Disney shares are down about 9% Thursday after the company reported subscriber losses at Disney+ during the most recent quarter.

The company, which posted profit and revenue for the period that were in line with Wall Street estimates, reported a loss of 4 million Disney+ subscribers. That downtick was offset by price increases, which led to a narrowing of operating losses at the streaming unit by $400 million for the fiscal second quarter.

related investing news

Still, Wall Street expected a gain of more than 1 million Disney+ subscribers, according to StreetAccount, and the surprise subscriber loss spooked the Street.

Shares of the company were trading at around $92 per share Thursday. The stock had been up over 16% so far this year as of Wednesday’s close.

The drop was set to erase around $15 billion from the company’s market value.

Disney will face headwinds from reductions in ad budget, intense streaming competition with Netflix’s new ad tier and continued economic uncertainty, according to a note from Paul Verna, principal analyst at research firm Insider Intelligence.

“While Disney managed to stem its streaming revenue losses, it did so mainly by raising prices, and that strategy is not sustainable in the long term,” Verna wrote. “Disney plans another price hike later this year, but it will soon run out of headroom for further increases.”

Analysts at SVB MoffettNathanson lowered their price target for the stock by $3 to $127 following the report but maintained the firm’s outperform rating. The firm sees aggregate subscriptions being roughly flat in the fiscal third quarter and rising in the fiscal fourth quarter.

Tim Nollen, Macquarie senior media tech analyst, also maintained an outperform rating, noting Disney “has the essential assets to successfully transition to streaming, but it’s a multi-faceted effort.”

“Disney is making headway in its cost-saving and operating-efficiency efforts amid a deteriorating linear TV business, both structurally and cyclically,” Nollen wrote in the note.

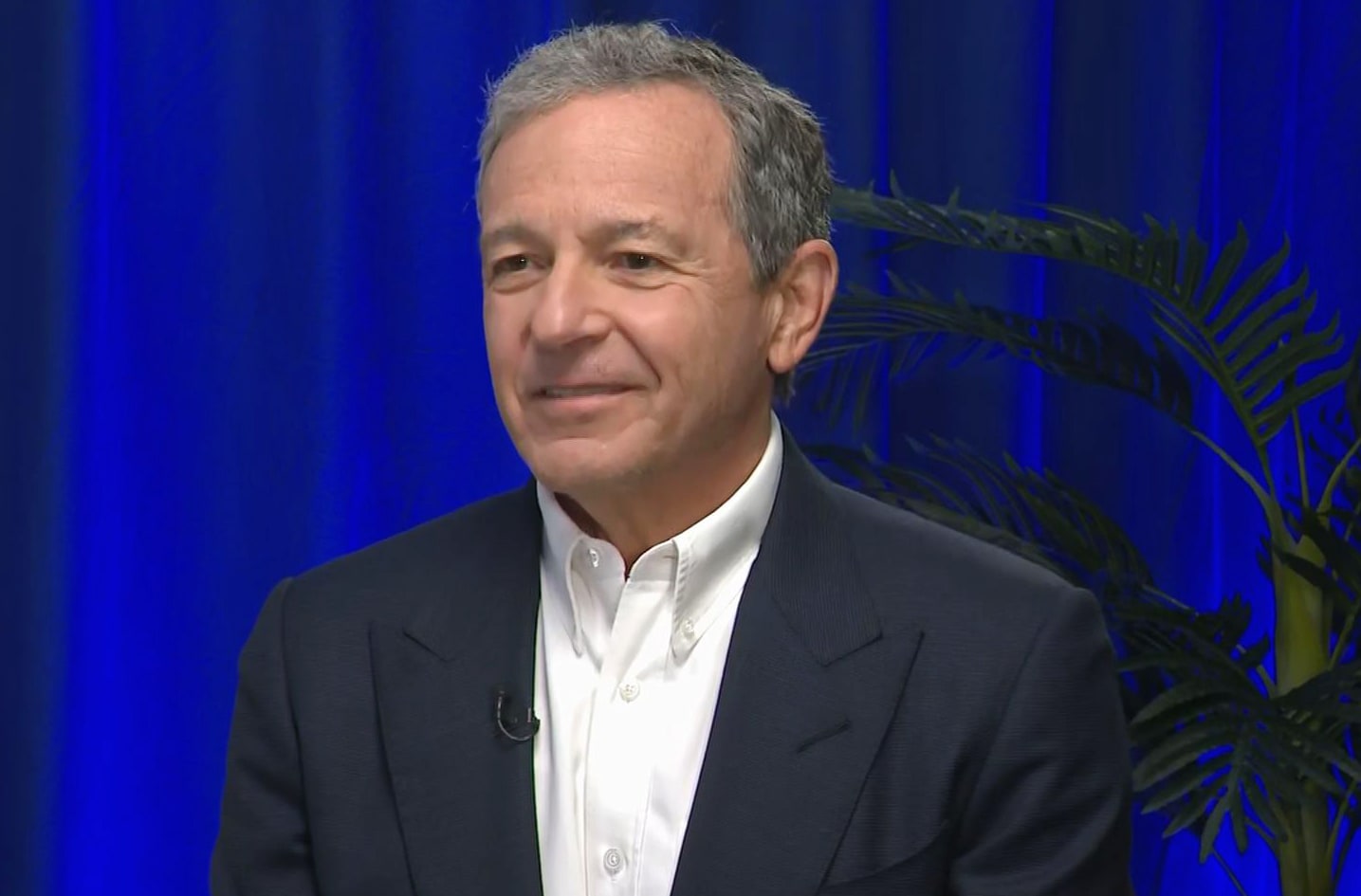

Disney CEO Bob Iger is overseeing a broad restructuring at the company, including around 7,000 total job cuts, which are planned to be completed before summer.

The company also said Wednesday it would add Hulu content to its Disney+ streaming app, while expecting to raise the price of its ad-free streaming service later this year.

Shares of fellow streams Warner Bros. Discovery and Paramount also fell Thursday, down roughly 4% each. Netflix shares were little changed.