positions IBM for solid y/y growth in CY20 (strongest hardware quarters within a cycle typically occur in the first 1-2 quarters post a mainframe launch).”

IBM shares are up about 25% since the beginning of the year.

With respect to guidance, IBM said it continues to see at least $12.80 in earnings per share, excluding certain items, for all of 2019. Analysts polled by Refinitiv had expected $12.81 in earnings per share, excluding certain items.

— CNBC’s Kevin Stankiewicz contributed to this report.

WATCH: IBM CEO: We’ll be in the UK for the next 100 years, whatever happens with Brexit