DETROIT – In already-contentious labor talks between the United Auto Workers union and major automakers, there’s a wild-card issue hanging over the discussions.

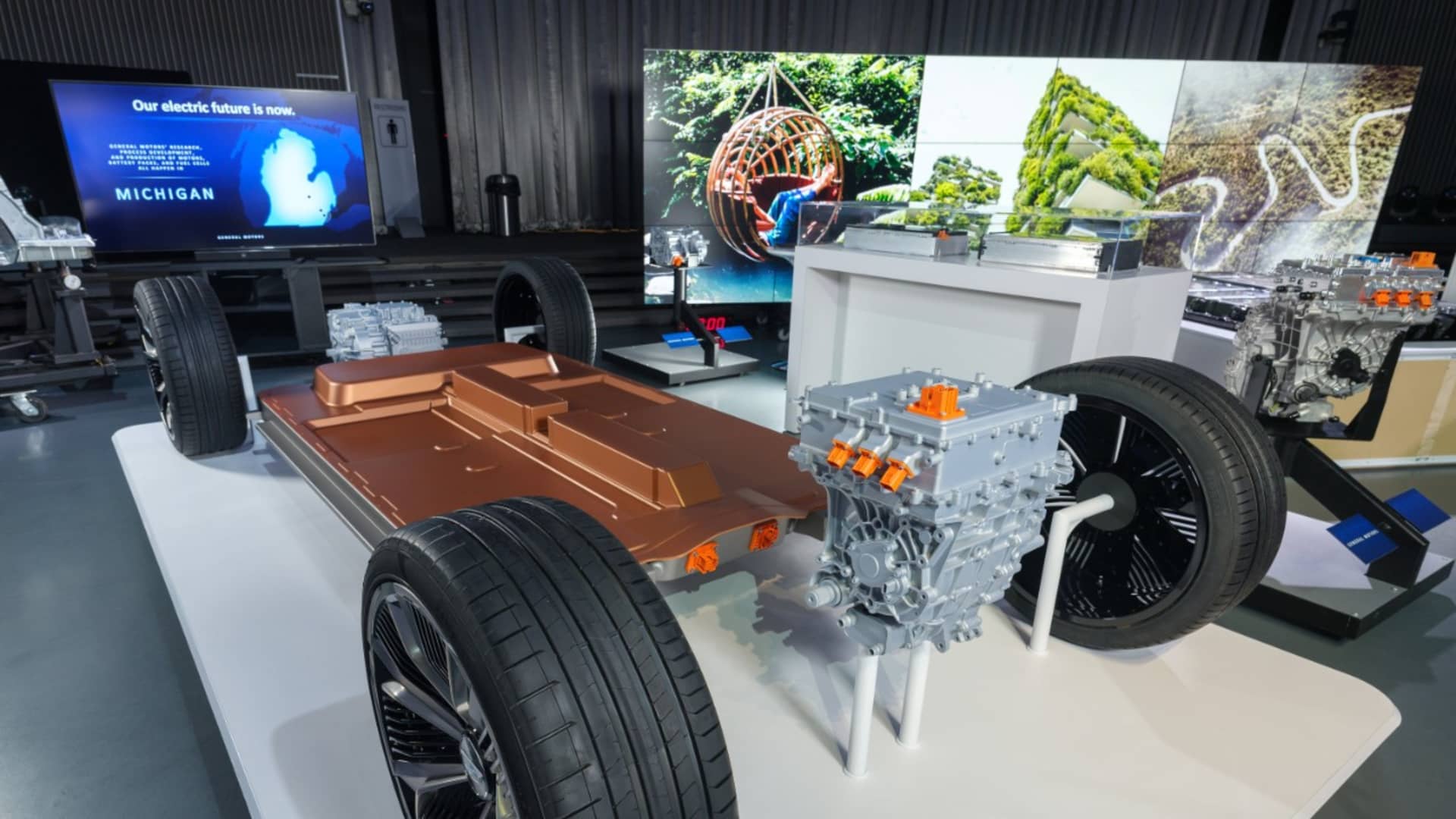

Multibillion-dollar EV battery plants — and their thousands of expected workers — are crucial to the automotive industry’s future and uniquely positioned to have wide-ranging implications for the UAW, automakers and President Joe Biden‘s push toward domestic manufacturing.

