Shaun Wilkinson | iStock | Getty Images Plus

For recent college graduates, the approach of December brings a dose of harsh reality.

Federal student loans, which make up the bulk of student debt, generally have a six-month grace period after graduation to give borrowers time to get on their feet before they have to start repayment.

That means grads are just now facing their first bill.

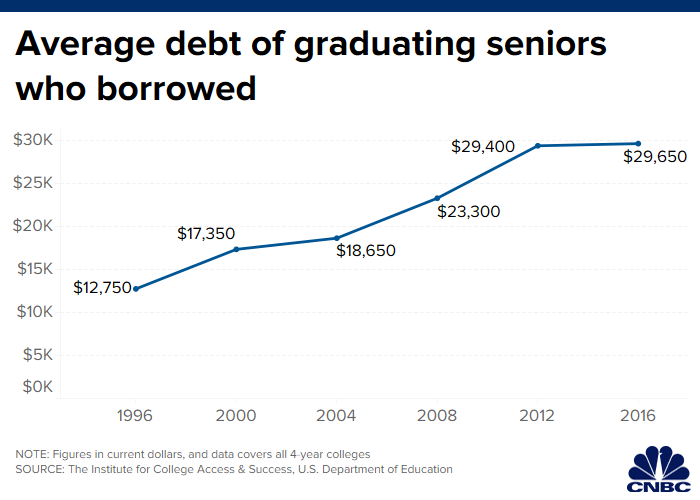

Seven in 10 college seniors graduate in the red, owing about $30,000 per borrower, according to the most recent data from the Institute for College Access & Success — a hefty tab for those just starting out.

“It’s a rude awakening for a lot of borrowers,” said Kaitlin Walsh-Epstein, a vice president of marketing at Laurel Road, a student-loan refinancer.

The majority, or 64%, of students are solely responsible for repaying their student loans, according to this year’s How America Pays for College report by Sallie Mae. Yet half haven’t even researched repayment methods, the education lender found.

For those just getting caught up, here’s a cheat sheet for what you need to do:

Step 1: Know your loans

Many borrowers have several loans, each potentially with a different interest rate, monthly due date and repayment period. That can be confusing.

“Cozy up to your debt,” Walsh-Epstein said. “First and foremost, it’s about understanding the loans you’ve taken out in the first place.”

The first step in building a student loan repayment plan is understanding who you owe, whether it’s the Department of Education or a bank, added Ashley Boucher, a spokesperson for Sallie Mae.

Then, determine how much you owe, including your interest rates and any accrued interest as well as your monthly due date.

By default, you are likely in a 10-year standard repayment plan but there are other options, including pay as you earn or income-based repayment. Ask your lender about what plan best suits you.

Step 2: Update your contact info

Chances are you’ve moved, changed your email address and have a new cellphone. Make sure each lender can reach you.

“As borrowers, we are responsible for making sure our contact information is accurate, including the correct address and email,” said Abril Hunt, the outreach manager at Educational Credit Management Corporation, or ECMC, a nonprofit dedicated to helping student borrowers.

Hunt recommends reaching out to each loan servicer at the outset to establish a direct line of communication. “By being proactive, we are showing lenders that we want to work with them,” she said.

Step 3: Establish a budget

Take your income minus expenses, including your rent, utilities and monthly loan tab, to determine if you can afford your loan payments.

“Once you have your budget set up, you can understand what you can afford — maybe you need to get a roommate or move home for a few months to make that minimum student loan payment,” said Walsh-Epstein.

Use an app to track your spending or Sallie Mae’s budget worksheet to create a plan to stay on top of your finances.

More from Your Money Your Future:

Here are the hidden benefits of a Roth IRA conversion

Here’s how much you can save toward retirement in 2020

Don’t miss the tax advantages of this savings account

If your budget feels stretched too thin, look into income-based repayment programs, which allow you to pay a percentage of your income rather than a flat rate, as long as you are under a certain income threshold. Generally, you’ll qualify if your federal student loan debt is higher than your annual discretionary income, according to the Education Department.

If you don’t have a job yet and your cash flow is negative, consider a deferment or forbearance. A deferment lets you put your loan on hold for up to three years. If you don’t qualify for a deferment, a forbearance lets you temporarily suspend payments for up to one year. However, in this case, interest will still accrue.

In each case, borrowers must apply for permission to postpone payments.

Step 4: Set up autopay

If you can afford your payments, sign up for autopay. An automatic program will decrease your chances of missing a payment and may come with the added perk of a modest interest-rate deduction on your loan.

A stretch of on-time payments will also put you on the right track to building a favorable credit history.

“That can make a big difference when you apply for a car loan, credit card, lease, mortgage or even a job,” said Boucher.

Step 5: Give your tab a cash boost

If you are feeling flush from monetary gifts at graduation or a starting bonus, consider beefing up your first few payments.

“If and when you can, make more than the minimum payment each month. You’ll pay off your loan faster, and you’ll pay less interest,” Boucher said. Just make sure extra payments go toward unsubsidized loans first, then toward loans with the highest interest rate.

You should also specify that those extra funds get applied to the principal of the loan and not to future interest payments.

However, if you are just getting on your feet, don’t forgo the chance to build an emergency fund or max out contributions to a 401(k) plan, either.

Step 6: See if your employer will chip in

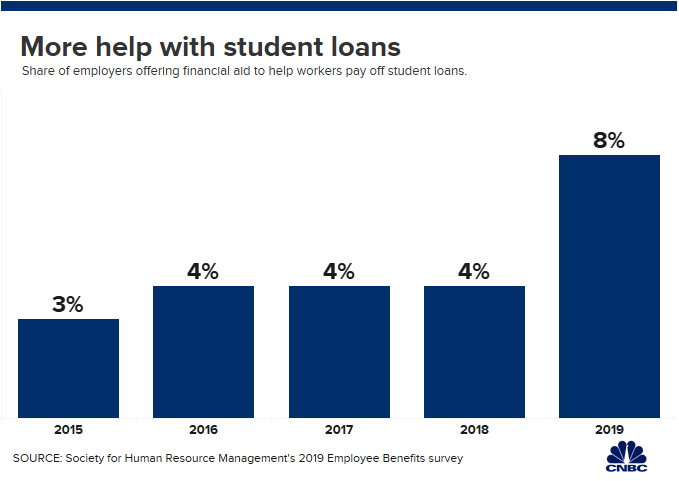

More employers are offering student-loan repayment benefits to their workers, which can help recent grads pay down their debt.

About 8% of companies, including Aetna, Fidelity and PwC, now offer taxable contributions to help employees repay student loans, up from 4% three years ago, according to the Society for Human Resource Management’s 2019 Employee Benefits survey.

If you are job hunting, give extra consideration to potential employers that do offer a student loan assistance program.

Step 7: Consider consolidating or refinancing

Once you have a steady job, a salary and a credit history, call a few lenders or talk to a financial advisor about your options.

If you have several different loans, you might consider consolidating them. Or you may be able to refinance at a lower interest rate. You could also choose to extend the terms beyond the standard 10 years to lower your monthly payments.

But weigh the options first. Consolidating or refinancing to a private loan will forgo the safety nets that come with a federal loan, including income-based repayment programs and loan forgiveness, for those who would qualify.

Additionally, extending the term of the loan means you ultimately will pay more interest on the balance.