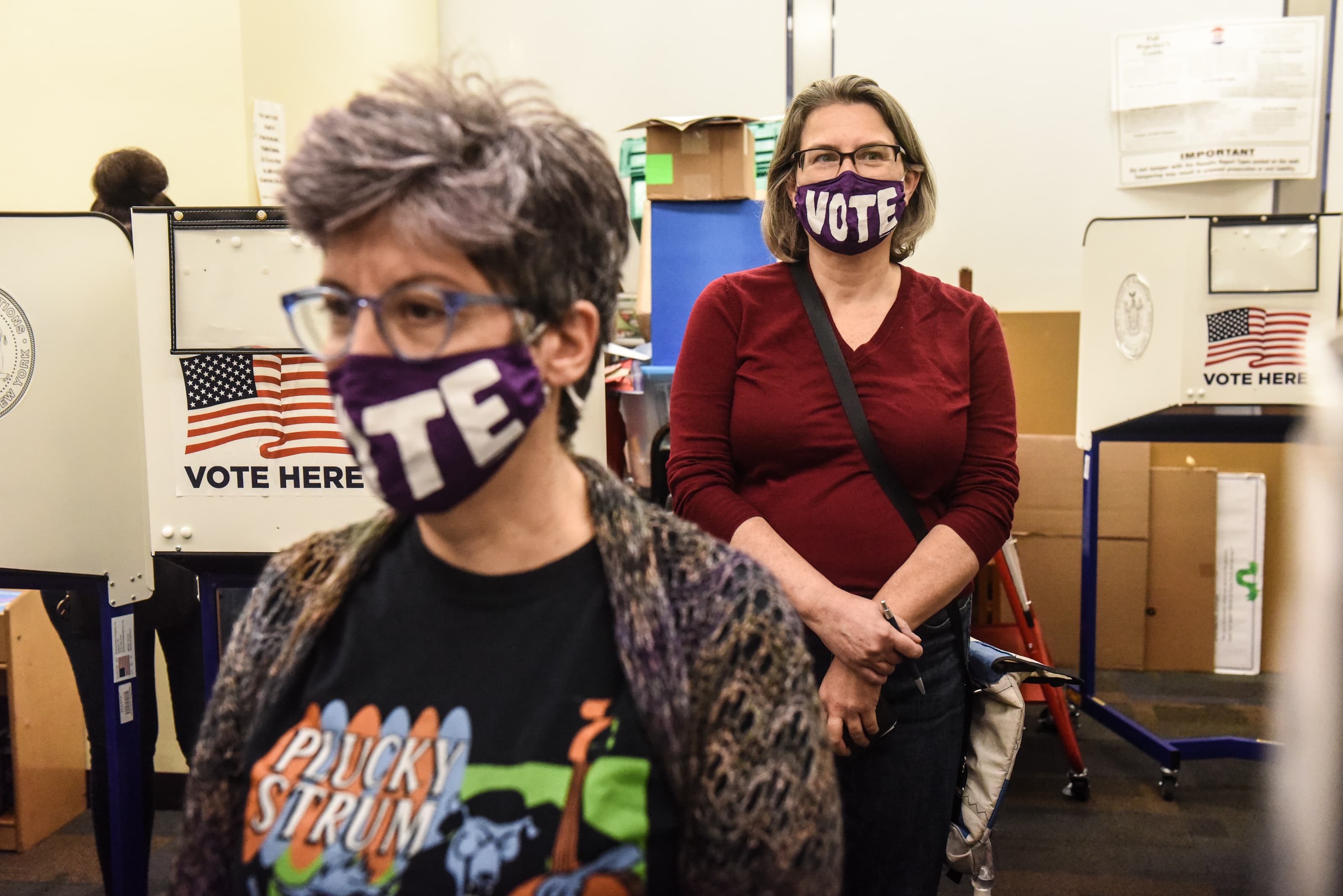

People line up for early voting at the Jackson Heights branch of the Queens Public Library in New York on Oct. 24, 2020.

Stephanie Keith | Getty Images

Before you head into the voting booth next Tuesday, get to know where the presidential candidates stand on your taxes.

Democrat Joe Biden is calling for tax hikes on wealthy households with income exceeding $400,000, proposing increases in both payroll and income taxes for those families.

Meanwhile, President Donald Trump has proposed further tax cuts to increase take-home pay, plus an expansion of opportunity zones — a tax incentive to reward investing in economically distressed areas, according to the Trump campaign.

More from Smart Tax Planning:

3 smart tax moves, no matter who wins the Nov. 3 election

These are the income tax brackets for 2021

Four ways wealthy families are trying to block bigger estate taxes under Biden

For now, the best bet is to refrain from making sudden changes to your tax plans.

“We’ve seen laws change quite a bit in the last 10 years or so, and it will change again in the future as new administrations come and go,” said certified financial planner Mark Bradford, senior vice president and wealth director of Bryn Mawr Trust Wealth Management in Bryn Mawr, Pennsylvania.

“My advice is to get educated on the proposals and what’s on the table.”

What may be ahead for income taxes

President Donald Trump after casting his ballot at the Palm Beach County Public Library in West Palm Beach, Florida, on Oct. 24, 2020.

Mandel Ngan | AFP | Getty Images

Three years ago, the president signed off on the Tax Cuts and Jobs Act, an overhaul of the tax code.

