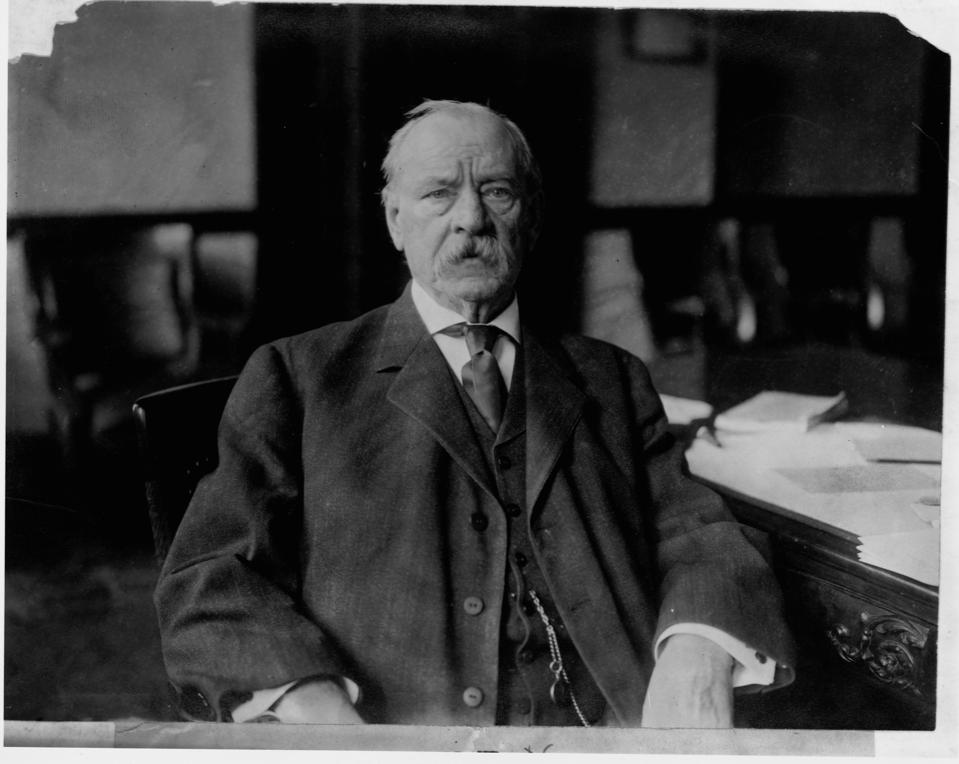

Grover Cleveland at Desk (Photo by Library of Congress/Corbis/VCG via Getty Images)

Corbis/VCG via Getty Images

No matter how you voted in the presidential election, Grover Cleveland should be your guy this month.

If you’re a disappointed Trump supporter, take solace in Cleveland’s singular achievement: He is the only American president to serve two nonconsecutive terms.

We tend to think of the presidency as a one-and-done contest — win your bid for reelection or retire quietly to the hinterlands. But Cleveland is proof that hope springs eternal, at least for the right sort of politician.

If you voted for Joe Biden but find yourself disappointed that Republicans seem likely to retain control of the Senate, Cleveland has lessons for you, too — although not necessarily happy ones.

Cleveland was the last newly elected Democrat to take office without a Senate majority from his own party. He developed successful tactics to cope with his predicament, including liberal use of the veto.

But whether those would work for a President Biden remains an open question.

Meteoric Rise

Cleveland “fell into politics without really trying,” observed historian Henry F. Graff in his capsule biography of the 22nd president of the United States, published by the University of Virginia’s Miller Center.

MORE FOR YOU

(Side note: Cleveland has long been an asterisk in these presidential counts, thanks to his nonconsecutive terms; he is best identified as both the nation’s 22nd and its 24th president.)

In 1881 local business leaders in Buffalo, New York, drafted Cleveland to run for mayor as a Democrat. He won the race and quickly earned a reputation as a vigorous anti-corruption reformer.

The very next year, Cleveland won a bid for governor, expanding his reform agenda to include a challenge to Tammany Hall, the powerful Democratic political machine based in New York City.

