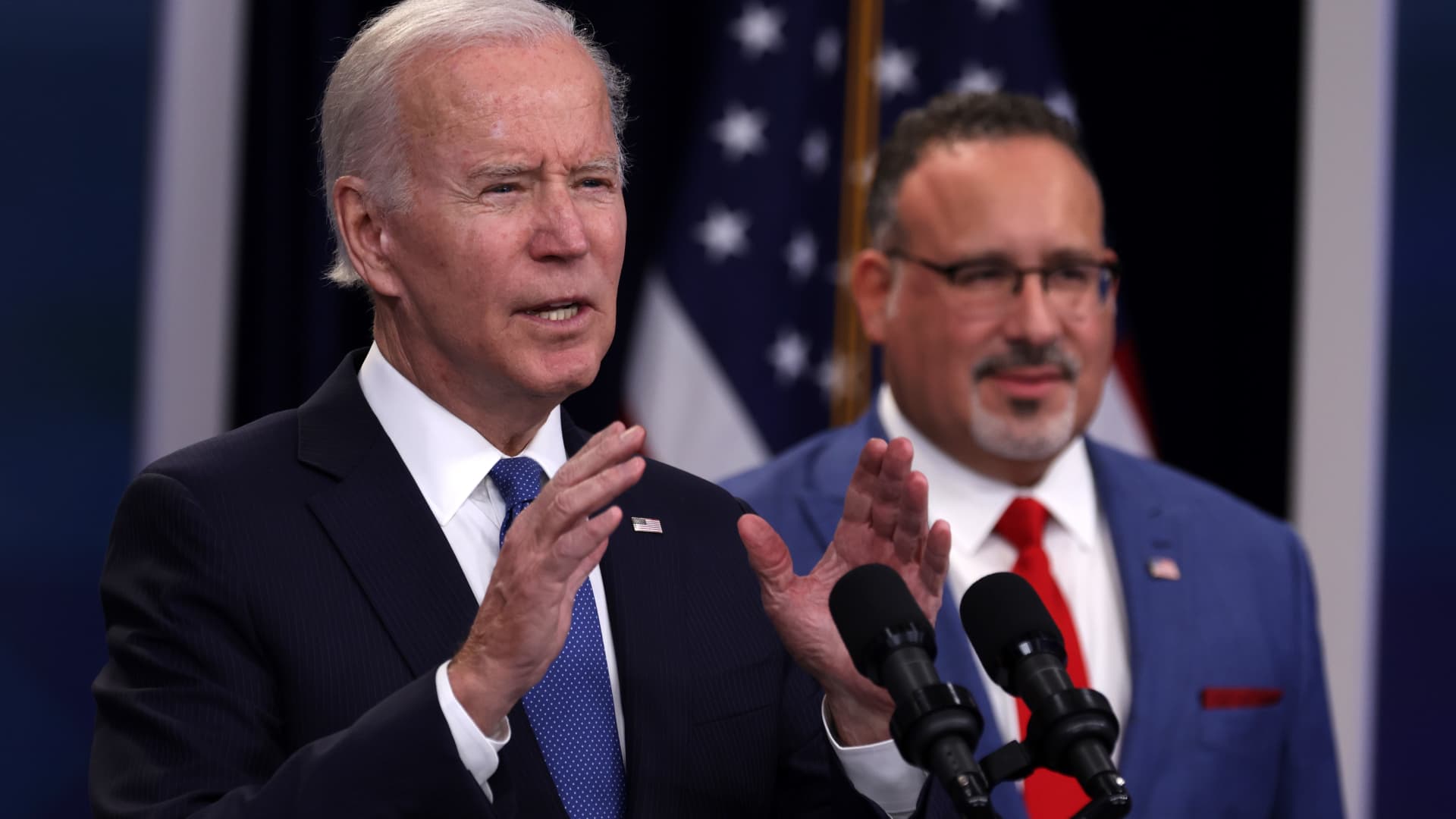

After the Biden administration’s gigantic setback at the Supreme Court over its sweeping student loan forgiveness plan, it almost immediately announced a new strategy to lower people’s debts.

