For most financial advisors, no one ever sat down and told us, “Here’s how you should go about your day.” Too many of us started our careers being judged by one single metric—new revenue generation—and the only tools we were given were a booklet in which to write down the names of as many friends and family members as we could conjure and a phone. The rest was up to us.

Day one, everything we did (in life, not just work) was designed to generate new business, and everything else was sublimated to that aim, including servicing those new clients, learning how to better serve them, and actually managing the business of a financial advisory practice. As long as you subjected yourself to one meeting per week with a dude doing his impression of Alec Baldwin’s “Always Be Closing” speech, the rest was up to you.

If you were one of the fewer who entered the business through a less sales-oriented route, you were still likely inserted into a system driven by someone else’s once-manic approach to achieving the singular goal of new revenue generation. Then the ubiquity of email, shared calendars, instant messaging, smart phones, and social media sprayed lighter fluid on the dumpster fire that was most of our days.

The end result is something computer science professor and productivity author Cal Newport calls “the hyperactive hive mind” in his new book, A World Without Email, where our days are a perpetual craze of task-switching through various media. We’re fooled into thinking we’re being productive because we feel so busy, but we’re actually vastly less productive than we otherwise could be if we only acknowledged the science and structured our days and weeks in a way that was designed to optimize our use of the only muscle we have to muster—our minds.

“Whatever we’re doing,” Newport told me, “our brain needs to give it full attention. And to do that, you need a surrounding workflow about how all the different tasks identified are viewed and assigned. Regardless of what type of work you do, this cognitive sequentiality is critical.”

I think this is especially true in our work as advisors, so while I will not attempt to tell you how to do your work or posit what elements of your work are most important—that will depend on your roles and goals—I’m pleased to offer a malleable workflow structure that you can adapt to help decrease distraction and increase your productivity, as well as a free online tool that will help you mobilize this method in a matter of minutes.

NOTE: This methodology is so highly adaptable that even if you’re not a financial advisor, you should be able to mold it to your work with ease.

To begin, Newport recommends we engage in an exercise called “asymmetric process optimization”—basically an accounting of what we do. Michael Kitces has done an exceptional job slicing up the pie of how “financial advisors actually spend their time and the limitations of their productivity” in a fair amount of detail. I’ve simplified that list to represent four foundational processes that represent how almost every advisor spends their time:

- Serving – Interacting with clients and prospects

- Analyzing – Research and number-crunching

- Learning – Advancing knowledge through continuing education

- Collaborating – Team, company, and networking meetings

Now, what if we took these four basic processes—contexts of our work, each requiring a slightly different mindset—and orchestrated them through a simple, agile system? The system is called Kanban, and the tool I’ll recommend to implement this workflow is Trello.

Kanban is Japanese for “signboard” or “billboard” and it originated as a way to increase efficiency in automobile manufacturing at Toyota, but it’s been adapted more recently as an agile framework to help distill highly complex software development projects into actionable, individual steps. Jim Benson then translated the wisdom to a Personal Kanban system that is so simple that when you watch the six-minute video, you’ll be like, “Really? That’s all?”

His basic sticky-note-filled premise is that we must first visualize our work and then limit our work in progress. He offers a super-simple flipboard example where all of our tasks are split into three lists: Options, Doing, Done.

The Options list is that typical, endless to-do list on your yellow-pad or online task-management system that keeps you sufficiently stressed out. But the real trick to PK is that Benson insists we have no more than three items in our Doing list at a time. It’s not until we move one of those to Done that we’re allowed to move another from Options to Doing.

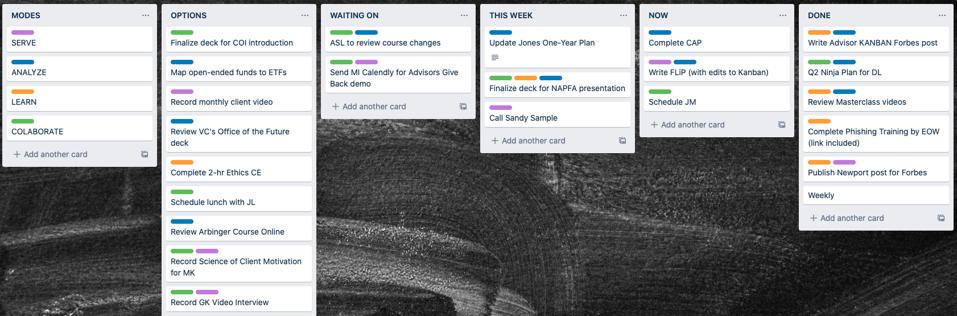

By combining Benson’s simple elegance with Newport’s brilliance and applying it to our advisory day-to-day, consider the customizable Financial Advisor Kanban Board:

Financial Advisor Kanban

Tim Maurer

From left to right:

- Modes is simply a legend representing each of your primary processes or modalities, a visual reminder that the types of tasks within each of these categories should remain distinct in your workflows. Edit them as appropriate.

- Options is where all new tasks land.

- Waiting (or Waiting On) is that David Allen-inspired (via Getting Things Done) column where tasks for which you’re waiting on someone else are kept front-of-mind (and checked weekly).

- This Week, as it implies, is the stuff you’re hoping to accomplish this week. Many know I’m a big Bullet Journaling fan, and the most important part of my personal process is my Weekly Planning exercise. I do it Monday morning, but some choose the end of a week instead.

- Now is where those no more than three items that are currently consuming your consciousness reside. And yes, this is the big differentiator with this particular productivity methodology. Simple, but brilliant—and most importantly, effective.

- Done is where you give yourself the momentary back pat, and deserving endorphin rush, of feeling a sense of completion. I allow these “to-dones” to pile up throughout the week and then archive that list during my weekly planning on Monday morning.

The online tool that I use (as does Cal Newport) is Trello—a virtual Kanban machine—and the only terminology you need to know is consistent with just about every Kanban system you’ll find:

Your Board is the view we just described above. Each column is a List, and it is comprised of your movable Cards, each representing a unique task to complete.

As mentioned, the best thing about this system is its flexibility. I hope you’ll feel free to customize the four foundational processes mentioned above—and by all means, if you want to reorder or rename the various Lists, I hope you will! The only non-negotiables for your system to be a true Personal Kanban is that you have a list for incoming tasks, that you never have more than three tasks you’re focused on right now, and that you give yourself the gift of visualizing the value of your efforts with a done column.

Here’s a link to a Financial Advisor Kanban Trello board with the setup I’ve described. If you don’t have a Trello account, you can sign up for free. Then, in order to take this board and make it your own, hit <Show menu> in the upper right-hand corner of the board, then <More>, and finally, <Copy Board>. I hope you’ll share your innovations with me as they occur!