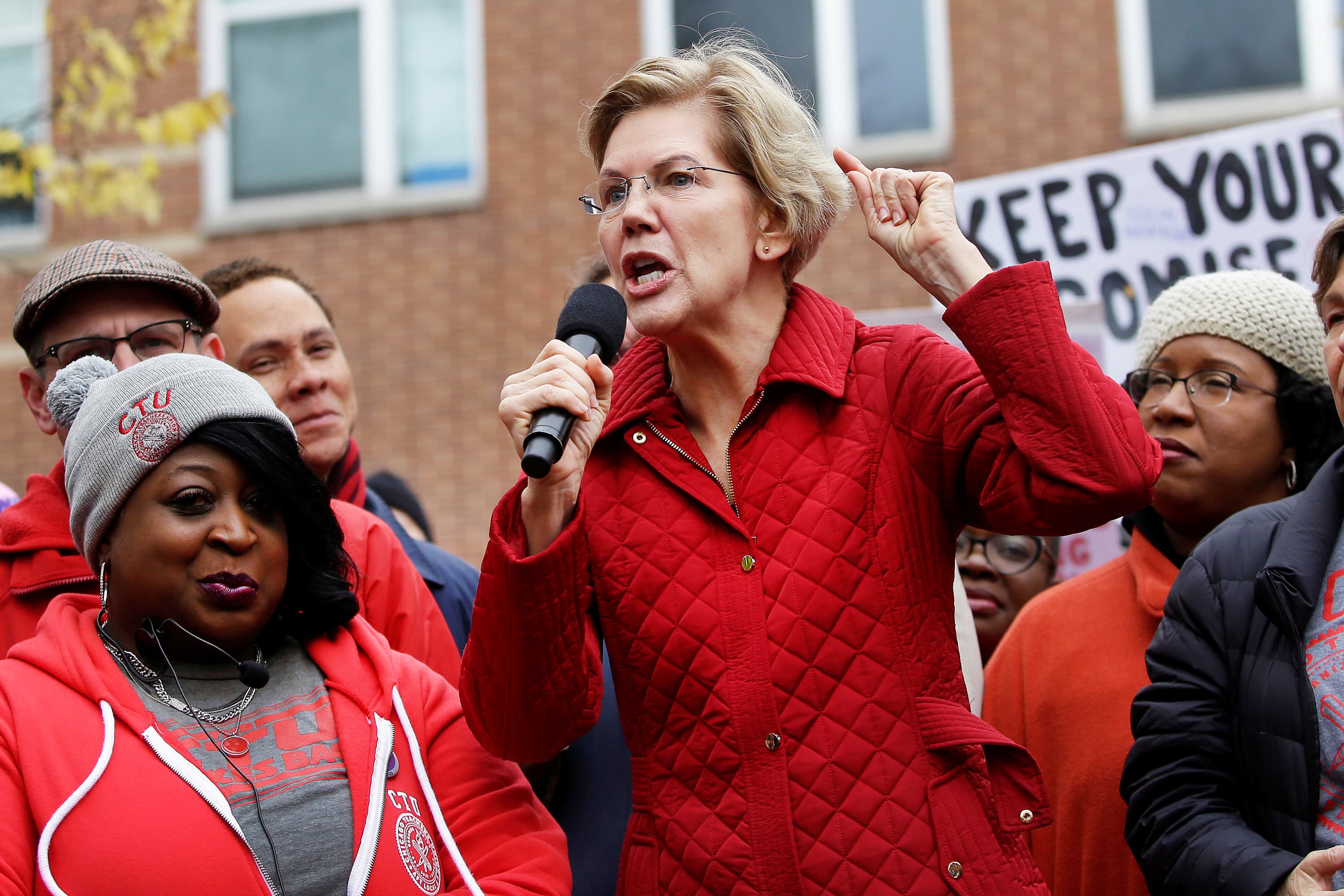

Sen. Elizabeth Warren, who has been surging in Democratic presidential polls, has been softening her attacks on the rich and could win the White House, a billionaire investment titan and major Democratic donor told CNBC on Thursday.

“I think she’s pivoting. I think she could win the election because she’s smart, she’s witty and she seems to be the best candidate on the stump,” said hedge fund manager turned cryptocurrency investor Michael Novogratz. “I think her recent language … is a lot softer than ‘all billionaires cheat.'”

However, Novogratz said Warren is not his top choice in the 2020 race, suggesting he would like to see more of a centrist get the Democratic nomination.

A Warren campaign representative didn’t immediately respond to a request for comment.

While he has not officially backed any candidate, campaign donation records show Novogratz gave the maximum $2,800 to Mayor Pete Buttigieg on Sept. 27. He also donated $2,800 on March 31 to Sen. Cory Booker.

On the night of the latest Democratic presidential debate, Novogratz tweeted, “Mayor Pete shining.”

According to the latest Real Clear Politics national polling average, Buttigieg was in fourth with 7% support. Former Vice President Joe Biden remained in first with 27.2%, followed by Warren at 21.8% and Sen. Bernie Sanders at 17.3%.

Novogratz’s comments come as some Democratic donors on Wall Street fret about the possibility that Warren will win the nomination, with some considering support for President Donald Trump.

Making a case that taxes can stand to go higher, Novogratz, 54, said on “Squawk Box” on Thursday morning that fears about taxes under former President Barack Obama crippling the nation were unfounded. The founder and CEO of cryptocurrency merchant bank Galaxy Digital said his wealthy friends didn’t see any net-worth drop under Obama. “The rich got richer,” he said.

“I don’t think a wealth tax is the way to go,” said Novogratz, referring to a policy idea supported by Warren and Sanders. But he said, “We should redistribute” wealth in America through “better taxation.”

Novogratz suggested, for example, that raising the capital gains rate to the same level as income taxes would rise tons of money. He readily admitted that much of his wealth has come from owning assets and holding them over time. He said that’s a tax advantage already without the capital gains rate being so low. “You don’t need to double dip,” he argued.

Last week, Novogratz created a stir on social media after he said to the wealthy: “You’re not victims, you’re the richest people in the world.” He then asked, “How in God’s name do you feel like a victim?”

In an interview published this week, another billionaire investor, Leon Cooperman, unloaded on Warren’s wealth-taxing proposal and rich-bashing rhetoric.

“What is wrong with billionaires? You can become a billionaire by developing products and services that people will pay for,” the Omega Advisors founder told the website. “I believe in a progressive income tax and the rich paying more. But this is the f—–g American dream she is s——g on,” said Cooperman, 76, son of a Bronx plumber who became one of Wall Street’s most successful investors.

Cooperman has never been shy about how he believes that a Warren presidency would be bad for America. He told CNBC last week, “If Elizabeth Warren is elected president, in my opinion, the market drops 25%.”

Novogratz, for his part, said on CNBC: “For 40 years, the rich have been getting richer for lots of reasons, not because they’re cheating. There’s lots of structural reasons. We have a wealth gap that just doesn’t make sense anymore.”

CNBC’s before the bell news roundup

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.