Fuel prices jumped in trading on Sunday night, as much of one of the largest pipelines in the U.S. remains closed following a cybersecurity attack.

West Texas Intermediate crude futures, the U.S. oil benchmark, advanced 47 cents to $65.37 per barrel. International benchmark Brent crude traded at $68.76 per barrel, for a gain of 48 cents. Natural gas futures were at $2.96 per million British thermal units, while gasoline futures jumped 3% to $2.193 per gallon.

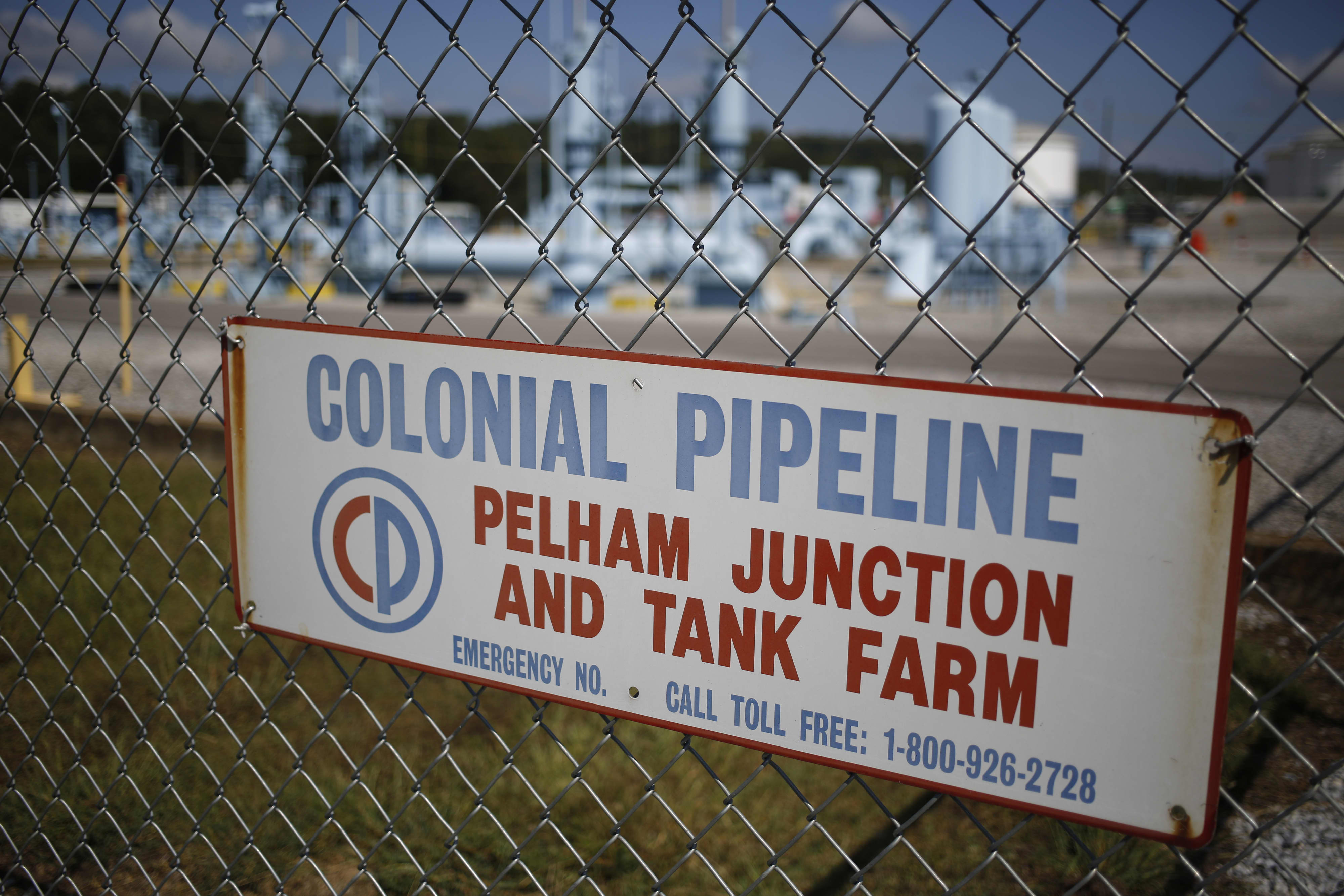

Colonial Pipeline said Sunday evening that some of its smaller lateral lines between terminals and delivery points are once again online, but that its mainlines are still shut down.

“We are in the process of restoring service to other laterals and will bring our full system back online only when we believe it is safe to do so, and in full compliance with the approval of all federal regulations,” the company said in a statement.

How quickly service is restored to the pipeline remains the crucial factor to watch. While tank farms typically have a few days of stored fuel supply, a prolonged outage could lead to a spike in fuel prices.

Colonial Pipeline, which operates the largest pipeline carrying fuel from the Gulf Coast to the Northeast, “halted all pipeline operations” on Friday night as a proactive measure following a ransomware cyberattack.

The pipeline is a crucial part of U.S. petroleum infrastructure, transporting around 2.5 million barrels per day of gasoline, diesel fuel, heating oil and jet fuel. The pipeline encompasses more than 5,500 miles and carries nearly half of the East Coast’s fuel supply. The system also provides fuel for airports, including in Atlanta and Baltimore.

“Without this, there’s no transportation in the region, so it’s critical the pipeline return to service as soon as possible,” said Patrick De Haan, head of petroleum analysis at GasBuddy. “The impacts will ramp up potentially exponentially after around day 5 or so,” he added.

President Joe Biden was briefed on the pipeline closure Saturday morning, and the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency is coordinating with Colonial Pipeline.

U.S. Commerce Secretary Gina Raimondo said Sunday that it’s an “all hands on deck effort right now.”

“We’re working closely with the company, state and local officials to make sure that they get back up to normal operations as quickly as possible and there aren’t disruptions to supply,” she told CBS’ “Face the Nation.”

The pipeline outage comes as Americans are beginning to travel again as restrictions are lifted and the Covid vaccination rollout accelerates. On Friday the TSA screened more than 1.7 million passengers, the highest in more than a year.

“The Colonial outage comes at a critical juncture for the recovering U.S. economy: the start of the summer driving season,” noted ClearView Energy Partners. “A sustained disruption that leads to a significant pump price spike could increase prospects of domestic policy interventions,” the firm added.

The national average for a gallon of gas stood at $2.962 on Sunday, up 60% from a year ago, according to AAA.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today

– CNBC’s Emma Newburger contributed reporting.