The Free Application for Federal Student Aid (FAFSA) has different rules concerning which parent(s) are responsible for completing a dependent student’s FAFSA and who is considered a dependent of the parent on the FAFSA. These rules are changing, starting with the 2023-2024 FAFSA.

The Consolidated Appropriations Act, 2021 changed the rules as part of an effort to simplify the FAFSA, to better align the FAFSA with federal income tax returns. The upcoming changes simplify the FAFSA in some ways but make it more complicated in other ways.

Sen. Lamar Alexander with the Free Application for Federal Student Aid (FAFSA)

ASSOCIATED PRESS

Current Rules Concerning the Student’s Dependency Status

A student is considered to be a dependent student if the student cannot answer yes to any of the dependency status questions on the FAFSA and the college financial aid administrator has not used a dependency override to change the student’s dependency status to independent.

A student is considered to be independent if the student satisfies any of these criteria:

- The student is age 24 or older as of December 31 of the award year.

- The student is married or the student is separated but not divorced.

- The student is (or will be) a graduate student or professional school student.

- The student has one or more children who receive more than half of their support from the student.

- The student has one or more legal dependents who live with the student and receive more than half of their support from the student.

- The student is a veteran of the U.S. Armed Forces or is servicing on active duty in the U.S. Armed Forces for a purpose other than training.

- Since the student turned age 13, the student is or was an orphan, in foster care or a ward of the court (not incarceration).

- The student is an emancipated minor or in a court-ordered legal guardianship (not to the student’s parent or stepparent) as determined by a court of competent jurisdiction in the student’s state of legal residence.

- The student is an unaccompanied youth who is homeless or self-supporting and at risk of homelessness.

Current Rules Concerning Which Parent(s) Must File the FAFSA

If a dependent student’s parents do not live together and are divorced, separated or never married, only one parent is responsible for completing the FAFSA. This parent, called the custodial parent, is not necessarily the same as the parent who has legal custody. The custodial parent is also not necessarily the same as the parent who claims the student as a dependent on the parent’s federal income tax returns. The other parent is called the non-custodial parent.

MORE FOR YOU

An informal separation is treated the same as a legal separation on the FAFSA, if the separated parents do not live together.

If a dependent student’s parents live together and are divorced, separated or never married, they are treated as though they are married and the income and asset information of both parents must be reported on the FAFSA.

The parent who files the FAFSA is based on the parent with whom the student resides. Ties are broken based on whichever parent provides more financial support to the student. If that is not determinative, then ties are broken based on whichever parent has the greater adjusted gross income (AGI).

The process for determining the custodial parent is as follows:

- The custodial parent is the parent with whom the student resided for the greater portion of the 12-month period preceding the date the FAFSA is filed. This is usually definitive, since there are an odd number of days in the year. But, sometimes it is not enough, as might occur during a leap year or a recent divorced.

- If that criterion is not enough to specify the custodial parent, then the custodial parent is the parent who provided the greater portion of the student’s financial support during the 12-month period preceding the date the FAFSA is filed.

- If that criterion is not enough to specify the custodial parent, then the custodial parent is the parent who provided the greater financial support during the most recent calendar year during which parental support was provided.

- If that criterion is not enough to specify the custodial parent, then the custodial parent is the parent with the greater adjusted gross income (AGI).

The first three rules are based on the Higher Education Act of 1965. The last rule is based on guidance issued by the U.S. Department of Education.

If the custodial parent has remarried as of the date the FAFSA is filed, the stepparent’s income is also reported on the FAFSA. If the custodial parent has died, the stepparent is no longer responsible for filing the FAFSA (unless they have legally adopted the student) and the non-custodial parent is responsible for filing the FAFSA.

Current Rules Concerning Family Size on the FAFSA

Family size on the FAFSA includes dependents of the student’s custodial parent, but the definition of dependent on the FAFSA is different than the definition of a dependent for federal income tax purposes. The former is defined by the Higher Education Act of 1965 and the latter is defined by the Internal Revenue Code of 1986.

For a dependent student, family size on the FAFSA includes

- The student.

- The custodial parent(s).

- Dependent children of the student’s parent(s) who receive more than half of their financial support from the parent, even if they do not live in the household. This includes any children who would be considered to be a dependent student on their own FAFSA.

- Any other people who live with the student’s parent(s) and who receive more than half of their financial support from the parent and who will continue to receive more than half of their support from the parent during the award year. This does not include any pets or live-in household employees.

If the student’s sibling is a graduate student (who is automatically independent for FAFSA purposes), the graduate student can be included in family size only if the parents provide more than half of the graduate student’s support. Note that student loans and fellowships received by the graduate student count as part of the graduate student’s own support. So, it is rare for a graduate student to be counted in family size on a sibling’s FAFSA.

If the student’s parents are divorced, separated or never married, and do not live together, the ex-spouse is not included in family size.