While governor, Cleveland made the case for progressive tax reform, including a state income tax. Advancing the idea in his first message to the State Assembly, Cleveland considered it less a serious proposal than a statement of principle.

“He did not get the change in taxation he was advocating — and had not expected to, but he had placed himself on the side of innovation,” explained Graff in his longer biography of Cleveland, published as part of the American Presidents series.

Grover Cleveland a portrait from old American money – Dollars

getty

Cleveland’s surging reputation for integrity (rather than his support for an income tax) made him a front-runner for the Democratic presidential nomination in 1884.

Supporters were impressed by his reformist zeal, but even more by his likely ability to carry New York — no small thing, given the Democrats’ underdog status in the Electoral College; no Democrat had won the presidency since the Civil War. Cleveland’s most serious competition came from Samuel J. Tilden, already famous for losing the disputed election of 1876.

But Tilden ultimately declined to run, and Cleveland captured the party nomination and ultimately the presidency, defeating Republican James G. Blaine of Maine.

Cleveland’s victory in the Electoral College was a narrow one: 219 to 182. He carried his home state by just 1,047 votes; had he lost New York and its 30 electoral votes, Blaine would have won.

Cleveland’s victory in the popular vote was also narrow: 48.9 percent to 48.2 percent.

Cleveland’s narrow victory didn’t come with coattails. In the Senate, Republicans retained control and actually managed to increase the size of their majority; Democrats lost two seats, and Republicans picked up one. In the House of Representatives, Democrats kept their majority but lost 18 seats, while Republicans picked up 21 (snatching a few extra from minor parties).

Cleveland, in other words, came to the presidency in circumstances that might seem unhappily familiar to President-elect Biden.

Governance by Veto

Cleveland took a rather limited view of the presidency. Democrats of the late 19th century were typically champions of small government and restricted federal power.

In Cleveland’s case, this view extended to the office of the presidency, where he believed his most important job was to serve as a check on overzealous lawmakers.

“Cleveland did not see himself as an activist President with his own agenda to pursue, but as a guardian or watchdog of Congress,” Graff recounts in his Miller Center biography.

Cleveland made good on that watchdog role through his liberal use of the veto power.

During the first of his two discontinuous terms, he more than doubled the number of vetoes issued by all his presidential predecessors combined (414 to their 205). During his second term, he slowed the pace, but still managed to finish his two terms with an impressive record: 584 total vetoes, with 346 of the regular sort and 238 of the pocket variety. Congress overrode seven of those.

