getty

I received an email last month from a follower of my YouTube channel. Tired of juggling multiple accounts, she wanted a single app that could monitor everything from bank accounts to credit cards to her 401(k). She had reached out to a financial advisor who offered to help her—for $3,000!

She asked me if $3,000 was a reasonable fee.

Deep breath.

No, it’s not reasonable for a financial advisor to charge $3,000 to do what can be done for free in less than 30 minutes. To help her, I created a video walking through exactly how I manage 28 financial accounts in my favorite free financial app—Personal Capital.

Account Aggregation Software

While Personal Capital is my favorite financial tool, it’s not the only alternative. There are a number of apps, software and tools that can help monitor a person’s financial life. They all have one thing in common. They link to your financial accounts and automatically download account data.

This is both a blessing and a potential cause for concern. It’s a blessing because it makes tracking every aspect of one’s financial life a breeze. Personal Capital keeps track of everything from the $4 latte you bought last Thursday to the reinvested dividend a mutual fund paid out in your IRA.

It can be a cause for concern, however, when it comes to security. In the case of Personal Capital, it uses bank-level security features. For example, not even Personal Capital has the login credentials to the accounts users link to its financial dashboard. Those are managed by a company called Yodlee, a data aggregation company used by many of the largest U.S. banks. Still, it’s a psychology hurdle one needs to clear before taking advantage of an account aggregation app.

If you clear that hurdle, there are many benefits to a seeing all your data in one place.

Financial Data in One Place

The first thing that Personal Capital does is bring all of date from linked accounts into one place. Rather than logging into 28 separate accounts to check balances and transactions, I can log into just Personal Capital. Here’s what its dashboard looks like using sample data:

Personal Capital Dashboard

Personal Capital

Along the left sidebar are all the linked accounts, their balances, and the last time they were updated. Beyond just the numbers, however, Personal Capital also analyzes the data and presents it in a number of ways. This can be seen in the middle of the Dashboard, where users will find snapshots of their net worth, budget, cash flow, portfolio, retirement planner and emergency savings.

Financial Analysis

The financial dashboard is just the beginning. For each of the different ways Personal Capital analyzes a user’s financial accounts, they can drill down into the details.

Cash Flow

The cash flow screens allow users to view details of their income and expenses across all accounts. They can select the time period, and they can also select which accounts to view. I use the income view across just my investment accounts to see how much interest and dividend income has been generated each month.

Personal Capital Cash Flow Screen

Personal Capital

Budgeting

Personal Capital also has a budget tracking feature. It starts with a predefined set of categories that it automatically applies to incoming transactions. These categories can be changed, and users can create new categories. This information is then displayed in a graph and chart (see image above) to make it easy to track spending by category throughout the month.

Bill Tracking

For each loan linked to Personal Capital, you can receive notices when the monthly payment is due. This is helpful to avoid missing a payment. We use it to track when each of our cash back and travel reward credit cards are due.

Net Worth Tracker

Net Worth Tracker

Personal Capital

Net worth is the single most important metric when measuring financial progress. It reflects, for better or worse, every financial decision we’ve made throughout our lives. I like to think of it as the ultimate financial scoreboard. Personal Capital tracks a user’s net worth and provides details on each asset and liability.

Users can also link the value of their real estate. Personal Capital pulls in the value from Zillow and updates the price daily.

Asset Allocation

Perhaps its best features relate to investment portfolios. For example, Personal Capital evaluates the asset allocation of all linked investment accounts. It then presents this information through graphs and account-level data in an easy to understand way. Each asset class (e.g., U.S. Stocks, Foreign Stocks, U.S. Bonds) offers further details at the investment level. For example, it will show users every mutual fund in their portfolio that includes a specific asset class.

Related to this feature, Personal Capital evaluates a user’s asset allocation and makes recommendations on possible changes. It even calculates the estimated long-term effect of making the recommended investment changes.

Retirement Fee Analyzer

Personal Capital’s Retirement Fee Analyzer is an innovative tool designed to show the effects of investment fees on a portfolio over time. It brings in automatically the fees paid on the investments linked to Personal Capital. It then calculates the cost of those fees over time. In this way, it’s able to show how even “small” fees can rob a portfolio of hundreds of thousands of dollars, or more, over a lifetime of investing.

Retirement Fee Analyzer

Personal Capital

Planning Tools

Personal Capital also offers several planning tools. Three of the most important are its emergency fund, debt paydown, and retirement trackers.

