Robert Federico waited more than four months for his unemployment benefits to arrive. In the end, the payout was more than $23,000. But he endured financial hardship in the interim.

Robert Federico

Robert Federico’s situation was bleak — dire, even, by his telling.

In March, the 52-year-old lost his job at a New York design firm, where he oversaw commercial interior-design projects.

Federico, an architect by training, immediately filed for unemployment benefits.

But four months later, he hadn’t received a dollar.

Unable to find a new job in a crumbling economy, his income was at a standstill. He cut living expenses to the bare minimum. He gave up his car when the lease became unaffordable. Credit card bills went unpaid. He depleted thousands in emergency savings.

Meanwhile, countless messages and calls to the New York Labor Department resulted in dead end after dead end.

Federico’s initial high hopes for aid had evaporated by the time he spoke to CNBC about his situation in early August. He had about $8,000 in savings left in a 401(k) plan.

“After August, I’m not in good shape,” said Federico, who lives in Wayne, New Jersey.

However, last week he received a call from a state labor official, who helped him sort out his application following an inquiry by CNBC.

A few days later, Federico received more than $23,000 in unemployment benefits — the amount owed to him after months in limbo.

For the first time since being laid off, he said he felt safe buying food for his 2 ½-year-old son and himself.

No man’s land

As it turns out, Federico was stuck in a sort of “no man’s land” of the unemployment system — a situation that’s been all-to-common across the country during the coronavirus pandemic, as an unprecedented volume of benefit applications overwhelmed states’ limited capacity.

Evidence suggests the number of jobless Americans still awaiting aid requested months ago is frighteningly high.

You can’t eat retroactively. You can’t afford medicine retroactively.

Rep. Danny Davis

Democrat representing Illinois in the House of Representatives

To that point, 10% of the 2.5 million people who received their first payment of unemployment benefits in June — or, around 250,000 people — had waited at least 70 days for the money to arrive, according to Labor Department data.

Nearly no one waited that long prior to the Covid-19 recession, data show.

(The Labor Department hasn’t yet reported June data for 15 states, meaning the true figure is likely much larger.)

“He’s probably not alone,” Julia Rosner, a senior attorney at Legal Services NYC and an employment law expert, said of Federico’s case. “I’m sure he’s representative of a great number of claimants in that position.”

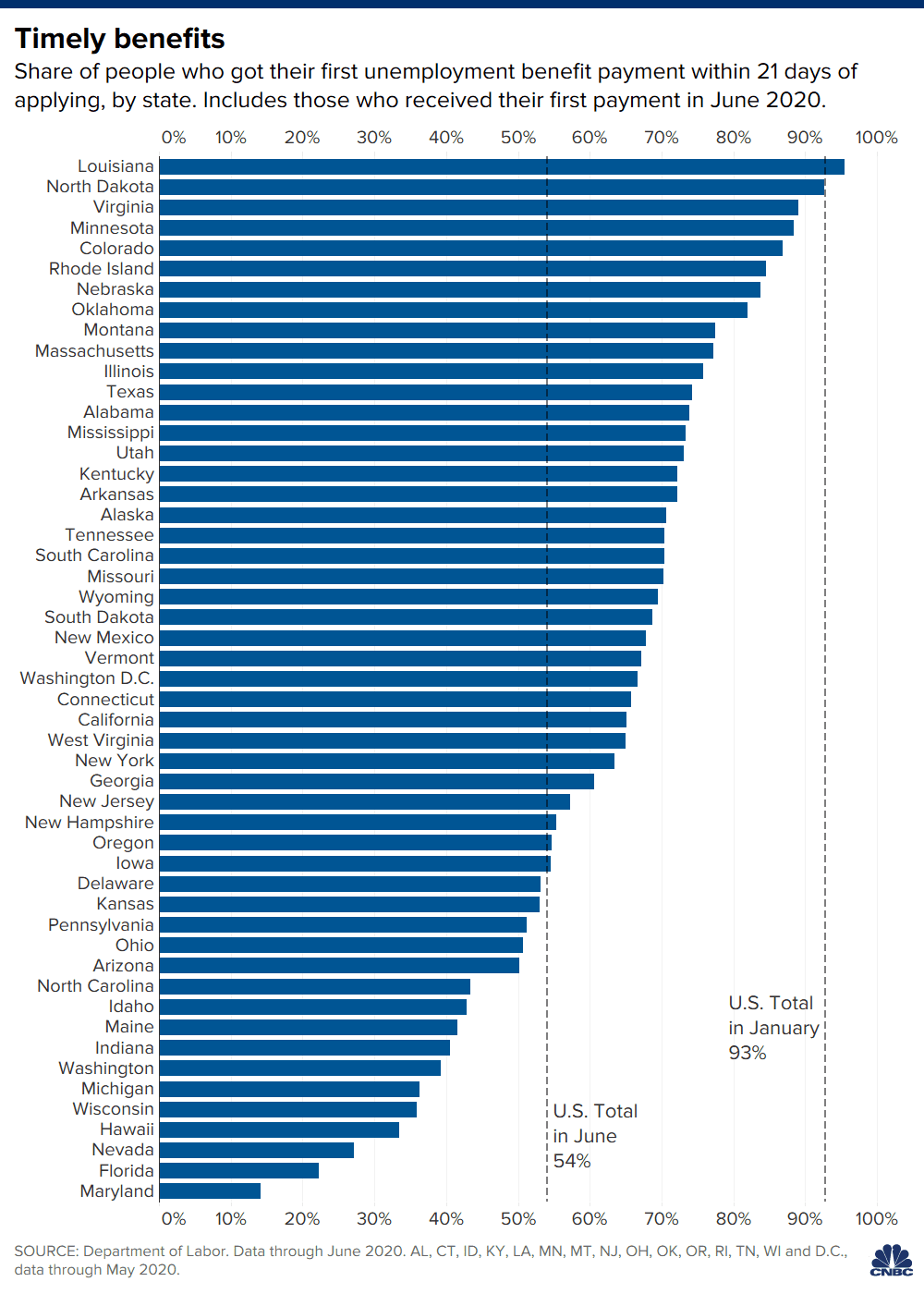

In normal times, the expectation is that “virtually everyone” is paid within 21 days of applying, said Stephen Wandner, a labor economist and senior fellow at the National Academy of Social Insurance.

