Ah, the joys of new marital bliss. Now … about those tax returns.

If you tied the knot this year (or plan to this month), it’s worthwhile evaluating what getting married will mean for your 2019 tax situation. While many couples will see their taxes drop, some will face a “marriage penalty” — paying more than if they had remained unmarried and filed as single taxpayers.

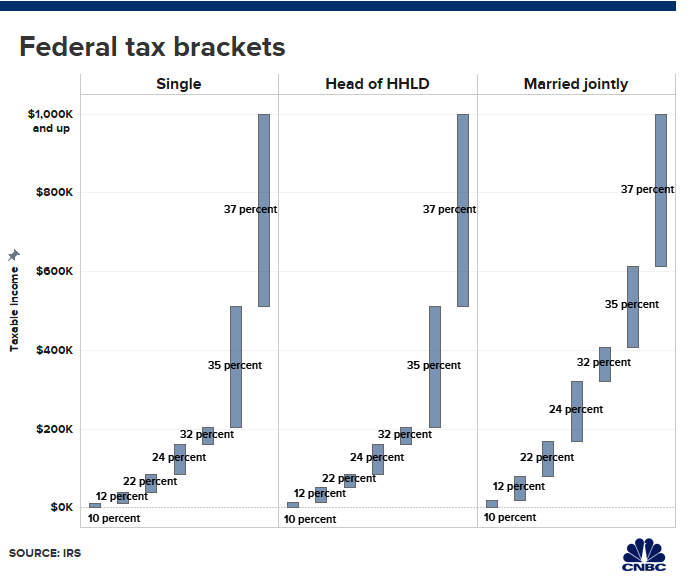

In simple terms, the penalty comes into play when tax-bracket thresholds, and deductions or credits, are not double the amount allowed for single filers.

Digital Vision | Photodisc | Getty Images

So, depending on your income, where you live and the deductions or credits you use, a bigger tax bill could be part of your married future.

“Marriage penalties exist for both high- and low-income couples, but are most common when two individuals with equal incomes marry,” said DeAnna D’Attilio, director at Acorn Tax Planning in Reston, Virginia.

Roughly 2.2 million marriages take place in the U.S. each year, according to government data. Most of them — 78% — occur between May and October, separate information from TheKnot.com shows.

While this year’s newlyweds generally won’t face a tax deadline until next April, the sooner you know what to expect, the more time you’ll have to plan accordingly. No matter when you get married during the year, you’ll be required to file your 2019 tax return next spring as a married couple. (Filing separate tax returns as a married couple rarely makes financial sense.)

For high earners, a bigger tax bill can come from a few different sources.

For starters, the top federal rate of 37% kicks in at taxable income of $510,300 for single filers in 2019. Yet for married couples, that rate gets applied to income of $612,350 and higher.

As an example: Two individuals who each have income of $500,000 would pay the second-highest rate, 35%, on their income if they filed as single taxpayers.

However, as a married couple with combined income of $1 million, they would pay 37% on $387,650 of that (the difference between their income and the $612,350 threshold for the highest rate). That would mean paying about $7,750 more in income taxes.

There also are other parts of the tax code that can cost married couples more. For instance, while an individual can have up to $200,000 in income before the Medicare surtax of 0.9% kicks in, the limit for married couples is $250,000.

Likewise, the income threshold for when a 3.8% investment-income tax kicks in is not doubled. Singles with modified adjusted gross income above $200,000 pay the tax, while married couples filing jointly pay it if their income exceeds $250,000. (The tax applies to things such as interest, dividends, capital gains and rental or royalty income.)

Additionally, the limit on the deduction for state and local taxes — also known as SALT — is not doubled for married couples. The $10,000 cap applies to both single filers and married filers. (Married couples filing separately get $5,000 each for the deduction). However, the deduction only is available to taxpayers who itemize.

More from Personal Finance:

The top 10 college majors American students regret the most

Here’s where employers stand on 2019 bonuses

Everything you need to know to help save on taxes in 2020

Another potential snag can arise if you’re repaying federal student loans.

If one, or both, of you are on an income-based repayment plan — except the Revised Pay as You Earn option — they should consider whether filing separately would make sense in order to avoid the other spouse’s income being used in the repayment calculation, said certified financial planner Jake Northrup.

“This is especially applicable when there’s a large discrepancy between the incomes of the spouses,” said Northrup, founder of Experience Your Wealth in Bristol, Rhode Island.

Likewise, newlyweds should be cognizant of limits applying to deductions and contributions for traditional and Roth individual retirement accounts, because income from both spouses feeds the equation.

“Often, IRA contributions are done earlier in the year, so they should revisit what their joint income will likely look like and whether any changes to their 2019 IRA contributions should be made,” Northrup said.

For people with incomes at the other end of the earnings spectrum, a marriage penalty can come from the earned income tax credit.

The credit is generally available to working taxpayers with children, as long as they meet income limits and other requirements. Some low earners with no children also are eligible for it.

Because it’s refundable — meaning it could result in a refund even if your tax bill is zero — it’s considered valuable to working parents with low or modest income.

However, the income limits that come with the tax break are not doubled for married couples. So two people with income of $25,000 each and one child would have paid $3,117 less in taxes in 2018 if they had remained unmarried, according to the Tax Policy Center, a nonprofit research group. The reason is that their $50,000 combined income exceeds the income limit for married couples with one child.

.1561748135402.png)

Some states also have a marriage penalty for taxpayers, although it’s more pointed in some places than others. For example, Maryland’s top rate of 5.75% applies to income above $250,000 for single filers and above $300,000 for married couples.

Also, if you’re retired and taking Social Security, be aware that tying the knot can come with additional tax implications.

For single filers, if the total of your adjusted gross income, nontaxable interest and half of your Social Security benefits is under $25,000, you don’t owe taxes on those benefits. However, for married couples filing a joint return, the threshold is $32,000 instead of double the amount for individuals.

The Tax Policy Center has a marriagecalculator that allows you to plug in the details of your and your partner’s financial life — wage income, business income, children you claim as dependents, etc. — to see how your taxes will shape up when you file as a married couple.