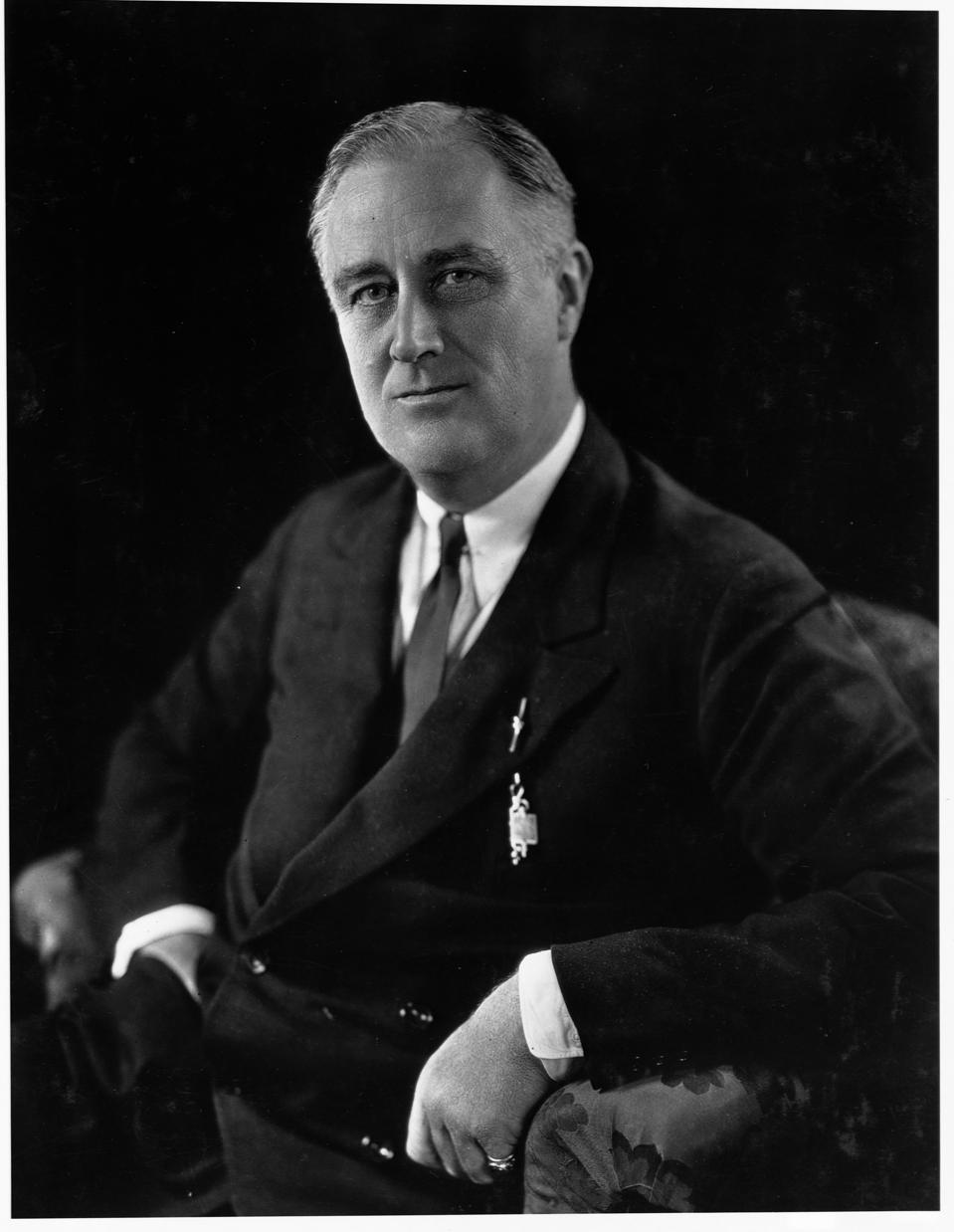

Only Franklin D. Roosevelt vetoed more legislation (racking up 635 vetoes, although he had more than four extra years on the job to reach that number).

Franklin Roosevelt (Photo by Library of Congress/Corbis/VCG via Getty Images)

Corbis/VCG via Getty Images

Cleveland saw the veto as an instrument of good government, especially in an era when lawmakers were inclined to spend money on favored constituencies and pet projects.

He vetoed countless private relief and pension bills, a mainstay of late-19th-century lawmaking. He also vetoed many local, small-scale construction projects.

Cleveland’s most famous veto, however, was for the Texas Seed Bill, which would have directed aid to drought-stricken farmers. Cleveland’s veto message articulated a strict, small-government objection to the measure, which has left him famous with conservatives ever since.

“I can find no warrant for such an appropriation in the Constitution, and I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering which is in no manner properly related to the public service or benefit,” he wrote.

Cleveland generally used his veto power to strengthen the weak hand voters had dealt him. His strategy was reasonably successful, but only because his ambitions were more negative than positive; the watchdog role he assigned to the presidency was well served by simply saying no.

Revenue Agenda

However, Cleveland had at least one positive legislative item on his agenda: tariff reform. In their 1884 platform, Democrats had struck a cautious note on the tariff, pledging to cut “taxes” (by which they meant import duties) “to the lowest limit consistent with due regard to the preservation of the faith of the Nation to its creditors and pensioners.”

Democrats insisted, however, that they would pursue only tariff reform that was “cautious and conservative in method, not in advance of public opinion, but responsive to its demands.” More to the point, they promised voters that “the Democratic party is pledged to revise the tariff in a spirit of fairness to all interests.”

These were not exactly fighting words, but they signaled at least some modest effort at tariff reduction. However, the party took its time; while some minor tariff legislation won consideration in 1886, it wasn’t until December 1887 that Democrats got serious about the issue.

When they did, however, Cleveland himself embraced it with uncharacteristic vigor, devoting his entire annual message to it.