However, that standard has deteriorated significantly in recent months.

More from Personal Finance

What we know about that extra $400 unemployment benefit

Tens of millions of Americans are desperate for relief

These business owners won’t get full PPP loan forgiveness

It couldn’t come at a worse time for those still waiting for benefits. Protections for homeowners and renters have disappeared for millions across the country, meaning potential eviction for those unable to pay. Food prices are increasing. The jobs that are available are being crowded out by a higher volume of applications per position, research shows.

The prospect of getting back pay from unemployment offices is of little consolation for those struggling to buy food and pay bills today.

“You can’t eat retroactively. You can’t afford medicine retroactively,” Rep. Danny Davis, a Democrat representing Illinois and chair of the House Worker and Family Support Subcommittee, said at an unemployment press conference last month.

System ‘stress’

More than 28 million Americans were collecting unemployment benefits at the end of July — a staggering increase from the 1.7 million people doing so during the same time last year. Months into the pandemic, more than 1 million workers continue to file a new unemployment claim each week through state and federal programs.

State unemployment agencies weren’t prepared for the deluge. They use antiquated technology and had limited resources available, since they corresponded to jobless levels near half-century lows prior to the pandemic.

Nearly half of workers paid for the first time in June – or, about 1.1 million people – hadn’t received aid within three weeks, according to the Labor Department. In January, that share was about 7%.

“Now, there’s more stress on the system,” Wandner said. “And if it involves any individual intervention, if someone has to look at your application and adjudicate it, it will take longer.”

Being in limbo

Unfortunately, this was the case for Federico, who existed at a unique cross section of the unemployment-benefits universe due to a work history split between two states.

Federico started a job in October as a design principal for Unispace, a global interior-design firm, working from its New York office. (This is the job he lost in March.)

He should have been told [that information] a long time ago.

Julia Rosner

Senior attorney at Legal Services NYC

Just prior to that, he’d been a senior design manager for Samsung in Ridgefield Park, New Jersey, where he’d joined in January 2019.

Prevailing guidance relative to unemployment benefits is to apply in one’s state of employment — in this case, New York.

As he later discovered from state labor-department officials, it would have been a better bet to file in New Jersey, where he lived and had more earnings history.

“He should have been told [that information] a long time ago,” Rosner said.

What ended up being a relatively quick and simple fix came after four months of confusion, frustration, unanswered e-mails and clogged phone lines.

In one instance, messages Federico e-mailed the New York Labor Department in April weren’t answered until July — and then only to say the correspondence was received and under review.

A New York labor official handling interstate cases (like Federico’s) ultimately reached out to Federico after being contacted for this article. The official then coordinated Federico’s filing with his counterpart in New Jersey.

“Due to my work situation of working partly in New Jersey and partly in New York, more salary information was needed to process my claim — even though it was sent,” Federico said of what he learned from his discussions. “For some unknown reason, my case just was in limbo due to the quantity of claims.”

New York officials couldn’t divulge the specifics of Federico’s case due to state privacy laws.

“Every state experienced an unprecedented surge in unemployment claims during this crisis, and New York is no different, but we have moved faster and more aggressively than any other state to get people their money,” according to Deanna Cohen, a spokeswoman for the labor department.

Those efforts include building a new unemployment application with Google, upgrading the phone system and improving proactive communication with New Yorkers, she said.

That work resulted in more than $34 billion in unemployment benefits paid to more than 3.2 million New Yorkers during the pandemic — the equivalent of more than 16 years’ worth of benefits paid in just over four months, Cohen said.

“This was undoubtedly a stress test on every state’s system, and we are taking the lessons learned to heart so we can best serve New Yorkers,” she said.

New York was, however, among the worst offenders relative to paying applicants within 70 days, data show. About 16% of people who received their first benefit payments in June got that aid after waiting at least 70 days.

Only six states — Maine, Hawaii, Nevada, Maryland, Washington state and Michigan — had worse track records. (Of course, New York also paid out the third-largest volume of first-time payments in June, behind California and Florida.)

$23,000

This week, a few days after his phone calls with officials, Federico received a direct deposit for months of unpaid unemployment benefits — $713 a week from New Jersey, the state’s maximum benefit, and four months of a $600-a-week federal supplement that began in April and lapsed at the end of July.

All told, it amounts to more than $23,000, before taxes. They pay is a fraction of what Federico had been earning from his job, but it will pay the bills, he said.

Luckily, Federico had already been living with his mother, to help her out, provide some more quality time with her grandson and to help him save a little money after a recent divorce. She was able to manage some living expenses Federico may have had trouble with absent living with family.

Federico doesn’t harbor a grudge for the delay. Ultimately, he feels his story is one of success and he is thankful for the help he received. The state officials were professional, kind and attentive once they learned of his application complications, he said.

Now, he’s looking forward to his next career move.

“One side of me is frustrated that it took so much time and the other side is so relived that help was given to me,” Federico said. “At least [the story] should tell that it was resolved successfully. It is the system that needs fixing not the staff.”