If the custodial parent has remarried, the stepparent and the stepparent’s dependents are included in family size. The stepparent’s children from previous marriages do not need to live in the household to be included in family size.

New Rules

In attempting to simplify the FAFSA, Congress made parenthood on the FAFSA more complicated.

The goal was to enable family size on the FAFSA to be based on whether a child or legal dependent was claimed as a dependent on the parent’s federal income tax return.

But, basing family size on federal income tax returns can be complicated, since the IRS allows mutual support agreements that allow parents who are divorced or in a legal separation to allocate which parent gets to claim the children as dependents, regardless of where the children live and who provides more financial support. Sometimes different parents claim the children in odd and even years. When there are multiple children, sometimes each parent claims half of the children each year.

The rules for determining which parent is responsible for filing the FAFSA and the parent’s dependents have changed, starting with the 2023-2024 FAFSA. Again, the determination of the custodial parent and the parent’s dependents are not the same.

If a dependent student’s parents are married and not separated, or the parents are unmarried but live together, both parents are required to report their income and asset information on the FAFSA. If the parents file separate federal income tax returns, both parents’ income and asset information must be reported on the FAFSA.

When a dependent student’s parents are divorced or separated, but not remarried, the parent responsible for filing the FAFSA is based on whichever parent provides more financial support to the student, not the parent with whom the student resides. The simplified FAFSA no longer considers where the student lives.

Thus, the parent responsible for filing the FAFSA is the parent who provides the greater portion of the student’s financial support. If this is not definitive, it is likely that the U.S. Department of Education will issue guidance basing the determination of the custodial parent on whichever parent has the greater adjusted gross income (AGI), similar to the current guidance.

If the custodial parent has remarried, the income and assets of the custodial parent’s spouse must be included on the FAFSA if they are married as of the date the FAFSA is filed, the same as with the current rules.

Note that this definition of the custodial parent is different than the IRS definition of a dependent. However, the IRS definition of a dependent is used for identifying other dependents of the student’s parent(s), as discussed below.

It is unclear if the definition of separated is now limited to legal separations, or also includes informal separations. It is also unclear whether the definition of separated includes parents who are considered unmarried for head of household status (e.g., living apart for the last six months of the tax year). The U.S. Department of Education will need to publish guidance to clarify the definition of separated.

Family size on the FAFSA includes the student, the student’s parent(s) and any dependents of the student’s parents in the tax year upon which the FAFSA bases income and tax information (e.g., the prior-prior year). This includes any dependents of the stepparent if the custodial parent has remarried.

Dependency status is based on the definition of a dependent in Section 152 of the Internal Revenue Code of 1986 and/or on the definition of an eligible individual for the purposes of the tax credit in Section 24 of the Internal Revenue Code of 1986.

The new law provides the U.S. Department of Education with the authority to provide alternate procedures for determining family size when the student’s household size or financial information has changed since the prior-prior year. This also includes divorce settlements that involve multiple support agreements. (A multiple support agreement specifies which parent can claim the children as dependents on their federal income tax return.)

Dependency Status on Federal Income Tax Returns

A dependent includes a qualifying child or qualifying relative under Section 152 of the Internal Revenue Code of 1986.

To be considered a dependent, the qualifying child must satisfy these criteria:

- The qualifying child must live with the parent for more than half of the tax year.

- The qualifying child must be under age 19 or, if a full-time student, under age 24 as of the last day of the tax year.

- The qualifying child must not provide more than half of their own financial support. Financial support received from a stepparent counts as support provided by the parent. Financial support does not include scholarships and grants.

- If the qualifying child is married, they must not file a joint return with their spouse.

Qualifying children can include not just children and their descendants but also brothers, sisters, stepbrothers, stepsisters and their descendants. Brothers and sisters include half-brothers and half-sisters.

Adopted children are considered to be dependents if they satisfy the other criteria and the parent is a U.S. citizen or national.

If more than one parent can claim the child as a dependent then the custodial parent is based on

- The parent with whom the child resided the most during the tax year, or

- if the child resides with both parents equally, the parent with the highest adjusted gross income (AGI).

The IRS allows for multiple support agreements that specify which parent can claim a child as a dependent if neither parent provided more than half of the child’s financial support but the parents together provided more than half of the child’s financial support. The parent claiming the child as a dependent must have provided more than 10% of the child’s financial support.

To be considered a dependent of the parent, a qualifying relative must satisfy these criteria:

- The qualifying relative’s gross income must be less than the exemption amount.

- The parent must provide more than half of the qualifying relative’s financial support during the tax year.

- The qualifying relative must not be a qualifying child of any other taxpayer.

- The qualifying relative must be a child or descendant or a child of the parent, brother, sister, stepbrother, stepsister, father or mother (or ancestor of the father or mother), stepfather or stepmother, niece, nephew, aunt, uncle, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, sister-in-law, or someone who resides with the parent and is part of the parent’s household.