In his message, Cleveland framed tariff reform as a question of excess taxation.

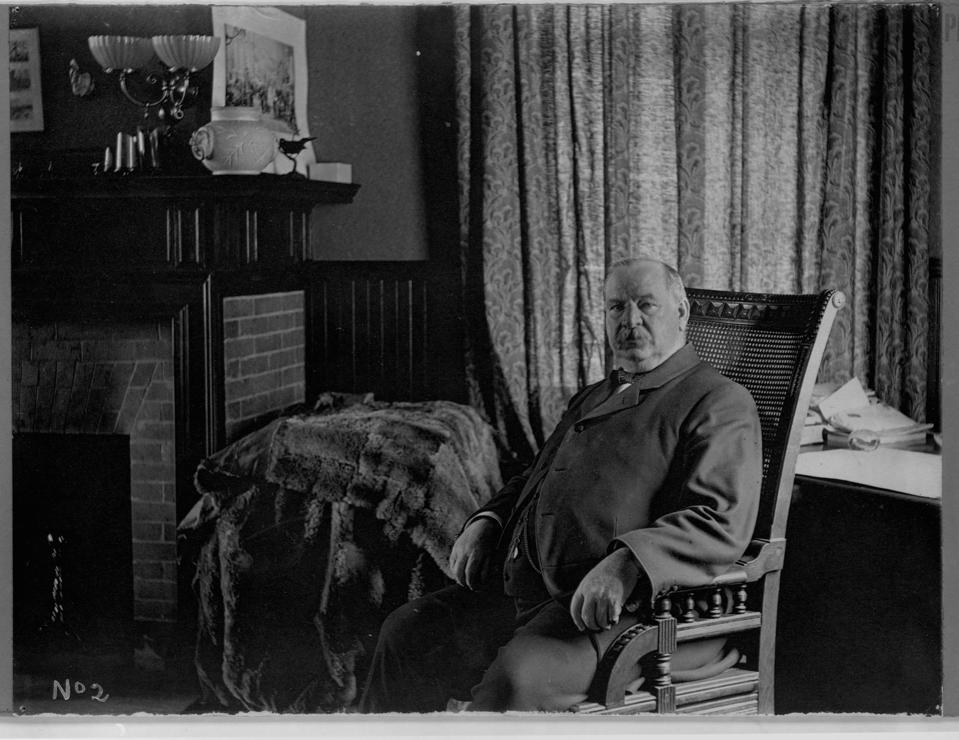

Grover Cleveland Relaxing by Fireplace (Photo by Library of Congress/Corbis/VCG via Getty Images)

Corbis/VCG via Getty Images

With the federal government running a large and consistent surplus, there could be no justification for keeping tariff duties at their current, elevated levels, he insisted.

The government should collect only the amount necessary for “the careful and economical maintenance” of its operations and institutions. Collecting anything more was an “indefensible extortion and a culpable betrayal of American fairness and justice,” he said.

Cleveland warned that collecting too much created endless problems.

“The public Treasury, which should only exist as a conduit conveying the people’s tribute to its legitimate objects of expenditure, becomes a hoarding place for money needlessly withdrawn from trade and the people’s use, thus crippling our national energies, suspending our country’s development, preventing investment in productive enterprise, threatening financial disturbance, and inviting schemes of public plunder,” he said.

Cleveland pointed out that federal revenue derived not just from tariffs, but also from excise taxes on alcoholic beverages and tobacco products. But these internal consumption taxes were unobjectionable, he said.

“It must be conceded that none of the things subjected to internal-revenue taxation are, strictly speaking, necessaries,” he told lawmakers. “There appears to be no just complaint of this taxation by the consumers of these articles, and there seems to be nothing so well able to bear the burden without hardship to any portion of the people.”

Tariffs, on the other hand, were overdue for sweeping reduction.

“Our present tariff laws, the vicious, inequitable, and illogical source of unnecessary taxation, ought to be at once revised and amended,” he declared.

Cleveland was clear about who bore the responsibility for repairing the nation’s broken revenue system. “If disaster results from the inaction of Congress, the responsibility must rest where it belongs,” he said.

