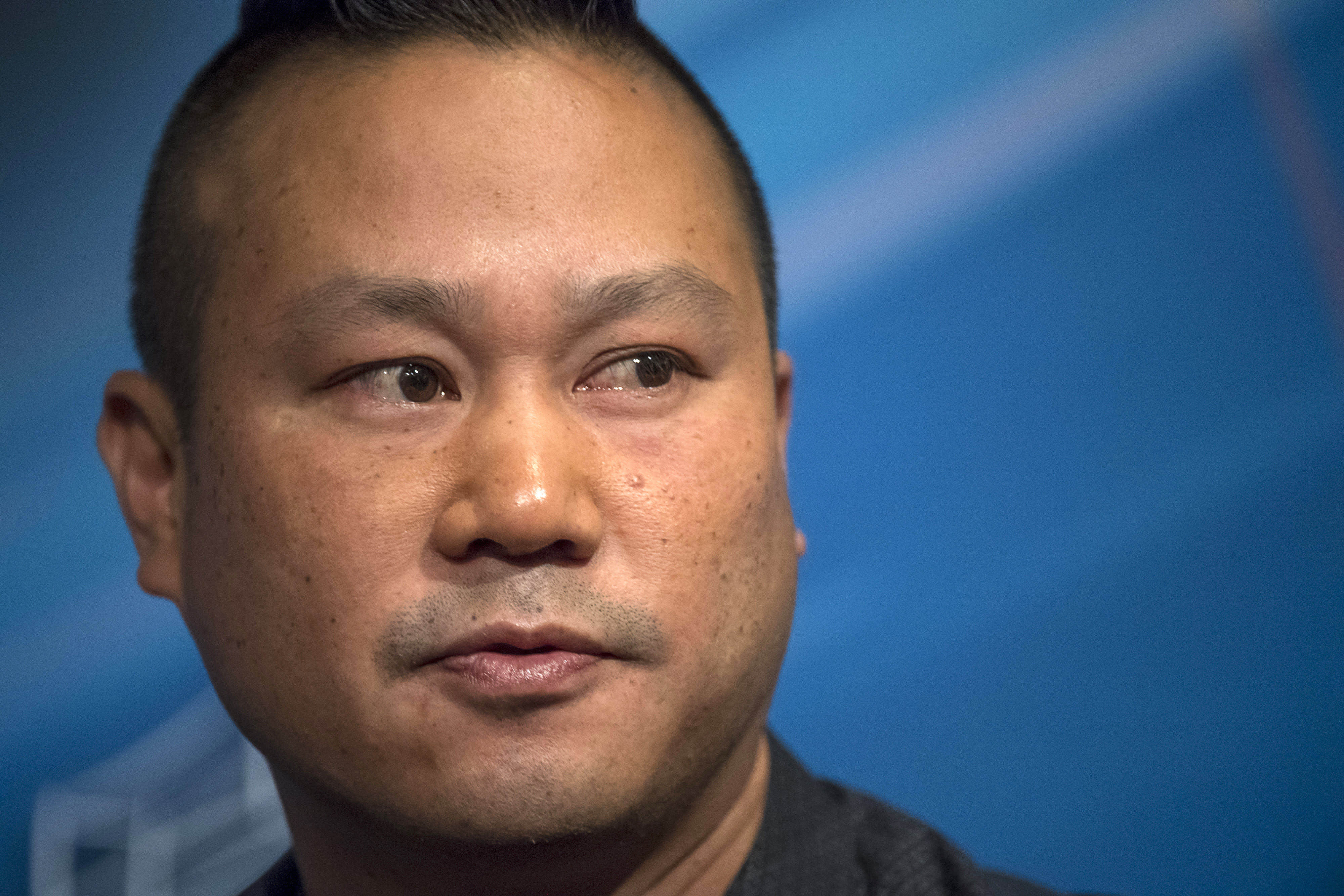

Tony Hsieh, former CEO of Zappos.com

Bloomberg | Bloomberg | Getty Images

Former Zappos CEO Tony Hsieh, who died last week from injuries sustained in a house fire, did not leave behind a will, according to published reports.

Hsieh, who retired in August from the shoe and clothing online retailer, succumbed to complications from smoke inhalation Nov. 27 after his rescue from a Connecticut house fire Nov. 18, reports say. He was 46.

Hsieh left behind an estate worth an estimated $840 million. With no will or estate plan, it may be tricky to know who should get what, or whether there was a preference. His family has asked a judge to name Hsieh’s father and brother as special administrators of his estate.

While you might assume estate planning only applies to wealthy people, that’s not the case. An estate only refers to what you own: financial accounts, real estate and possessions.

Putting a plan in place for those assets helps ensure that upon your death, your wishes are carried out and that family squabbles don’t evolve into destroyed relationships.

In other words, it’s partly about making things easier for your loved ones during an already-difficult time. And with the deadly coronavirus still raging (the U.S. hit a record 100,000 hospitalizations Wednesday) it’s more important than ever.

Here’s what else you should consider if you want to prepare.

