hept27 | iStock | Getty Images

More and more college graduates are regretful.

A recent survey by Fidelity found 40% of graduates would now make different decisions about their education if they could. Half of college grads polled by Gallup wish they’d studied something else or attended another institution.

Graduates’ regrets are mostly financial, Fidelity’s research revealed. “People would have considered costs more heavily,” said John Boroff, the director of retirement and college leadership at Fidelity.

One year at a nonprofit, four-year private college, including tuition, room and board, currently costs nearly $49,000, compared with $22,000 in 2000. Meanwhile, after accounting for inflation, the median family income today —$59,000 — has barely budged over the last two decades.

“Family income has been flat, so their ability to pay for college has not changed even as college costs have increased,” said Mark Kantrowitz, publisher of SavingForCollege.com.

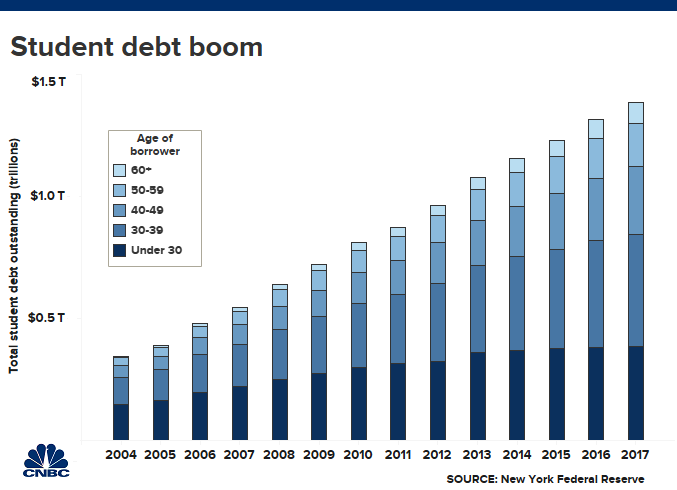

To fill the gap, more people lean on student loans. Nearly half of borrowers worry they’ll be in debt forever, Fidelity found.

To make matters worse, starting salaries for new college graduates are up less than 1% over the last two years, remaining at around $50,000. And a decade after leaving school, more than 1 in 5 college graduates still are working in a job that doesn’t require a degree.

The good news is there are ways, even amid rising costs, to make college less financially painful.

Only around 1 in 5 families have a 529 savings account. Those investment accounts, which are named after Section 529 of the Internal Revenue Code, are offered through states to encourage people to save for college. Withdrawals put toward qualifying education expenses are tax-free.

The benefits are hard to overstate. If you start to contribute to a plan at your son or daughter’s birth, about a third of your savings goal could come from investment earnings alone, according to calculations by Kantrowitz.

When it comes time for college, all families should fill out the FAFSA, or Free Application for Federal Student Aid.

More than one-third of high school graduates in 2018 didn’t complete the form, leaving behind $2.6 billion in free college money, personal finance website NerdWallet found. The average person who filed the FAFSA in the 2015-2016 academic year received around $8,500 in federal aid.

More from Personal Finance:

Chase forgives debts of certain credit card holders

Here’s one easy way to pay less to your credit card company

These moves can tank your credit score

Scholarships are another source of help, said Elaine Griffin Rubin, senior contributor and communications specialist at Edvisors. Around 8% of undergraduate students had a scholarship in the 2015-2016 academic year, up from 3% in 1989-1990. Th SavingForCollege.com website features a list of ways to find the awards.

When it comes to borrowing, students shouldn’t take out more than they expect to earn in their first year of employment, Kantrowitz said. The Georgetown University Center on Education and the Workforce has a pretty thorough breakdown of salaries by major.

“Borrowers should assume the lower end of the income range,” Kantrowitz said. “That way, they are less likely to over-borrow for their field of study.”