These were heated words. But Cleveland followed them up with characteristically tepid actions.

“He had come out of the gate strong for tariff reform, but he did not crusade for it — evidencing once again that he was not a fighter,” Graff noted. A moderate tariff revision bill passed in the Democrat-controlled House, but died swiftly in the Republican Senate.

Presidency Interrupted

Having made an issue of the tariff, Cleveland and his fellow Democrats entered the 1888 election season with nothing to show for it.

When voters went to the polls, they punished the party, giving Republicans majorities in both houses of Congress. Cleveland, meanwhile, lost his reelection bid to Republican Benjamin Harrison.

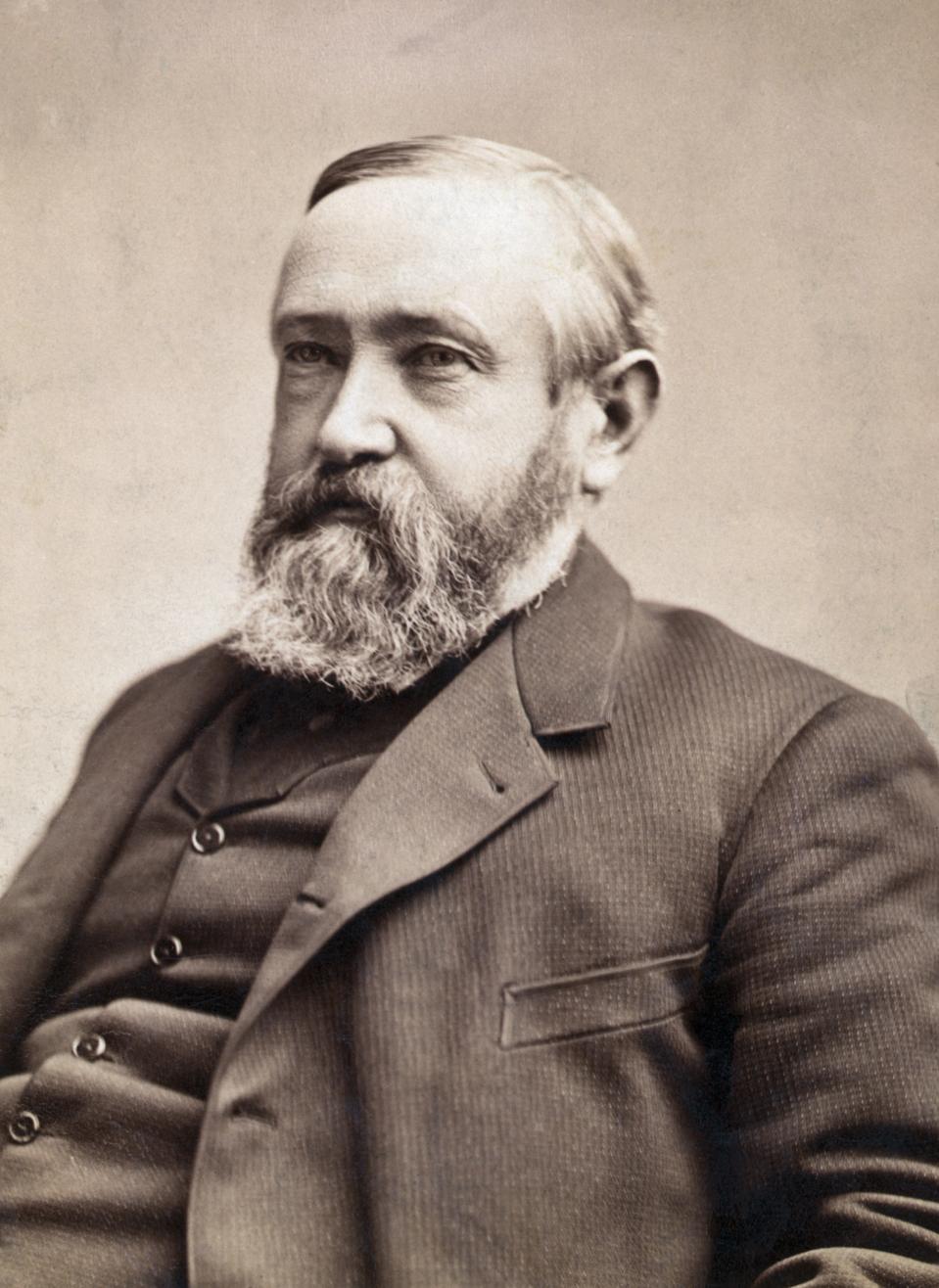

Portrait of Benjamin Harris (1833-1901), the twentieth President of the United STates. Undated … [+]

Bettmann Archive

In the popular vote, Cleveland actually won a narrow victory: 5,539,118 to 5,449,825.