This legislation reduced individual income tax rates, nearly doubled the standard deduction and limited certain itemized deductions, including a new $10,000 cap on the state and local taxes.

“President Trump has made incredible strides to lower taxes on families and help Americans keep more of their hard-earned paychecks in their pockets,” said Courtney Parella, deputy national press secretary for the Trump campaign.

Extending the tax cuts from the overhaul would reduce taxes by $1.1 trillion from 2021 through 2030, according to a recent analysis from the Tax Policy Center

Trump has said he would “cut taxes to boost take-home pay and keep jobs in America.” How this might unfold remains to be seen, as the campaign hasn’t shared many details.

“There’s some uncertainty of what that tax cut is to increase take-home pay,” said Erica York, an economist with the Center for Federal Tax Policy at the Tax Foundation “There’s no specificity on those cuts.”

“Some people have pointed to the ‘Tax Cuts 2.0’ that the administration has discussed since 2018,” she said. One idea floated in that package included lowering the 22% marginal income tax bracket to 15%. In 2020, the 22% bracket applies to income between $40,126 and $85,525 for single taxpayers ($80,251 to $171,050 for married-filing-jointly).

On the other hand, former vice president Biden has proposed raising the top individual income tax rate to 39.6% from its current level of 37%.

My advice is to get educated on the proposals and what’s on the table

Mark Bradford

senior vice president and wealth director of Bryn Mawr Trust Wealth Management

He is also calling to limit the value of itemized deductions — the write-offs households can take on expenses that include medical costs and charitable giving — to 28% for households with incomes exceeding $400,000, according to an analysis from the Tax Policy Center.

Though Biden hasn’t specifically proposed an increase in taxes on individuals making less than $400,000, policy analysts have said that middle-income households could see a decline in wages and investment income due to higher corporate income taxes.

Indeed, the former vice president has said he wants to raise the corporate income tax to 28% from 21%. On average, after-tax income for all taxpayers could fall by 1.7% in 2030, according to an analysis by the Tax Foundation.

“The Biden campaign is proposing raising taxes on high-income individuals and corporations with some tax credits for low-income folks,” said Gordon Mermin, senior research associate at the Urban-Brookings Tax Policy Center.

Those credits include a temporary expansion of the child tax credit, boosting it to $3,000 for kids 17 and younger, plus a $600 bonus for children under 6.

The Biden campaign did not immediately respond to an email seeking comment.

Tax treatment of your investments

Based on an investor’s income, he or she could face long-term capital gains tax rates of 0%, 15% or 20%.

Certain high-income households — that is, singles with modified adjusted gross income in excess of $200,000 or $250,000 if married — pay an extra 3.8% tax on top of that.

In order to for a gain to be considered “long-term,” you must have held the asset for more than a year prior to selling it.

Trump said at an Aug. 10 press conference that he was weighing a capital gains tax cut.

Meanwhile, Biden’s proposal will raise the capital gains rate to 39.6% for taxpayers with income over $1 million, according to the Tax Policy Center.

The president has also called for expanding opportunity zones.

The Tax Cuts and Jobs Act created qualified opportunity funds — investments that direct money to low-income or distressed areas and reward investors with a tax break in return.

Your payroll taxes

Democratic presidential candidate Joe Biden speaks at The Mountain Top Inn & Resort in Warm Springs, Georgia, on Oct. 27, 2020.

Jim Watson | AFP | Getty Images

Biden has proposed increasing payroll taxes for those high-earners.

That means extending the 12.4% portion of the Social Security tax — which is shared by both the employee and employer — to earnings over $400,000, the Tax Policy Center found.

Currently, wages up to $137,700 are subject to the Social Security tax.

Meanwhile, Trump has called for a temporary suspension of the payroll tax for workers earning less than $104,000 on an annual basis.

This holiday is voluntary for employers, and workers who partake would see their tax withholding rise during the first four months of 2021.

The president has called for forgiving the deferred payroll taxes — a move that would require an OK from Congress. He also said this summer that he would make permanent cuts to the payroll tax if reelected.

Wealth transfer taxes

President Donald Trump and Democratic presidential candidate and former vice president Joe Biden at the final presidential debate at Belmont University in Nashville, Tennessee, on Oct. 22, 2020.

Morry Gash and Jim Watson | AFP | Getty Images

Trump’s Tax Cuts and Jobs Act nearly doubled the amount of money that families can pass on free of taxes either in a bequeath or in lifetime gifts. This is known as the gift and estate tax exclusion.

In 2020, an individual can transfer up to $11.58 million to an heir without federal estate or gift taxes of 40%.

Biden’s plan would bump the top tax rate on these transfers to 45%, limit the amount people can pass on at death free of taxes to $3.5 million and limit the exclusion to $1 million for gift taxes, according to the Tax Policy Center.

He is also proposing to eliminate the step-up in basis, a provision in the tax code that allows heirs to receive assets valued as of the date of death. This means, an heir who sells the holding right away would pay little to no capital gains taxes on it.

Instead, Biden’s proposal would tax unrealized capital gains at death, according to the Tax Policy Center’s analysis.

As jarring as this proposal may seem, tax experts are suggesting wealthy families review their estate plans and prepare to make changes — but hold off on massive asset transfers for now.