Senate procedures, particularly those for budget reconciliation, mold the tax laws that are created or altered in that process in critical ways.

Most recently, the reconciliation process prompted revision of the monthly distribution plans for the child tax credit, resulting in its being changed — at least statutorily — from a monthly benefit into a periodic one.

The reason why has implications for future tax provisions that Congress attempts to pass under the same procedures.

Budget reconciliation is an optional procedure established in the Congressional Budget Act of 1974. Since its first use in 1980, 22 budget bills have become law that way; four were vetoed by the president.

The chief appeal of the process lies in the number of votes required for the budget bill to pass the Senate — under reconciliation, it’s a simple majority; under regular order, it’s 60. The reconciliation process effectively prevents a filibuster.

The relative prevalence of reconciliation as a mechanism for passing tax laws makes the rules and precedents the Senate parliamentarian helps apply profoundly important to budget drafting.

But the precedents the parliamentarians and Senate staffers use to decide whether the tax provisions in a reconciliation bill fit within the guidelines of the Byrd rule, which governs what can be included in legislation passed through the reconciliation process, are opaque.

The Effect of the Congressional Budget Act

In practice, the budget process established in the Congressional Budget Act of 1974 has proven an imperfect vehicle for making coherent tax policy because the trade-off for avoiding a filibuster and passing a bill with a simple majority is the potential removal of provisions that have merely incidental budgetary effects.

It may be an expeditious route to passing new tax laws, but it’s not an ideal one.

Administrative provisions important to a policy are often stripped out through the reconciliation procedures, which contain a prohibition against “extraneous matter” in reconciliation legislation.

If a senator makes a point of order against extraneous material and it’s sustained by the chair of the relevant committee, the extraneous material is deemed stricken from the bill and may not be offered as an amendment from the floor, according to 2 U.S.C. section 644(a).

When the Byrd rule has been invoked to oppose extraneous material, more often than not it has been found to apply.

Extraneous items (1) don’t produce a change in outlays or revenues, or changes in the terms and conditions under which outlays are made or revenues are required to be collected; (2) produce an outlay increase or revenue decrease if the net effect of provisions from the committee is that the committee doesn’t achieve its reconciliation instructions; (3) aren’t in the jurisdiction of the committee with jurisdiction over the title or provision in question; (4) produce changes in outlays or revenues that are merely incidental to the non-budgetary components of the provision; (5) increase net outlays or decrease revenues in fiscal years after the fiscal years covered by the reconciliation bill; and (6) recommend changes in Social Security. The “merely incidental” stipulation and prohibition against increasing the deficit outside the budget window pieces are the most relevant for tax measures.

An exception to the prohibition against extraneous material is a provision that originates in the Senate that doesn’t change outlays or revenues.

That exception requires the chair and ranking members of the Budget Committee and the committee reporting the provision to certify that the provision mitigates direct effects clearly attributable to a provision that changes outlays or revenues, and that both together result in a net deficit reduction.

The provision must also result in a substantial reduction of outlays or increase in revenues in one of these situations: outside the budget window; or because of regulations, court rulings, or relationships between economic indices and stipulated statutory triggers.

A provision that is likely to substantially reduce outlays or increase revenue, but can’t be reliably estimated because of insufficient data, also falls within the exception.

The extraneous material provision of the Byrd rule was famously used to remove the title of the Tax Cuts and Jobs Act, but the procedural requirements had more substantive effects in that bill as well.

An exemption from the 1.4% excise tax on endowment income for colleges like Berea College in Kentucky where students don’t pay tuition fell to the parliamentary rules.

