Rising gas prices on the Ethereum network have significantly cut into users’ profits. Luckily, if reported correctly, you can convert these burdensome gas fees into tax savings.

What Is Gas?

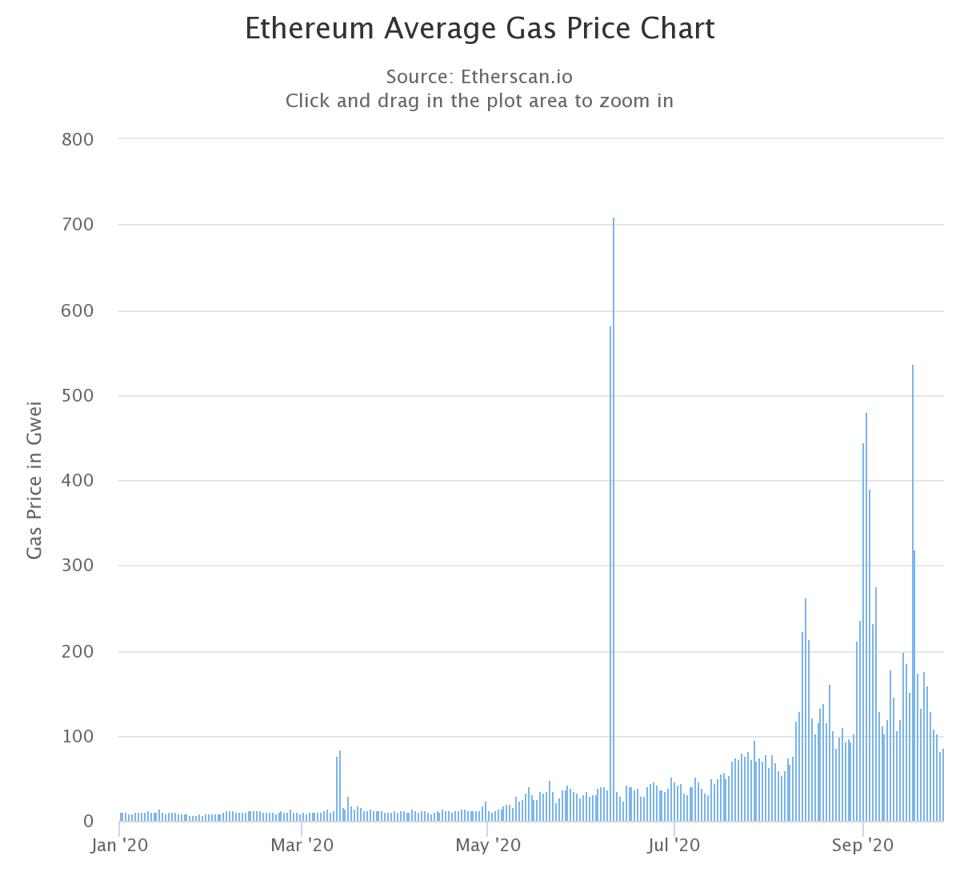

Gas is the transaction fee you have to pay to the Ethereum network to execute transactions. Gas is measured in gwei, a subunit of the ether cryptocurrency. As transactions increase on the Ethereum network, gas prices go up. As you can see in the chart below, over the past few months, average gas fees steadily rose while spiking on multiple occasions due to the congestion caused by DeFi activity. As a result, every time you move your coins in the Ethereum network, there is a hefty transaction fee you have to pay which reduces your profits and/or transacted value.

Ethereum Average Gas Price Chart

Ethersca.io

Although it’s not explicitly mentioned in the tax code, gas fees paid on transactions can be used to reduce your tax bill when properly tracked and reported.

Gas Fees On Sales

Gas fees on sales and dispositions are deducted from proceeds. For example, if David sells 1 ether (ETH) for $100 and spends $5 for gas, his total proceeds on the transaction would be $95 ($100 – $5).

Gas Fees On Transfers

Gas fees on transfers could be added back to the basis of the token. Suppose David purchases 1 ETH at $10 on Coinbase. In order to transfer this token to Metamask, he has to incur a $2 gas fee. Once the transfer is complete, the cost basis of his 1 ETH on Metamask will be $12 ($10 + $2). When you up the cost basis with the gas fees incurred, the eventual capital gain resulting from selling that coin will decrease.

Failed Gas Fees

Losing ether to failed transactions is a somewhat common occurrence in the Ethereum blockchain. Transactions can fail if you don’t enter sufficient gas limit to pay the transaction fee and/or when a contract rejects the transaction. Even though the transaction will be reverted, the ether used during the process will not be refunded

Ether lost on failed transactions could result in a capital loss which could offset your capital gains. Suppose you spent 1 ETH in gas fees and the transaction failed. You purchased this ETH for $100. At the time you spent it on gas, it was worth $80. Here, you have a disposition event and a capital loss of $20 ($100 – $80). Note that if the price of ETH has gone up in value, you could also have a capital gain.

In order to get these tax benefits, you should keep detailed records of your ether transactions, cost basis of ether you hold and the market value of ether at the time you spent on gas.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.