During market pull-backs, investors in different generations tend to behave differently. Plan participants close to retirement are more inclined to prematurely exit the market and younger people tend to remain invested. Market, “sequence of returns”1 and longevity risks address those concerns; but longevity risk has likely been the most influential factor over the past several years, leading to higher equity allocation across many target date glide paths. “Gliding” down the glide path does indeed work and puts participants in auto-pilot as they age and take less equity (stock) risk. However, regardless of what their stock exposure is, when older people see the market in a precipitous 35% nosedive, they put longevity risk aside and switch to survival mode. They no longer see it as gliding down the path, but they perceive it as the crashing of their retirement dreams.

Staying invested is the key to managing longevity risk

Interestingly, after the rapid market sell-off in the first quarter of 2020, the market roared back in a V-shaped recovery and proved everyone who exited the market wrong. The data indicates that it was the older demographic who sold out of their target date funds. One could argue that behavioral factors were at play against the more rational quantitative factors. Regardless of the cause, there are lessons to be learned from market periods like this where quantitative and behavioral factors should coalesce to create potentially better outcomes through both participant education and product innovation/research.

Managing longevity risk is essential in retirement research. It is simply the risk of running out of money before running out of time. Academic research has convincingly shown that people do live longer as societies develop with an ongoing increase in the age of transition to disability.2 This has increasingly informed the glide path construction for some of the largest target date providers, leading to increased equity exposure across the glide paths. Among many other factors, depending on the treatment and prominence of longevity risk in the glide path methodology, an asset manager may determine a certain level of equity exposure to be ideal to reduce longevity risk for an average participant. The higher the equity exposure, the less risk of running out of money before a participant runs out of time. That assumes participants will stay invested in transition to retirement and beyond, but do they?

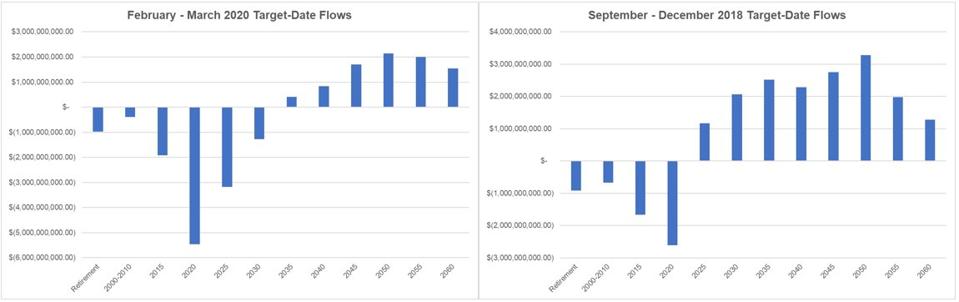

The two charts below show asset flows in the vintages going back to two stress periods; the last quarter of 2018 and the first quarter of 2020.

Change in target date fund asset flows during market stress.

Morningstar Direct

Source: Morningstar Direct

MORN

The charts approximate asset flows in the 40 Act mutual fund space (they do not include collective investment trusts) and indicate the change in asset flows for each vintage of a target date suite.3 In both cases, the outflows were steeper around retirement while vintages further away from retirement date were not as affected by the weaker markets. While it is normal to see outflows from near retirement vintages of target date funds, the outflows were unusually high in those stress periods. In the grand scheme of things, with more than $2 trillion in assets under management, the outflows shown in the charts are not significant in relative terms, but they do signal a certain behavior among the target date investors. Perhaps one could extrapolate from this and foresee larger outflows in a more persistent bear market in the future.

Sticking with the plan is critical

Accounting for longevity risk is a prudent practice and has a lot of merit when considered from a purely quantitative perspective and long-term demographic trends. Many target date providers incorporate behavioral factors and balance out risks in multiple dimensions traversing across extensive amounts of data. However, the decumulation phase is the trickiest part of the glide path and there is no silver bullet there. Participants’ behavior shows a larger, more diverse variation depending on their financial condition and evolving risk preferences through time. And let’s not forget the fear factor.

To be clear, there is no foolproof way to prevent bad decision-making in the face of so called “sequence of return” risk – the possibility of bad market outcomes as investors near retirement, which leads them to sell at the worst possible time, locking in market losses that permanently shrink their nest eggs and impair their ability to support sustainable income in retirement as a tragic consequence. In general, only wise financial counsel to “stay the course” in times of market volatility can prevent self-harm through the abandonment of the long-term strategic asset allocation program that target date providers have designed to do the hard work for participants, but only if they stick with the program.

How better education and a guaranteed lifetime income solution can help

One path toward improving retirement outcomes is encouraging plan sponsors to provide better education for plan participants about the myriad of risks facing them near and in retirement, and the related principles of strategic asset allocation that have been developed to address those risks. In particular, the importance of exposure to equities as part of a diversified target date portfolio near and through retirement to mitigate longevity risk.

On the other hand, the product manufacturers can directly help improve outcomes by baking ingredients into their solutions that are designed to mitigate the downside impact of market risk, and explicitly combat longevity risk through guaranteed lifetime income. Increasingly, they have looked for ways to add more customization and innovation in terms of in- and out-of-plan retirement income products, inclusion of stable value funds in custom glide paths and customizable managed accounts among other solutions. Furthermore, fiduciaries have stepped up efforts to bring defined contribution retirement outcomes closer to defined benefit plans. Guaranteed retirement income products allow participants to turn assets into long-term income with embedded guarantees.

Coupled with enhanced participant education, “guaranteed retirement income-powered” custom target products offer participants another opportunity to reduce/eliminate longevity risk for a better retirement experience.

1. Sequence of returns risk refers to the timing of the cash flows in relation to investment performance.

2. Advancing front of old-age human survival.

3. Source: Morningstar Direct