But there’s a problem. They aren’t part of the negotiations.

Nearly all of the announced plants are separate joint ventures with their own operations, negotiations and contracts — contracts that aren’t under the umbrella of labor agreements being negotiated with General Motors, Ford Motor and Stellantis ahead of a Sept. 14 deadline. The automakers contend the joint venture plants are therefore not legally part of the discussion.

But UAW leadership has made it a priority to ensure a “just transition” to EVs for auto workers, including the battery plants. Current and former union leaders told CNBC that the battery plants will have to be a priority for the labor organization, regardless of whether they’re directly discussed in the national agreement, for the long-term viability of the union.

“It’s a shell game,” UAW President Shawn Fain said last week regarding the battery facilities. “At the end of the day, they can form joint ventures and still have an obligation to their members, to their workers, and they chose not to do that for one reason, because they want to drive a race to the bottom.”

Either side could use the battery plants as indirect leverage in the negotiations, according to current and past negotiators from both sides of the table.

The idea would be to bake in future protections (or restrictions) for EV workers into the labor agreements covering traditional auto workers that could then serve as a model for EV worker negotiations in the future, those experts say.

GM Ultium workers

GM is the only Detroit automaker with a joint venture battery plant in operation and unionized – making it the first in the country to face this particular negotiating dynamic and a landmark plant to set standards for the industry.

GM CEO Mary Barra and other executives have said its up to members to decide whether or not the battery plants should be unionized as these types of jobs increasingly replace traditional assembly jobs.

However they argue workers at the plants should be paid less than traditional assembly jobs because it’s different work — creating parts for the overall vehicle rather than assembling the final products —traditionally done by third-party suppliers, who typically earn less than workers employed directly by the automakers.

At GM’s Ultium battery plant in Ohio, workers make between $16 and $22 an hour with full benefits, incentives and tuition assistance.

That’s in line with suppliers and “subsystem” work currently being done by UAW members at the major automakers but below the wages of traditional auto workers who assemble vehicles and engines and earn anywhere from $18 an hour to upward of $32 an hour.

Fain has particularly criticized the automakers as well as the Biden administration for utilizing billions in federal tax dollars to subsidize the facilities without committing to better wages and benefits for workers.

“The message to the Biden administration has been simply that if we’re going to do things for these companies to help this transition, labor can’t be left out of the equation,” Fain said outside a Stellantis plant last week.

Fain is withholding a reelection endorsement for President Joe Biden until the union’s concerns about the auto industry’s transition to all-electric vehicles are addressed.

The Detroit automakers have announced investments of roughly $22 billion in eight U.S. battery plants, including a $3.5 billion plant in Michigan that will be a wholly owned subsidiary of Ford, rather than a joint venture.

All of the plants are scheduled to begin operations within the next four years.

Setting a standard

UAW last week released a white paper detailing some reported safety issues and concerns at the Ultium plant. That report was released two days ahead of the official start to national contract negotiations between the union and the Detroit automakers.

In its white paper, the union suggested the GM national agreement could offer a solution to fixing the problems at the site, calling a forthcoming UAW-GM national labor agreement a “highly successful model for protecting safety that could be applied at Ultium Cells Lordstown and other battery cell manufacturers.”

The union could argue for a multi-company agreement or reach a new national agreement with the companies and then bargain with Ultium to pattern a deal off the finalized agreement.

While the union wants the battery jobs at the highest pay, it also could model a contract off the subsystem work as well. GM’s subsystem employees currently start at $18.50 an hour and can reach either $22 or $24 an hour, depending on the work.

However, Ultium and UAW are still “far apart” on a deal for wages and benefits, according to two people familiar with the talks.

GM declined to comment on the white paper, referring questions to its Ultium Cells joint venture with LG Energy Solution.

An Ultium spokeswoman condemned the report and the UAW’s depiction of the plant, calling the UAW’s characterization of the safety concerns “knowingly false and misleading.”