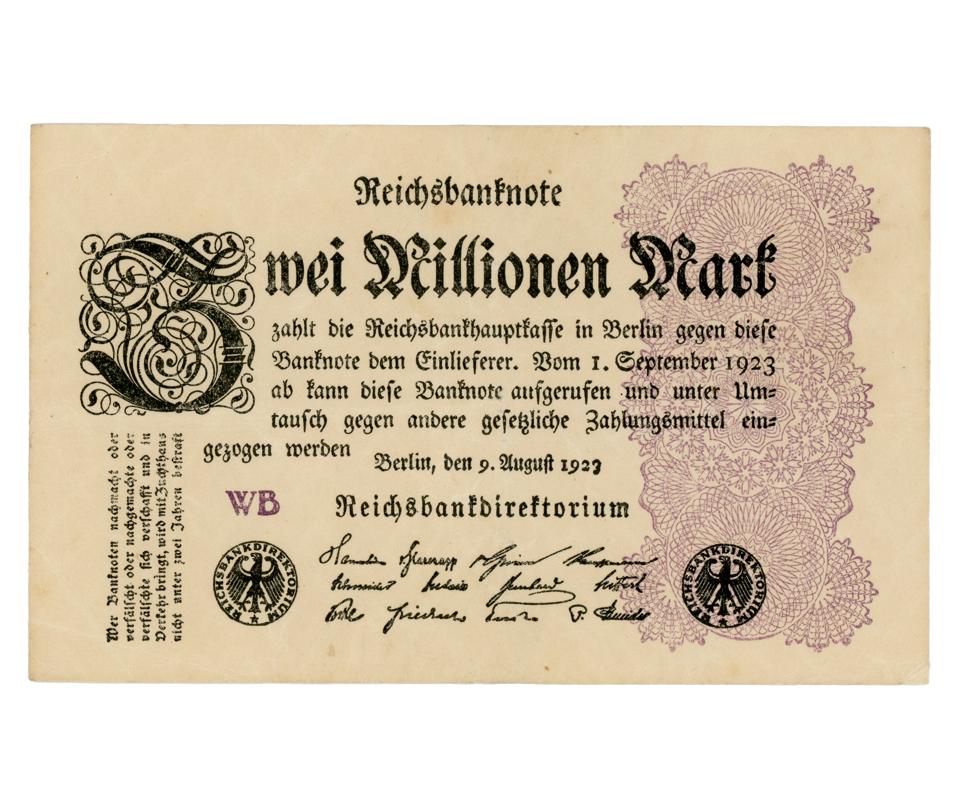

2 million mark banknote, 1923.

Getty

Modern Monetary Theory — the dream that we can spend quite a bit more money on such government programs as the Green New Deal, a Universal Basic Income, or similar agenda items merely by printing the money (or the 2020 virtual equivalent thereof) — insists that the United States has much more “room” for spending-via-money-printing without triggering inflation than is otherwise believed to be the case, and, in any event, if inflation does appear to be getting out of hand, our politicians and economics-experts can easily adjust as needed. My lament has long been that is hubris of the highest order, to imagine that it is possible to come up to that line, but not crossing over into unleashing exactly the sort of inflation which can exact so much harm on so many, especially the elderly with fixed incomes.

But I’ve now read in more depth about the hyperinflation of Weimar Germany, in the form of the book When Money Dies, by Adam Fergusson (first published in 1975, and reprinted in 2010), and have been surprised to learn that the story is not quite what I had believed to be the case. The main outline of the crisis is well-known: during World War I, the government funded its costs by means of borrowing, expecting to make up the funds by profiting from a victory. Instead, they were saddled with unfathomably-high reparations, which they were obliged to pay in hard currency. To continue to fund regular government operations, they turned to the printing press; and the more inflation increased, the more difficult it became to collect any sort of taxes paid in arrears. An already-bad situation became much, much worse in 1923, especially in summer and fall, until a stabilization plan pegging a new currency to items of tangible value, took hold in November, in which, when all was said and done, a new mark, the Rentenmark, was worth 1 trillion Reichsmark; and at the same time, at long last, the German government was obliged to balance its budget. (Wikipedia is one ready source of information.)

The story seems straightforward enough — and offers the prospect that some other, smarter, more technocratic, government could do a better job in the future. But the piece to this story that’s missing is this:

Until the crisis took that turn for the (far) worse in 1923, the politicians and industrialists who controlled Germany judged their situation to be the lesser of two evils.

German businesses managed to cope with the situation in various ways, dealing in other currencies. Unions demanded regular and automatic inflation adjustments which, until the fall of 1922, kept blue-collar wages at an acceptable level relative to prices. Anyone with any cash invested in stocks to hold on to some of the value of their funds. Renters benefited from rent control based on pre-inflation rents; borrowers saw the real cost of their debt vanish. Clever speculators might even feel they could profit from the situation. And the frenzy with which everyone spent, to get rid of their cash for items of value meant that, ironically, there was little unemployment in the country, however weak the purchasing power may have been.

Fergusson writes of the wealthy industrialist Hugo Stinnes, in spring 1922,

“He justified inflation as the means of guaranteeing full employment, not as something desirable but simply as the only course open to a benevolent government. It was, he maintained, the only way whereby the life of the people could be sustained” (p. 74).

And into this mix fell the Ruhrkampf: the occupation, in January 1923, of the Ruhr Valley, the industrial heart of the country, by French and Belgian armies, in order to seize coal and other goods that they claimed as reparations payments. In protest, the Germans adopted a policy of passive resistance — mines and factories shut down, and the German government printed yet more marks in order to fund relief programs for the occupied Ruhr, and in the succeeding months crime, looting, barter, all accelerated as the mark collapsed. In September of 1923, the financial devastation Germany faced finally led the government to declare the end of the passive resistance — and a State of Emergency, and further political chaos and threats of local rebellions, plus, as the harvest proceeded, the refusal of farmers to bring food to market as long as the currency was worthless — before the ultimate implementation of currency reform in conjunction with the Dawes Plan to restructure reparations and provide loans.

Here are, in the end, two key paragraphs in Fergusson’s book:

“Long before the Ruhr invasion, and perhaps even before the preliminary meetings of the Reparations Commission, there came a stage when it was politically impossible to halt inflation. In the middle of 1920, after the brief post-Kapp Putsch period of the mark’s stability, the competitiveness of German exports declined, with unemployment beginning to build up as a result. The point was presumably not lost on the inflators. Recovery of the mark could not be achieved without immediate repercussions in terms of bankruptcies, redundancies, short-time working, unemployment, strikes, hunger, demonstrations, Communist agitation, violence, the collapse of civil order, and thus (it was believed), insurrection and revolution itself.

“Much as it may have been recognized that stability would have to be arranged some day, and that the greater the delay the harder it would be, there never seemed to be a good time to invite trouble of that order. Day by day through 1920, 1921 and 1922 the reckoning was postponed, the more (not the less) readily as the prospective consequences of inflation became more frightening. The conflicting objectives of avoiding unemployment and avoiding insolvency ceased at last to conflict when Germany had both” (p. 253 – 254).

This means that the Weimar hyperinflation is not merely a cautionary tale with respect to monetary policy, but with respect to larger issues of political dysfunction. How often do we worry about the depletion of the Social Security Trust Fund, but nonetheless assume that sometime between now and then, someone will fix it? The history of the Weimar hyperinflation forces us to admit that we cannot take it for granted that, if only the situation gets bad enough, someone else will fix it.