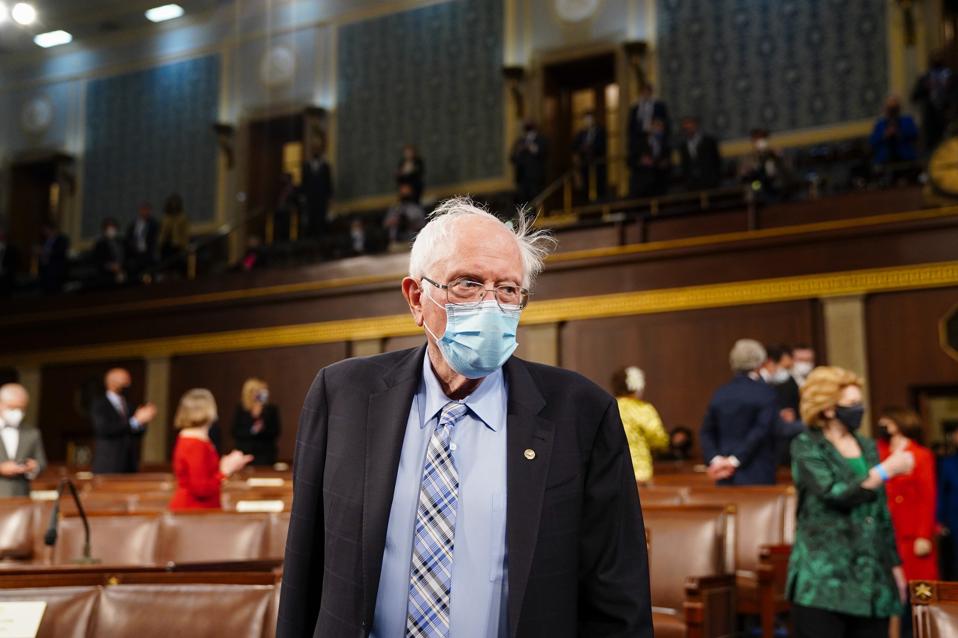

Sen. Bernie Sanders, I-Vt., raised the point of order objecting to the exemption. And Sen. Ted Cruz, R-Texas, saw his amendment to include home-schooling expenses in education savings accounts under section 529 stripped out.

WASHINGTON, DC – APRIL 28: Sen. Bernie Sanders (I-VT) arrives before President Joe Biden addresses a … [+]

Getty Images

Along with the removal of extraneous material, the prohibition on out-year deficit effects means tax provisions that pass as part of a reconciliation package are sometimes saddled with expiration dates. The result of navigating the stipulations of the Byrd rule is frequently time-limited tax laws that have been drafted to leave out possibly necessary, but procedurally impermissible, portions of the rules.

The Role of the Parliamentarian

The conservators of the procedural rules and precedents of the Senate are the parliamentarians, who provide their interpretations to the chamber.

“The Parliamentarian’s influence is proportional to the complexity of Senate rules,” according to a 2011 paper by James Wallner, now of American University.

But the parliamentarian doesn’t have any compulsory power. The presiding officer can ignore their advice, and the Senate can vote to overturn their decision.

The office is nonpartisan with no term limit, and at least a few assistant parliamentarians work with the office leader, now Elizabeth MacDonough.

The Senate parliamentarian’s main job is to advise the presiding officer on the interpretation of Senate rules and precedents. That advice is typically taken.

Former Parliamentarian Robert Dove has explained that the presiding officer is generally doing what the parliamentarian or their assistant says to do because the parliamentarians whisper the rulings that should be made to whoever is sitting in the presiding officer’s chair.

Floyd M. Riddick, another former Senate parliamentarian, agreed in 1978 that the parliamentarians always whisper to the presiding officer what to say because “it’s impossible” for any single senator to master the assortment of precedents, and it’s therefore better to feed senators the procedure while they’re presiding, rather than possibly let them make a misstep.

That practice, well established by the late 1970s, was an outgrowth of the overall expansion of the federal government, according to Riddick. He said that at least through the late 1930s, Congress spent a lot of time debating procedure, as opposed to the contents of legislation.

“As the government began to grow and get bigger, the senators had less time to devote to procedure, and it was just natural that they had to begin to depend on somebody to do the procedural aspects for them,” he said.

Byrd Bath

The parliamentarian essentially sits as the judge in a dispute over whether a provision or piece of a provision is in violation of the Byrd rule. The “Byrd bath” is purely a creature of the budget process — the parliamentarians generally don’t have to review a regular-order bill.

