Kenneth Fisher, founder, chairman and chief executive officer of Fisher Investments, speaks during a television interview in New York, May 10, 2010.

Jonathan Fickies | Bloomberg | Getty Images

The Chicago police pension fund is ending its $67 million relationship with Fisher Investments.

The Policemen’s Annuity and Benefit Fund of Chicago joins a number of institutional investors that have cut ties with the Camas, Washington-based asset manager following sexist comments billionaire founder Ken Fisher made at a conference on Oct. 8. There, he likened winning new clients to picking up women at a bar.

The Windy City’s police pension fund has about $2.6 billion in total assets as of Oct. 30. The pension’s board passed a motion to put Fisher on its watch list last month, wrote Thomas Beyna, board president.

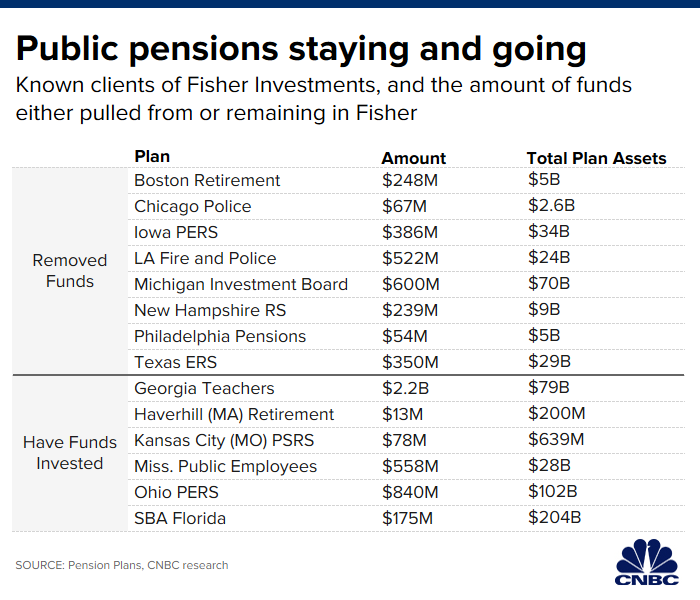

Fisher Investments has lost more than $3 billion in assets as government pensions and other institutional partners have left.

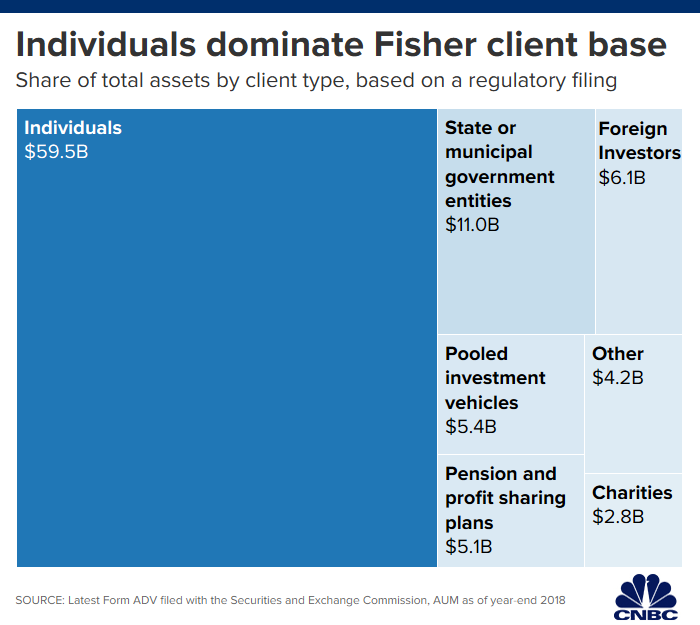

Fisher had $94 billion in assets under management as of Dec. 31, 2018, according to their filing with the Securities and Exchange Commission.

That figure reached $112 billion as of Sept. 30, 2019, according to the firm.

Major pension clients to have left Fisher include the Los Angeles fire and police pension, which pulled $522 million and the Michigan Investment Board, which is withdrawing $600 million.

Last month, giant investment bank Goldman Sachs confirmed Fisher would no longer be an underlying manager for the Goldman Sachs Multi-Manager Global Equity Fund in an Oct. 25 filing with the SEC. It pulled $234 million from the firm.

While the institutional investors have reacted quickly to the controversy, retail clients have largely remained.

In the week following Fisher’s comments, about 1% of individual investors raised concerns, with about $20 million in lost assets as a result, according to a research note from Mercer, an advisor to institutional investors.

Mercer spoke with Fisher executives on Oct. 14 to assess the fallout from the founder’s comments.

Individual clients account for about $60 billion of the $94 billion in assets that Fisher oversaw as of the end of 2018.

More from Personal Finance:

Don’t botch this year-end retirement move or you’ll face taxes

The world’s top 6 jumping off points for adventure travel

Here’s what Americans really want for the holidays