A blue-chip dividend portfolio pays about 2% today. Put a million bucks into a bucket of these stocks and you’ll bank just $20,000 in yearly dividends. That’s barely extra change–on a million invested!

There’s a better way. I prefer to focus on stocks and funds that simply aren’t as familiar as the big names to most investors. They do offer growth potential. But most importantly, they don’t sacrifice yield for perceived safety. In fact, they yield roughly 3x to 4x the blue-chip stocks, providing a lot more retirement-income cushion in years where the market stalls.

Most people love the idea of this Perfect Income Portfolio, yet millions of retirees across the country find themselves piled into the same group of overowned, overpriced blue chips because the “traditional wisdom” says that’s what retirement is supposed to look like.

We can avoid that trap and indeed live on dividends for the rest of our lives.

Sure, retiring well isn’t as easy as just finding any stock with a high yield and blindly buying with both hands. For example, “first-level” income investors thought they couldn’t lose with Guess? (GES) a couple years ago. Its sinking share prices drove its yield to as high as 9%—what a bargain!

But, had they looked past the first level, they would’ve seen the rapidly declining cash and terrible payout coverage figures—then bolted for greener pastures and avoided a 25% payout cut.

The key is sustainability, and a dividend payment (blue line above) that’s higher than the cash flows that fund it (orange line above) is not built to last.

That’s exactly what Contrarian Income Report subscribers got with Cohen & Steers Infrastructure Fund (UTF), which I recommended in February 2016. This closed-end fund—which focuses on energy, water, transportation and other infrastructure-related companies—was distributing a whopping 8.8% at the time. That hefty yield propelled 70% in total returns in just three years!

Today, let’s explore some high-dividend picks doling out fat yields ranging from 7.5% to 12.2%. We’ll highlight a couple of near-perfect retirement dividends, and two more flawed payouts to avoid.

Altria (MO)

Dividend Yield: 8.2%

Tobacco stocks have traditionally been high yielders, but Altria’s (MO) sudden ascendency to 8% territory truly grabs my attention.

Too bad this isn’t a screaming dividend growth story.

Altria has long had to deal with mounting pressures in the U.S.: greater health-consciousness, governmental anti-smoking campaigns, escalating taxation of its products. But now it has a new anchor strapped to its ankle.

Back in March, when I highlighted MO as a clearly cheap high-dividend stock, I pointed out Altria’s efforts to stem the tide by taking a $12.8 billion, 35% stake in e-cigarette company Juul. I also pointed out that Altria still could be in long-term jeopardy regardless because Juul is increasingly finding itself in a similar regulatory pickle.

“Juul isn’t immune from the same pressures. The company faces class-action lawsuits in Philadelphia and New York federal courts over the company’s marketing tactics and over its disclosure of nicotine levels. Juul also temporarily halted sales of most of its flavored nicotine pods in November in hopes of getting out in front of aggressive federal regulators worried about spiking e-cigarette use.”

It has gotten worse since then.

Reports of vaping-related illnesses have sprung up across the country. The Centers for Disease Control says 12 deaths and 805 cases of lung injury have been linked to vaping. The CDC has warned against e-cigarette use while it investigates. Several states have either banned or are working on bans of flavored vaping products. The upheaval essentially forced Altria to scuttle merger discussions with Philip Morris International (PM).

Altria has lost a quarter of its value since my warning, and it’s possible this gets much worse before it gets better.

New Mountain Finance (NMFC)

Dividend Yield: 10.0%

Business development companies (BDCs) were created by Congress to provide capital to small- and midsize companies. It’s a noble cause, but a difficult trade to ply. In fact, it’s one of the few industries I advise against investing in via funds, because all the duds tend to drown out the handful of stars in the space.

New Mountain Finance (NMFC) is one of the few BDCs that inspire a little confidence.