But unlike in an appellate court, there’s typically no public record of why a parliamentary ruling went one way or what factors were considered in giving the advice.

However, the deliberations are far from cursory or arbitrary, according to former Senate staff members who have participated in them in the past. The vetting process when a Byrd rule point of order is anticipated is extensive and often begins before the bill’s markup.

Senators’ staffs explain the policies in the proposed reconciliation bill to the parliamentarians. The staff members then work through the bill text with them, and the parliamentarians ask questions and sometimes give assignments to provide further explanations.

Sometimes senators offer insights into the deliberations behind the rulings. For example, on the Senate floor on March 25, 2010, then-Sen. Kent Conrad explained that the parliamentarian had advised that two provisions in the Healthcare and Education Reconciliation Act of 2010 violated the Byrd rule, and found it persuasive that the Congressional Budget Office concluded that they didn’t score for budgetary purposes (156 Cong. Rec. S2085). But that level of transparency is rare.

The parliamentarian is hired by the majority leadership, which means they can also be terminated by the party in control. But historically, the parliamentarian has generally continued to hold office through changes in party control.

There have been six parliamentarians since the role was established in 1935. Two were fired by the majority leader and then rehired later.

The Role of Precedent

If the parliamentarian plays the role of judge in matters of procedure, the precedents are akin to case law. One of the 1978 oral history interviews with Riddick highlighted the influence of precedents in legislative outcomes.

“The precedents of the Senate are just as significant as the rules of the Senate,” he said. “The rules are very vague in some regards, and the practices of the Senate pursuant to those rules are developed and established, and as they are established they become the rules of the Senate until the Senate should reverse this procedure.”

A thorough knowledge of the precedents is therefore an important part of the parliamentarian’s job, as is cataloguing them for future reference. The parliamentarians are some of the only people with access to all of them.

The main procedural rules of the Senate are printed in the Senate Manual and Riddick’s Senate Procedure. Riddick’s was at one point edited by former Sen. Robert C. Byrd, the principal Byrd rule sponsor who had an abiding interest in Senate procedure, and it compiles the principal rules governing how the body functions, plus minor tidbits like when flowers may be brought into the Senate chamber.

WASHINGTON DC – JANUARY 26: Sen. Robert Byrd of West Virginia in his Senate Office January 26, 1999 … [+]

David Hume Kennerly

For the budget process, the Office of the Parliamentarian assembles a collection of electronic Senate precedents that is available only to senators and their staffs.

Those documents are unofficial and include precedents created after the publication of Riddick’s in 1992. The precedents are created by the Senate through a vote or a ruling by the presiding officer.

Sometimes the precedents regarding consideration of potential Byrd rule violations are made publicly available, but usually not in their entirety. The Byrd bath process, in which the parliamentarians meet with both Democratic and Republican Senate staffers, is closed to the public, and the underlying rationale for the decision is made public only if a senator chooses to talk about it publicly.

Only the ruling on whether a Byrd rule violation exists is usually announced. Although senators frequently announce when they have secured a favorable opinion from the Senate parliamentarian, they rarely explain the grounds for it.

Still, some of the considerations that go into whether there’s a Byrd rule violation are readily identifiable. Senate staff members look to revenue and budgetary estimates when available to show the budgetary impact of provisions.

Similar provisions in enacted reconciliation bills provide perhaps the most persuasive precedent, especially if they are relatively recent and survived a challenge from the Senate floor. Provisions in prior bills that went unchallenged might be less compelling precedent.

The opaqueness problem arises when a directly analogous precedent is lacking.

The Senate rules and precedents aren’t self-enforcing. It is incumbent on the senators to raise a point of order to contest a potential violation of the rules, and sometimes they don’t.

The Byrd rule, for example, doesn’t automatically apply to excise offending provisions.

The expediency of the budget reconciliation process for the majority party comes with distinct drawbacks, and that’s by design. The tax laws that result from the process are accordingly sometimes distinctive in what they’re missing because of the Byrd rule and the not entirely transparent precedents that have been created under it.