These rules are complicated and may change, but except for multiple support agreements, the FAFSA will be based on the number of dependents claimed on the relevant federal income tax returns.

Practical Takeaways

These changes have several practical implications for students whose parents are divorced or separated.

- Planning must start two tax years prior instead of one year prior to FAFSA award year

- Other children must reside in the household in addition to receiving more than half of their support from the parents to be counted in family size.

- Parents should consider the potential impact of multiple support agreements on eligibility for need-based financial aid when drafting the financial settlement and child custody agreement. Which parent claims the children as dependents on their federal income tax return may affect eligibility for need-based financial aid.

- The treatment of graduate students may change due to (1) the exclusion of financial aid from counting as part of the student’s own financial support and (2) the requirement that the student reside in the household.

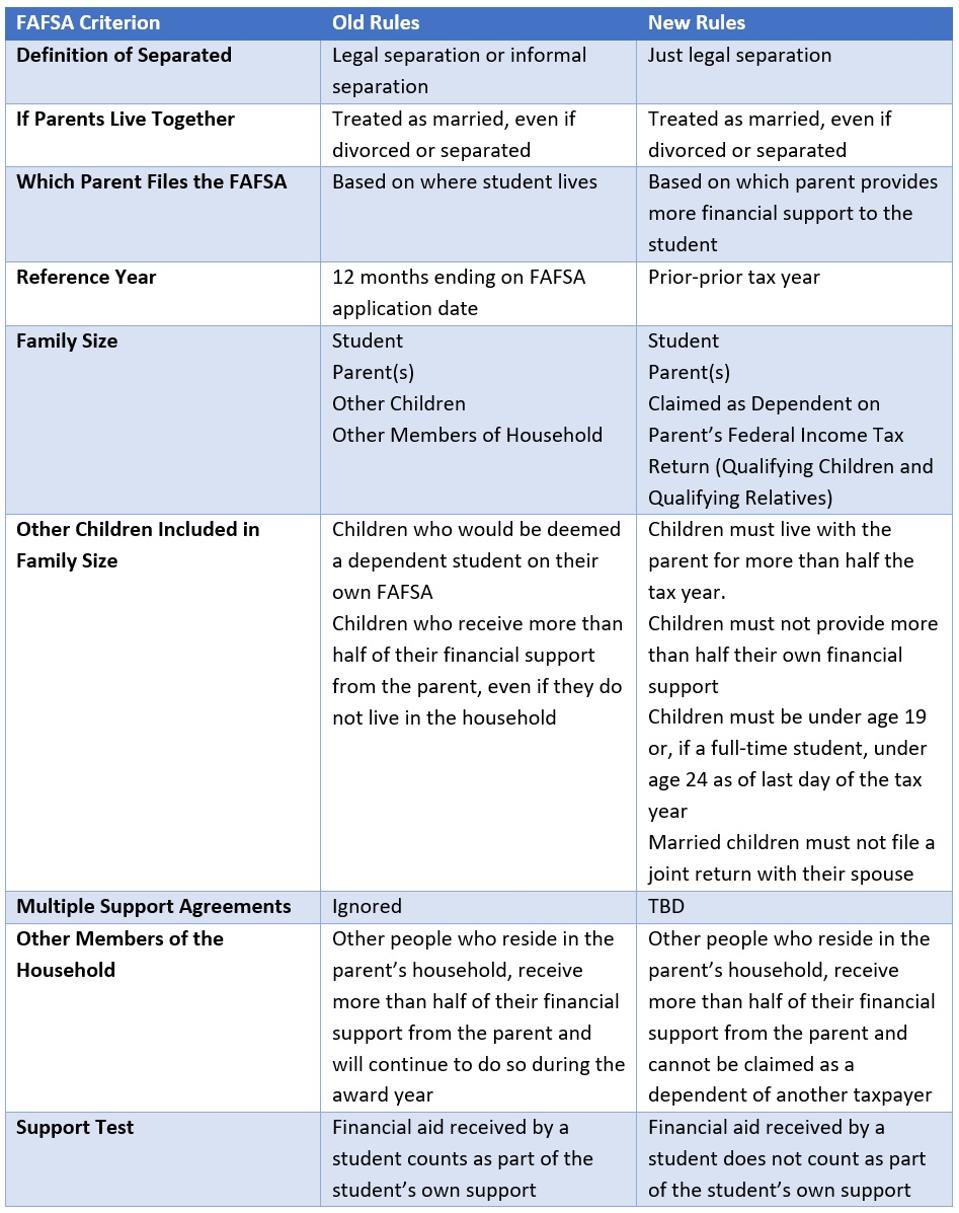

Comparison Chart

Mark Kantrowitz