But Harrison won the Electoral College, 233 to 168. Cleveland lost two of the most important states he had won four years earlier, Indiana and (gallingly) his home state of New York.

Cleveland accepted his loss with at least a modicum of good humor. Asked to explain the disappointing result, he suggested that “it was mainly because the other party had the most votes.”

Cleveland retired to private life, but he never stopped preparing for a return to Washington.

And four years later, he and Harrison faced off in a rematch. This time, they were joined by James B. Weaver of the Populist Party.

When the votes were counted, Cleveland had 277 electoral votes, Harrison 145, and Weaver 22. Democrats also won majorities in both houses of Congress.

Explanations for the Democratic sweep encompass a range of issues, but the McKinley Tariff of 1890, which raised import duties and consumer prices significantly, probably deserves much of the blame for GOP losses. Certainly, many Democrats believed that the tariff was responsible for their victory, and they resolved to follow through on tariff reform in short order.

First, though, they had more immediate problems. Cleveland had barely any time to savor his victory before the Panic of 1893 plunged the nation into a severe depression.

The president and his congressional allies responded with monetary reforms. At the end of 1893, however, they also returned to the tariff, advancing a package of revisions designed to bring down consumer prices.

The Wilson-Gorman Tariff Act, passed by the House in December 1893, featured a moderate reduction in many import duties, as well as a new, flat rate tax of 2 percent on personal and corporate incomes over $4,000.

In the Senate, protectionist members managed to water down the legislation; critics said the resulting bill was hardly any better than the McKinley tariff it was designed to replace.

Many Democrats, including Cleveland, were outraged. But the president — who played a relatively minor role in shaping the legislation — allowed it to become law without his signature. It was a distinctly modest victory for the champions of tariff reduction.

And while the inclusion of an income tax seemed to herald the arrival of a new era in federal finance, the Supreme Court quashed those hopes the following year with its decision in Pollock v. Farmers’ Loan & Trust Co.

Lessons for Today

If the story of Grover Cleveland has a lesson for Donald Trump, it’s probably about perseverance.

WASHINGTON, DC – NOVEMBER 26: President Donald Trump speaks in the Diplomatic Room of the White … [+]

Getty Images

After his defeat in 1888, Cleveland remained a player in national politics, and just four years later, his doggedness paid off with a return to the White House.

In some respects, Trump seems to be channeling Cleveland these days, albeit unwittingly. According to Axios, Trump is already talking to advisers about making another run for the White House in 2024 — even as he continues to challenge the validity of his loss in this year’s election.

Trump is also set to announce the creation of a new leadership political action committee, according to The New York Times.

Such a fundraising vehicle would bolster his dominance of the Republican Party after he leaves the White House. It might also serve as a clear signal that he plans to run again, keeping the field clear of serious competition for the GOP nomination.

If Cleveland’s story is a hopeful one for Trump, it’s probably less inspiring for Biden. Cleveland’s governing agenda — keeping a lid on activist government by simply saying no to Congress — was well served by the veto power. That was convenient, since the veto was pretty much the only leverage Cleveland had, at least during his first term.

Biden, by contrast, brings a more positive view of government to the presidency.

Deprived of a majority in the Senate, he would likely meet with frustration on Capitol Hill; ambitious plans for health, environmental, and tax policy (to name just a few) would be a heavy lift.

In theory, threatened vetoes might still be a source of leverage for an activist president facing a recalcitrant Congress. But for what it’s worth, the veto power did nothing to help Cleveland advance tariff reform during his first term.

It’s hard to advance a legislative priority by saying no.