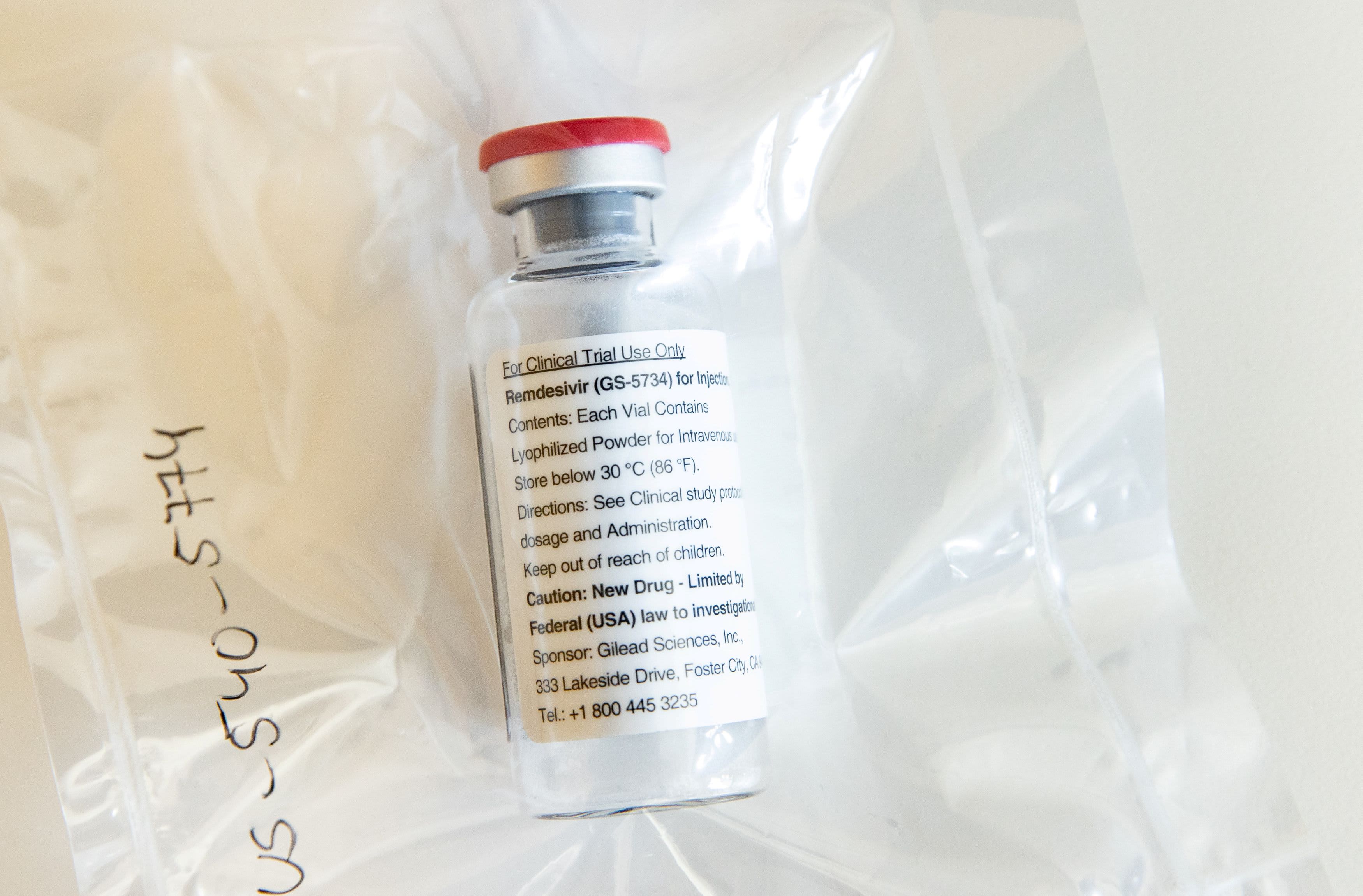

An ampule of Ebola drug remdesivir is pictured during a news conference at the University Hospital Eppendorf (UKE) in Hamburg, Germany, April 8, 2020, as the spread of coronavirus disease (COVID-19) continues.

Ulrich Perrey | Reuters

Gilead Sciences said Thursday that it can produce “several million” rounds of its antiviral drug remdesivir next year to help patients fight the coronavirus.

The company expects to produce more than 140,000 rounds of its 10-day treatment regimen by the end of May, and anticipates it can make 1 million rounds by the end of this year.

“Our focus at this time is on both our work with remdesivir and our ongoing commitments to the people who depend on our medicines today,” Gilead CEO Daniel O’Day said in the company’s first-quarter earnings release.

On Wednesday, Gilead released preliminary results from its clinical trial on remdesivir, showing at least 50% of the patients treated with a five-day dosage of the drug improved. The clinical trial involved 397 patients with severe cases of Covid-19. The severe study is “single-arm,” meaning it did not evaluate the drug against a control group of patients who didn’t receive the drug.

The National Institute of Allergy and Infectious Diseases also released results from its own study Wednesday. It showed Covid-19 patients who took remdesivir usually recovered after 11 days, four days faster than those who didn’t take the drug.

Remdesivir, touted by President Donald Trump, has not been formally approved to treat the virus and U.S. health officials caution new data on the drug has yet to be peer-reviewed.

Gilead said it spent $50 million on its research and development of the drug during the first quarter.

Overall, the company beat Wall Street’s earnings expectations, reporting an adjusted $1.68 per share, higher than the $1.57 analysts had expected. Revenue rose 5% over last year to $5.55 billion, higher than Wall Street expected.

On an unadjusted basis, the company’s first-quarter profit slid 21% to $1.55 billion from $1.98 billion during the same period last year.

The company said it generated $200 million more in first-quarter sales due to “increased buying patters and patient prescriptions trends” from the pandemic.