Borrowers could see that relief this year, experts say.

However, far fewer people will benefit from the revised aid package, and the plan could be met with the same legal challenges as President Joe Biden’s first policy.

Here’s what borrowers should know about student loan forgiveness prospects in 2024.

How Plan A, Plan B student loan forgiveness compares

Nearly 40 million Americans would have gotten relief from Biden’s original student loan forgiveness plan.

The president’s Plan B is looking much narrower. That’s because the justices ruled in June that the first plan, which covered more than 90% of federal student loan borrowers, was too far-reaching.

“Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?” wrote Chief Justice John Roberts in the majority opinion for Biden v. Nebraska. “We can’t believe the answer would be yes.”

The new forgiveness policy will include only a small share of borrowers, said Luke Herrine, an assistant professor of law at the University of Alabama.

“I think it would be easier to justify in front of a court that is skeptical of broad authority,” Herrine said in an earlier interview with CNBC.

The Biden administration seems focused on still delivering relief to specific groups of borrowers, according to a recent paper issued by the U.S. Department of Education. Those are:

- Borrowers with current balances greater than what they originally borrowed

- Those who entered into repayment on their undergraduate student loans 20 or 25 years ago

- Students who attended programs of questionable value

- Borrowers eligible for existing relief programs, including Public Service Loan Forgiveness, who just haven’t applied or perhaps didn’t know about those options

- Debtors in financial hardship

Altogether, it’s possible somewhere between 4 million and 10 million borrowers will be eligible for the revised forgiveness program, said higher education expert Mark Kantrowitz. It’s hard to know this figure, though, until the final rule is published, he cautioned.

There’s another key difference between the plans.

Biden first tried to cancel student debt with an executive order in August 2022 and had promised borrowers the relief within six weeks of them completing their paperwork. This time he’s turning to the rulemaking process. That procedure is lengthier, typically involving a public comment period and other time-consuming steps.

Borrowers could see cancellation this year

Kantrowitz anticipates that the proposed rule for the relief will be published by March. At that point, there will likely be a 30-day public comment period.

There may be many comments from the public, which could slow things down, but the final rule will probably be published in the Federal Register no later than November, Kantrowitz said.

Normally, due to the timeline of regulatory changes, that would mean the relief would go into effect on July 1, 2025.

More from Personal Finance:

This strategy can help you meet New Year’s resolution goals

Student loan borrowers won’t face missed payments penalties

Fewer students are enrolling in college

However, there’s good reason to believe the Biden administration may try to speed things up, Kantrowitz said.

“Given the political significance of Plan B, it would not be surprising if the U.S. Department of Education decides to implement the new regulations sooner, before the election,” he said.

More legal challenges are ‘very likely’

It’s “very likely” there will again be Republican lawsuits seeking to block the new relief, Kantrowitz said, “which could add delays.”

“This will set up a sharp contrast between Democrats and Republicans ahead of the elections,” he said.

Indeed, Republican nominees for president oppose student loan forgiveness.

Former New Jersey Gov. Chris Christie has said that Biden didn’t have the authority to cancel student debt without prior authorization from Congress.

“He knows he’s done something that is illegal and over the top,” Christie said on ABC’s “This Week” in 2022, shortly after Biden announced his sweeping debt forgiveness plan.

This will set up a sharp contrast between Democrats and Republicans ahead of the elections.Mark Kantrowitzhigher education expert

Former President Donald Trump sided with the Supreme Court.

“Today, the Supreme Court also ruled that President Biden cannot wipe out hundreds of billions, perhaps trillions of dollars, in student loan debt, which would have been very unfair to the millions and millions of people who paid their debt through hard work and diligence; very unfair,” Trump said at a campaign event last year.

Voters, however, support forgiving at least some student loan debt by a 2-to-1 margin, according to a Politico/Morning Consult poll. Less than a third oppose the policy.