A will and its limitations

A will is a document that lets you relay who gets what when you pass away. You can get as specific as you want (you leave a certain family heirloom to a particular person) or keep it more general (you want your surviving spouse to get everything).

If you pass away without one — called dying intestate — a state court generally decides who gets your assets and, if you have children, who will care for them.

“In every jurisdiction, if there isn’t a valid will, assets will pass on to your heirs by law, who may or may not be who you would have provided for in a will,” said Samantha Weyrauch Davis, an estate planning attorney and director with the law firm Hall Estill in Tulsa, Oklahoma.

More from FA Playbook:

However, some assets pass outside of the will, including 401(k) plans, individual retirement accounts and life insurance policies.

This means the person named as a beneficiary on those accounts will generally receive the money no matter what your will says. Be aware that 401(k) plans require your current spouse to be the beneficiary unless they legally agree otherwise.

Regular bank accounts, too, can have beneficiaries listed on a payable-on-death form, which your bank can supply.

If no beneficiary is listed on those non-will items or that person has already passed away (and there is no contingent beneficiary listed), the assets automatically go into probate. That’s the process by which all of your debt is paid off and the remaining assets are distributed to heirs. This can last several months to a year or more, depending on state laws and the complexity of your estate.

If you own a home, be sure to find out how it should be titled to ensure it ends up with the person (or people) you intend, because applicable laws can vary from state to state. Moreover, there can be other considerations when it comes to how a house is titled, including protection from potential creditors or for tax reasons when the home is sold.

Putting someone in charge

As part of the will-making process, you’ll need to pick an executor of your will (sometimes called a personal representative).

This can be a big job, experts say. Things such as liquidating accounts, ensuring your assets go to the proper beneficiaries, paying any debts not discharged (i.e., taxes owed to the IRS), and even selling your home could be among the duties undertaken by the executor.

In other words, just because you’ve known your best friend since elementary school doesn’t mean handling the challenge of being an executor is up their alley.

Where to get a will

To prepare a will, you can turn to an estate planning attorney in your local area — to ensure familiarity with state laws — or use an online option. However, be aware that not all web-based alternatives will necessarily reflect the specifics of your state’s law.

“There’s risk in doing it that way,” Davis said. “Those forms or software may not be compliant with your local law, so look at the fine print.”

Stockshares | Getty Images

If an online option ends up being appropriate for your situation, you may be able to find a form to download for free. Software will-making options can run about $60 or more, depending on what else is included. Setting up an estate plan with an attorney could run several hundred dollars to more than $1,000, depending on the complexity of your situation.

Also, you’ll need to have a witness and/or notary sign it and make the document official, depending on the state where you live. The American College of Trust and Estate Counsel’s website offers a guide to laws and accommodations in every state if in-person meetings are not permitted due to the pandemic.

Other key documents

Typically, estate planning also includes preparing a few other legal documents. This includes an advance health-care directive, also known as a living will.

This document outlines your wishes if you become incapacitated due to illness or injury.

Say you are on life support. Instead of a loved one making the agonizing decision whether to end all life-saving measures, your wishes would be specified in a legal record.

It’s also worth assigning powers of attorney. If you become incapacitated, the people to whom you grant powers of attorney will handle your medical and financial affairs if you cannot.

Sometimes we see people named who, down the road, are not well-suited for the responsibility.

Samantha Weyrauch Davis

Estate planning attorney and director with Hall Estill

Often, the person who is given this responsibility when it comes to your health care is different from whom you would name to handle your financial affairs.

As with choosing an executor, make sure whoever you hand the financial reins to is trustworthy and smart.

“I tell my clients it’s really important to carefully consider the individuals you name,” Davis said. “You want to make sure they have the ability, skill set, time and desire to make such decisions and do these sorts of things.

“Sometimes we see people named who, down the road, are not well-suited for the responsibility,” she said.

Make a master list

While it can be hard to imagine your own death, picture your family having to search through drawers for your original will, documents regarding your bank accounts and other assets, and maybe even your Social Security number.

The best way to avoid forcing them to deal with that task on top of mourning is to leave an organized list of information that the will’s executor will need to settle your estate, experts say. Be sure this includes passwords so your online accounts can be accessed.

Consider a trust

If you want your kids to receive money but don’t want to give a young adult — or one prone to poor money management — unfettered access to a sudden windfall, you could create a trust to be the beneficiary of a particular asset.

A trust holds assets on behalf of your beneficiary or beneficiaries, and is a legal entity dictated by the documents creating it. If you go that route, the assets go into the trust instead of directly to your heirs. They can only receive money according to how (or when) you’ve stipulated in the trust documents.

The average cost to set up a trust using an attorney ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple, according to LegalZoom.com. Doing it yourself with online software could run at least several hundreds of dollars.

Follow up on your plan

Life changes. And as it does, so should your estate plan.

Couples split up, relationships change and new assets are acquired or disposed of. The person you named as your child’s guardian might have developed an unsavory lifestyle, or your executor might have passed away.

Any time a major change occurs in your life, it’s time to make sure your will and other estate documents reflect it. Otherwise, review them every few years.

“An estate plan is not something you put in a file for a decade,” Davis said. “You want to make sure it stays in step with what you want.”