You should not solely rely on amounts reported on IRS Form 1099-K to prepare your crypto taxes. Since this tax form doesn’t take cost basis information into consideration, amounts reported are overstated significantly. Reporting these numbers on your tax return without accounting for cost basis will lead to inaccurate capital gains and a higher tax liability.

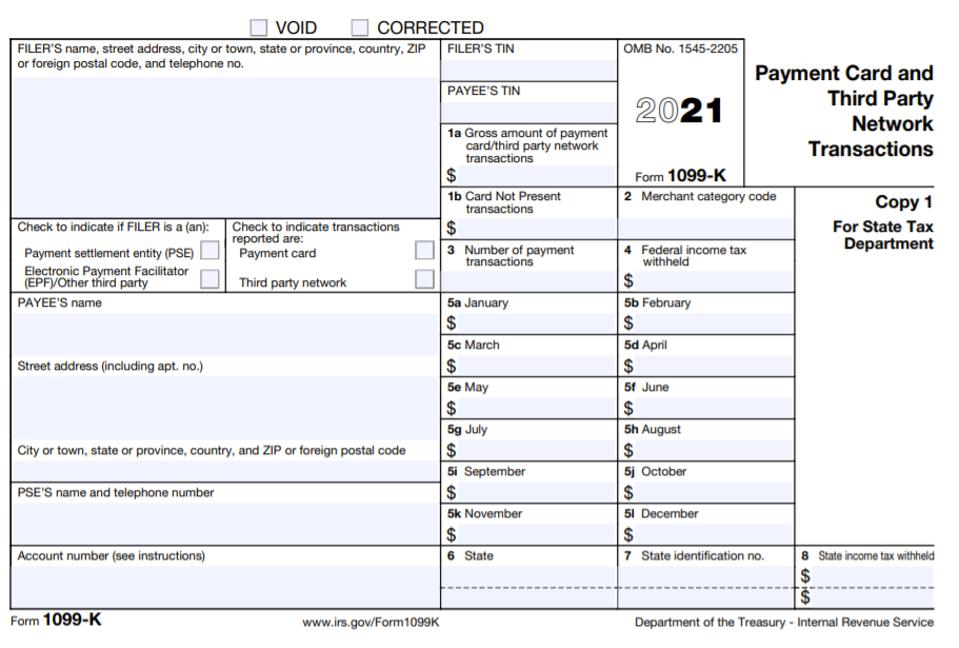

Form 1099-K

IRS

What Is Form 1099-K?

Certain US cryptocurrency exchanges issue Form 1099-Ks (Payment Card and Third Party Network Transactions) to users with more than 200 transactions and $20,000 gross volume in any given year. This form reports your monthly and annual gross receipts coming from cryptocurrency trading activities. Although the gross receipts reported on this form may be right, this is only partially useful in preparing your taxes accurately.

For example, during 2020, say Jennet sold 1 bitcoin (BTC) for $50,000 in ABC cryptocurrency exchange. She bought this coin for $40,000 (cost basis) several years ago. Her 2020 Form 1099-K would show $50,000 as gross receipts. If she were to prepare her taxes solely relying on this form, she will have to pay taxes on $50,000 of income. However, if she accounts for the cost basis ($40,000) which is not reported on Form 1099-K, only $10,000 ($50,000 – $40,000) of income is subject to capital gains taxes.

Cryptocurrency Exchanges Don’t Know Your Cost Basis

Crypto users often blame exchanges for issuing 1099-Ks with incomplete and inflated amounts. However, exchanges are not the culprit here. Due to the unique nature of how cryptocurrency works, crypto exchanges often don’t have access to cost basis information. Going with the example above, say Jennet transferred the BTC to ABC exchange from her hardware wallet. In this case, ABC exchange would not know Jennet’s cost basis for the BTC because it wasn’t purchased through the exchange. Similarly, if she were to transfer the coin from XYZ exchange to ABC exchange, ABC exchange wouldn’t know how much she paid for the BTC at XYZ exchange since there’s no communication between ABC and XYZ exchanges at the moment.

If you buy and sell coins in the same exchange, the exchange would know your cost basis. However, there’s no place to report this information on Form 1099-K.

Therefore, crypto users should keep detailed records of cost basis to correctly calculate their capital gains and losses. Solely relying on 1099-Ks issued by the exchanges would lead to incorrect tax calculations and higher tax bills. Misreporting could also lead to receiving CP2000 tax notices from the IRS.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.