The quick hits on its business: It invests between $10 million to $50 million by issuing debt all across the capital structure – and most of that is floating-rate. Its target businesses generate annual EBITDA of $10 million to $200 million. Portfolio companies tend to have barriers to competitive entry, recurring revenues and strong free cash flow.

These businesses provide strong profits to help fund NFMC’s payouts. And it’s not every day you can get a double-digit dividend at a discount, but here we are. NMFC has a net asset value of $13.41, and at last check, it traded at $13.30 per share.

So while recession worries are going to rattle BDCs of all stripes, New Mountain’s high credit quality makes it a safer bet than most.

Armour Residential (ARR)

Dividend Yield: 12.2%

I quipped in a June 12 column that “ARMOUR Residential REIT (ARR) is taking a rare multi-year break from cutting its dividend.”

Not so fast, my dividend friend.

On June 24, the company tucked this into a press release: “The Company also announced today the expected July 2019 cash dividend rate for the Company’s Common Stock of $0.17 per common share with an anticipated record date of July 15, 2019, and anticipated payment date of July 29, 2019.”

That’s how you tell investors you just cut the dividend without actually telling them you cut the dividend.

I’ll keep this quick. Through a long series of dividend cuts, this mortgage real estate investment trust (mREIT) has reduced its monthly payout by 82% since 2011. I’ve mentioned before that stock prices typically chase dividends higher. Well, the same goes for the other direction.

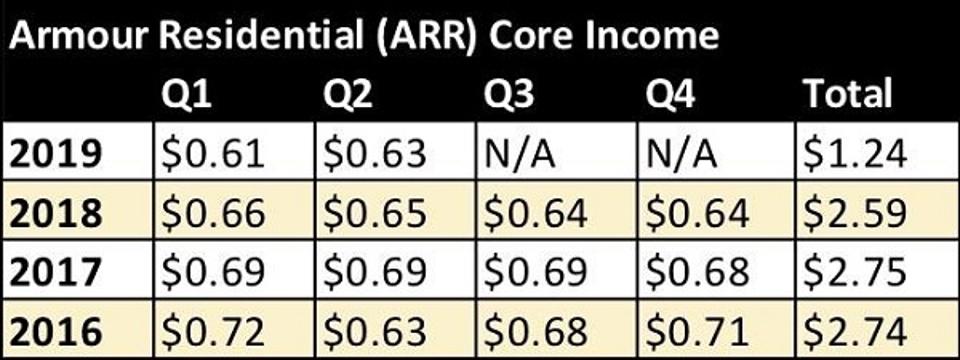

Armour even boasted in its most recent quarterly report that “Core Income exceeded dividends paid for the twelfth straight quarter,” referring to its non-GAAP measure of profitability.

That’s not much to crow about when you’re OK with adjusting the dividend lower. Also, here’s what “Core Income” has been up to over the past few years.

Contrarian Outlook

Let’s move on.

New America High Income Fund (HYB)

Dividend Yield: 7.5%

New America High Income Fund (HYB), a closed-end fund (CEF) focused on junk debt, isn’t immune from the occasional downtick in its distributions, either. But it’s a far more common (expected, even) issue in debt funds, which serve at the whims of the debt market.

What’s important is that HYB maintains a fairly high yield level, and that active management has proven its worth over time by walloping the indexes.

New America High Income is a primarily U.S.-focused junk bond fund. But it does offer a little international diversification, investing a little less than 20% of its portfolio in countries such as Canada, Luxembourg and Brazil.

Credit quality is middling–about 40% of its bonds are in the higher tiers of non-investment-grade debt. But here, you’re trusting management’s judgment to not only spy values in this kind of debt, but to properly use leverage to make the most of its bets.

It’s not a smooth ride, for sure. HYB’s ebbs and flows are far more exaggerated than index funds such as the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), thanks in part to that leverage.

But it’s hard to argue with the results. They’re certainly better than its junk bond ETF counterparts!

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, click here for his latest report How To Live Off $500,000 Forever: 9 Diversified Plays For 7%+ Income.

Disclosure: none