Emergency Fund Planner

Personal Capital calculates a recommended emergency fund based on a user’s monthly budgeted spending. It uses three to six months of expenses. It then compares this goal with actual emergency fund savings, based on the linked bank accounts. Users can then plan to add a set amount to their emergency fund savings each month until their goal is reached.

Debt Paydown Planner

Users can also track paying off debt in Personal Capital’s Debt Paydown planner. The first step is to link loans to the tool. This can include car loans, student loans and other debt. Personal Capital then tracks the debt and balances as you make payments. It also provides recommendations on which debts to tackle first.

Retirement Tracker

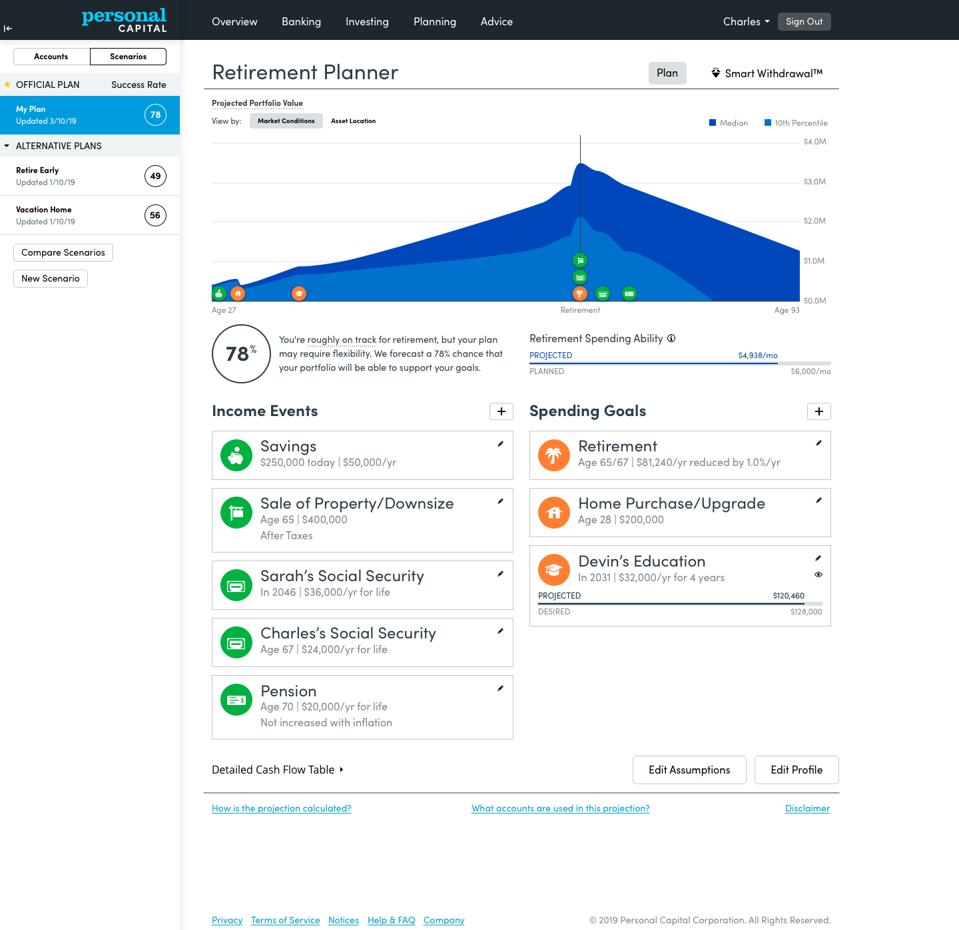

The Retirement Tracker is the most robust planning tool Personal Capital offers. Based on a user’s linked accounts, planned retirement date, and planned spending in retirement, it calculates a retirement readiness score. Users can set variables such as social security and inflation. One-time expenses, such as a trip around the world, can also be added to the tracker.

Retirement Planner

Personal Capital

In addition, users can compare multiple retirement scenarios. For example, one could compare retiring a year earlier or later than planned. The tool shows the results of the assumptions through informative graphs as well as with a yearly cash flow view.

Final Thoughts

Personal Capital makes it easy, and I would say even fun, to track multiple accounts. It also comes with smart phone and tablet versions of the app. The combination of data aggregation, financial analysis tools, and planning features make it arguably the best financial management tool available today.

And as an added bonus, it won’t cost you $3,000. It’s free.