IBM shares rose 3% in extended trading on Tuesday after the technology services company issued first-quarter results that beat expectations.

Here’s how the company did:

- Earnings: $1.40 per share, adjusted, vs. $1.38 per share as expected by analysts, according to Refinitiv.

- Revenue: $14.2 billion, vs. $13.85 billion as expected by analysts, according to Refinitiv.

Revenue in the period rose 7.7% from a year earlier, IBM said in a statement. This is the company’s first full quarter without the managed infrastructure services business it spun off into an entity called Kyndryl. Sales to Kyndryl added 5 percentage points to revenue growth in the quarter.

Net income from continuing operations jumped 64% from a year earlier to $662 million. Overall net income declined 23%.

IBM raised its full-year guidance, calling for revenue growth in constant currency in the high end of its mid-single-digit range, with an additional 3.5 percentage points of growth from Kyndryl. In January the executives told analysts to expect mid-single-digit growth, not including impact from Kyndryl or currency.

In the first quarter, IBM’s software segment generated $5.77 billion in revenue, which was up 12% and above the $5.63 billion consensus among analysts surveyed by StreetAccount.

Consulting revenue rose 13% to $4.83 billion, higher than the $4.6 billion StreetAccount consensus.

Revenue from infrastructure fell 2% to $3.22 billion, as clients prepare for IBM’s next-generation mainframe computer later this year.

Also during the quarter, IBM said Francisco Partners agreed to buy its Watson health-care data and analytics assets in a deal reportedly worth over $1 billion. IBM issued updated historical figures for its high-margin software segment to better reflect its financials without those businesses.

In early March, IBM said it stopped doing business in Russia after the country invaded Ukraine.

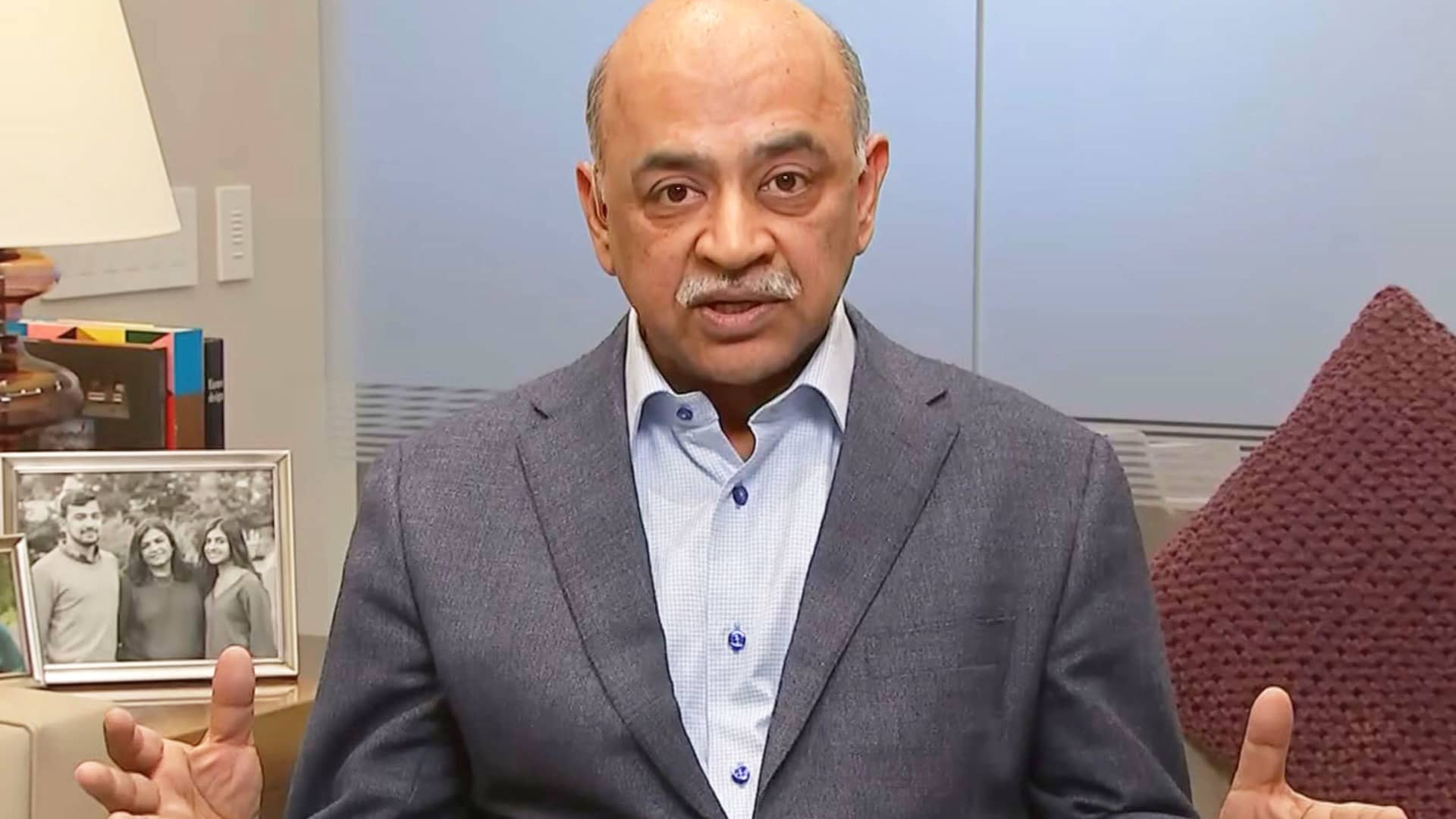

“Russia is a very de minimis part of IBM,” Jim Kavanaugh, the company’s finance chief, said in an interview on Tuesday. The country accounts for 0.5% of total revenue and 2% of profit, he said. Management hasn’t witnessed any effects on business in Western Europe as a result of the departure, he said.

IBM also announced the acquisitions of environment data analytics software maker Envizi and telecommunications consulting firm Sentaca.

IBM’s stock has been outperforming the S&P 500 this year, falling about 3% as of Monday’s close, while the broader index is down 6%. Investors have rotated into value stocks in 2022, given rising interest rates and the war in Europe.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

Correction: This story has been updated to accurately reflect IBM’s 2022 forecast.

This is breaking news. Please check back for updates.