A beach home on the west end of Dauphin Island, Alabama in the Gulf of Mexico is left pieces in the wake of Hurricane Katrina Thursday, September 1, 2005. Photographer: Kari Goodnough/Bloomberg News

BLOOMBERG NEWS

Hurricane Dorian made landfall in the Bahamas over the weekend. The category 5 storm has been called the strongest storm to ever threaten the east coast with maximum sustained winds of over 185 mph. According to the National Hurricane Center, “Although gradual weakening is forecast, Dorian is expected to remain a powerful hurricane during the next couple of days.” This means that strong winds, heavy rains, and storm surges are expected to impact parts of the southeastern United States from Florida to New Jersey as the slow-moving storm moves north, putting lives and property at risk.

In years past, taxpayers who suffered an economic loss due to a natural disaster like a hurricane could claim a deduction on their federal income tax return. That changed in 2018. Under the Tax Cuts and Jobs Act (TCJA), losses for individuals are now only deductible to the extent they are attributable to a federally declared disaster (federal casualty loss). Additionally, since you can no longer claim any miscellaneous itemized deductions (more on those here and here), business casualty losses of property used in performing services as an employee cannot be deducted or used to offset gains.

A federal casualty loss involves casualty or theft loss of personal-use property that is attributable to a federally declared disaster. The casualty loss must occur in a state receiving a federal disaster declaration. If the loss isn’t attributable to a federally declared disaster, it isn’t a federal casualty loss, and you may not claim a casualty loss deduction unless an exception applies.

For a list of federally declared disaster areas, check out the Federal Emergency Management Agency (FEMA) website. You’ll find the list specifically attributable to Hurricane Dorian here.

(There is an exception to the rule. If you have personal casualty gains reported on line of your form 4684 – more on that in a bit – you may deduct personal casualty losses that aren’t attributable to a federally declared disaster to the extent they don’t exceed your personal casualty gains.)

Typically, a casualty loss is defined as the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event. That includes a hurricane, flood, tornado, fire, earthquake, or even volcanic eruption. A casualty loss does not include normal wear and tear or damage that happens over time, like termite damage.

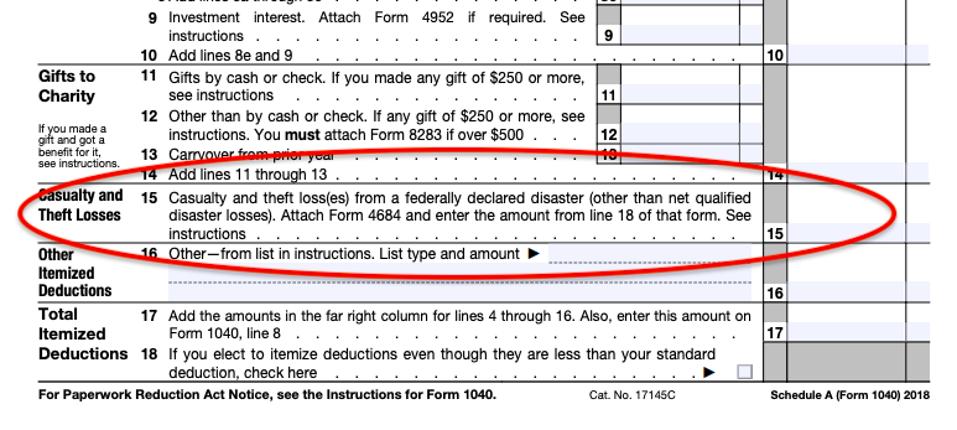

To claim a casualty loss on your federal income tax return, you must itemize your deductions using Schedule A, Itemized Deductions (downloads as a PDF). Schedule A looks a bit smaller these days, so now you’ll report the loss on line 15 of that form. You’ll find it just below the section where you’d report charitable gifts:

KPE

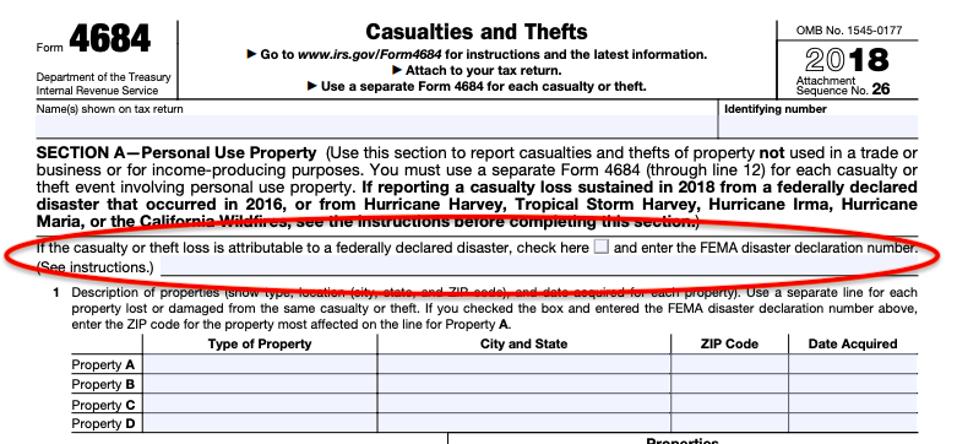

The number that goes on Schedule A, line 15, is figured using federal form 4684, Casualties and Thefts (downloads as a PDF). Right off the bat, you’ll notice that the form looks different than before. Specifically must indicate that your casualty loss is attributable to a federally declared disaster by ticking a box and entering the FEMA disaster declaration number:

KPE

On Page 1, at Section A of that form, you’ll report any damage or loss of personal-use property like your home or car. On Page 2, at Section B of that form, you’ll report any damage or loss of business or income-producing property.

If your property is personal-use property or is not entirely destroyed, the amount of your loss is the lesser of your adjusted basis or the decrease in the fair market value of your property because of the damage. For this purpose, your basis is typically what you paid for the item plus any long term improvements (like an addition).

If your property is business or income-producing property, such as rental property, and is completely destroyed, then the amount of your loss is your adjusted basis. For this purpose, your basis is typically what you paid for the item plus any long term improvements less any depreciation that you might have previously claimed for your business property.

To the extent that you could salvage your property or if you were reimbursed by insurance, you must report those adjustments. If you expect to be reimbursed by insurance but haven’t yet received any money, you have to report that, too. Don’t worry: you can always amend your return (or otherwise report the adjustment on next year’s return) if it turns out that you received more or less than expected.

Some property may not be covered by insurance. In fact, most homeowners and renters insurance does not typically cover flood damage. According to the National Flood Insurance Program, more than 20 percent of flood claims come from properties outside the high-risk flood zone and flood insurance can pay regardless of whether or not there is a presidential disaster declaration.

For damage not covered or reimbursed by any insurance, subtract $100 for each event (meaning storm or disaster). Next, subtract 10% of your adjusted gross income (AGI) from that amount to calculate your allowable loss.

Here’s a quick example:

Your AGI is $50,000. You suffered damage to your home during a hurricane, and your home is located in an area attributable to a federally declared disaster.

The value of your home decreased by $15,000. You received $2,000 in insurance money. Your initial loss is $15,000 less $2,000 (insurance), or $13,000. That amount is reduced to $12,900 ($13,000 less $100). Finally, subtract $5,000 (10% of your AGI). Your casualty loss, for tax purposes, is $7,900.

If, after you figure your loss deduction, it’s more than your income, you may have a net operating loss. However, you don’t have to own a business to claim a casualty loss. You can find out more about operating losses here.

As with most deductions, you’ll want to keep excellent records. It’s a good idea to take pictures of the damage: hopefully, you have some before pictures to compare to the after. Keep receipts of repairs and replacement values. In some cases, you may need or want to obtain an appraisal.

(You can find out more about tax, insurance and business records, here.)

Casualty losses are generally deductible in the year the loss occurred. However, if you have a casualty loss from a federally declared disaster, you can choose to treat it as having occurred in the previous year.

(You can find out more about losses at IRS Publication 547, which downloads here as a PDF.)

Tax relief other than casualty loss deductions may also be available, including extensions of time to file and make payments. To find out if you may be affected, check back with me, or head over to the IRS website for updates.

As terrible as disasters are, they can also bring out the good in people. Remember that your gifts to qualifying charitable organizations are tax-deductible (again, assuming you itemize) in the year that you make the gift. Be generous, be smart, and get receipts. You can find out more here.