Think of a budget as just another list.

It’s most efficient to build a budget on a spreadsheet somewhere — whether it’s Microsoft Excel or a Google doc. Add your income and then add new expenses as you spend.

And those new expenses will surely pop up. Try to do as much planning as you can for occasional costs, such as presents for the holidays, or that getaway you plan every year — or the unexpected doctor appointment.

The more you track your spending and keep an eye on it, the better you’ll get at understanding your expenses month to month.

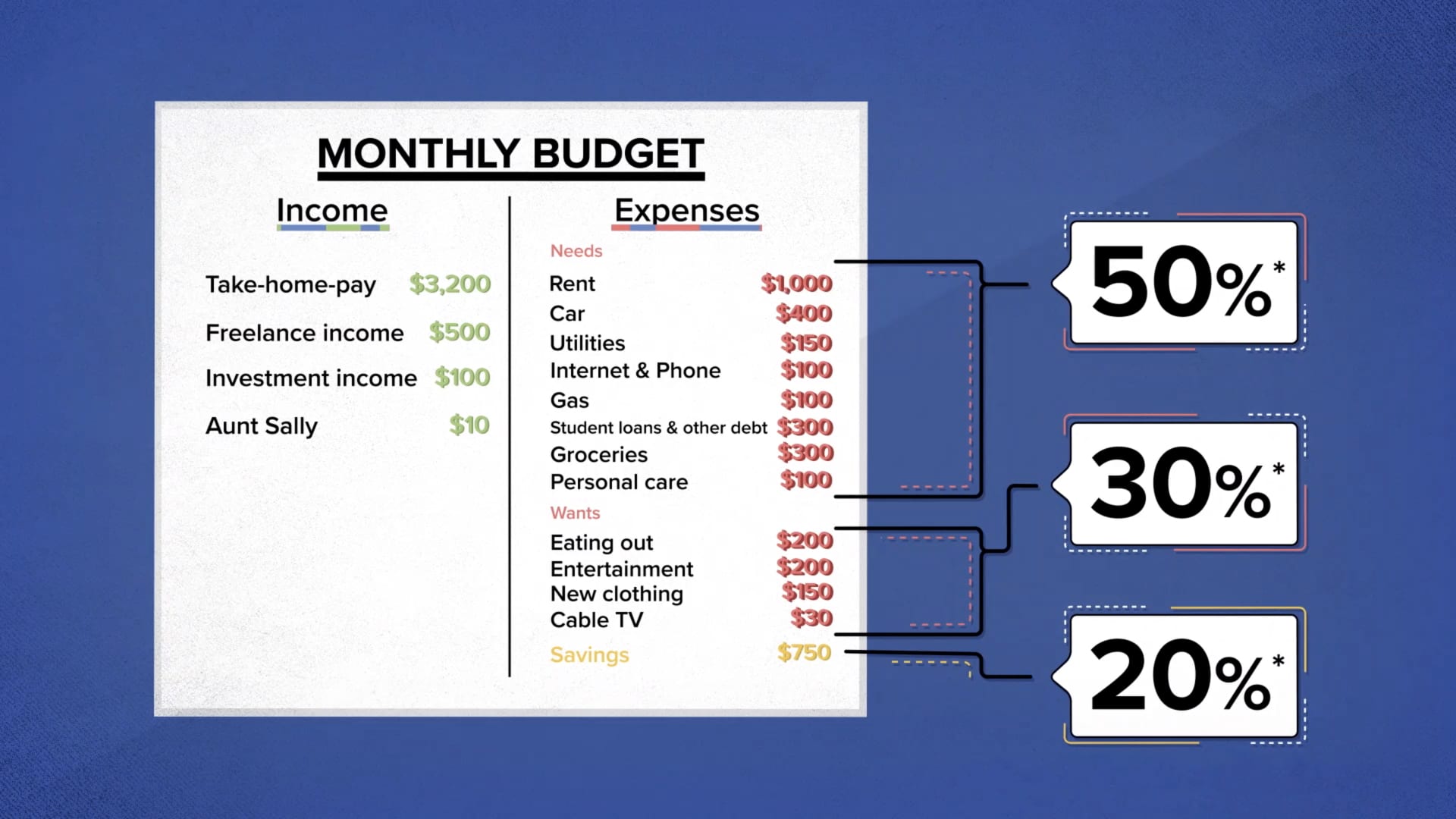

Watch this video for a step-by-step guide to making a budget that will work for you.

More from Invest in You:

Retirement is expensive – here’s how much you really need to save for it

Here’s how to invest your money if you are saving for your next vacation

Here’s how you can save $500,000 for retirement on an annual salary of $35,000

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version, Dinero 101, click here.

CHECK OUT: This teen got nearly 100 classmates to join an investing club and collected $120,000: Here are his top tips for getting started with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.