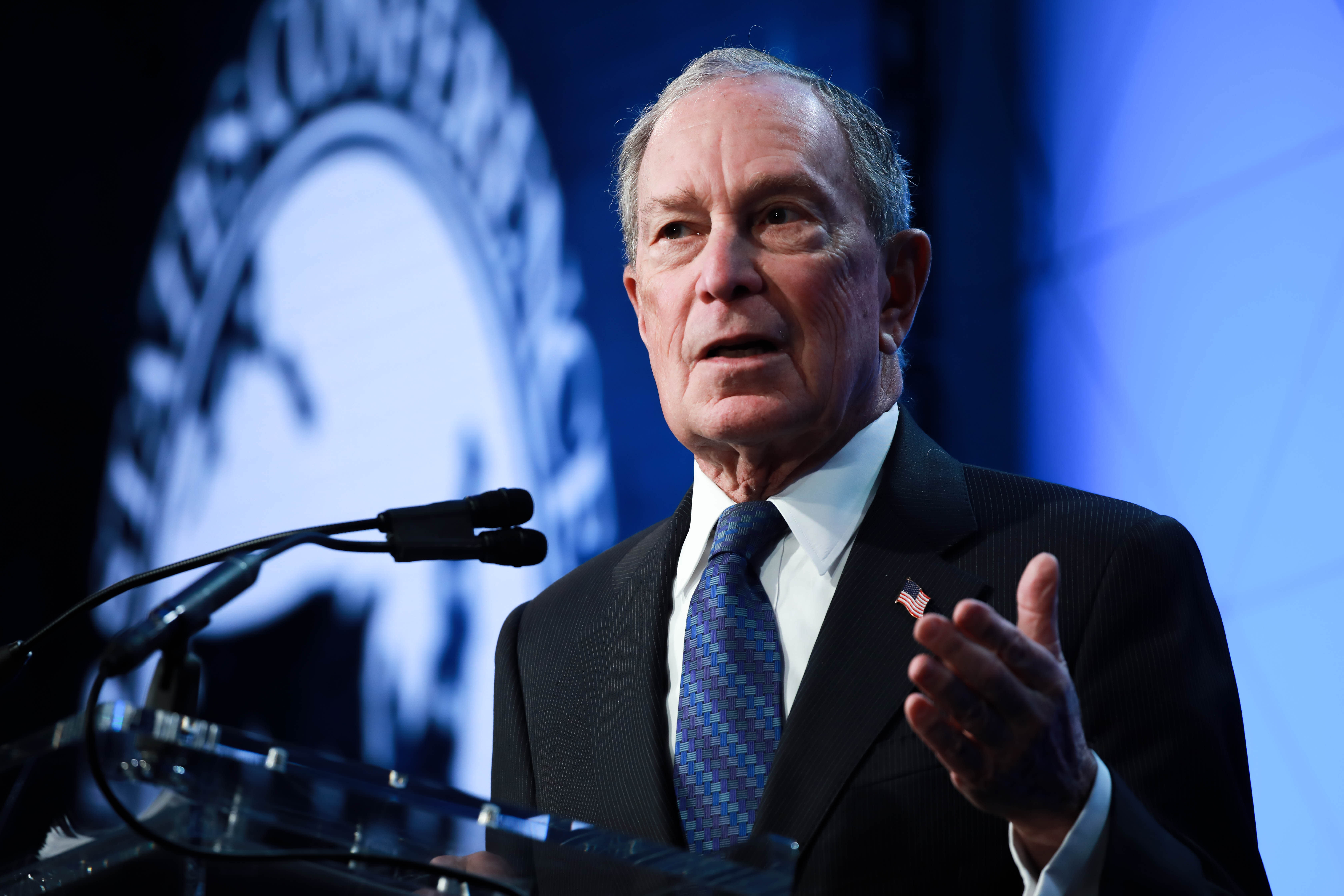

Former New York City mayor Michael Bloomberg, a democratic presidential candidate, attends the U.S Conference of Mayors 88th Winter Meeting in Washington, D.C, January 22, 2020.

Yasin Ozturk | Anadolu Agency | Getty Images

Democratic presidential candidates are taking aim at a new tax break for small businesses.

Billionaire Michael Bloomberg last week pitched a $5 trillion tax plan that would raise levies on wealthy individuals and corporations.

He also wants to repeal the 20% qualified business income deduction, a feature of the Tax Cuts and Jobs Act, which went into effect in 2018.

This write-off permits owners of “pass-through” entities, including S-corporations and partnerships, to deduct up to 20% of their qualified business income.

The so-called QBI deduction was intended to bring S-corp tax rates into parity with the reduced rates on C-corporations, said Garrett Watson, senior policy analyst at the Tax Foundation.

The 2018 tax overhaul lowered income tax rates on C-corps from 35% to 21%.

Close to 16 million tax returns claimed the pass-through deduction on their 2018 taxes, according to IRS filing data through July 25, the most recent set of figures available from the agency.

The tax break was especially popular among households with adjusted gross income between $100,000 to $200,000. See below.

Bloomberg isn’t alone. Fellow candidates Sen. Bernie Sanders, Michael Bennet and Pete Buttigieg also have proposed ending the tax break, as well as raising rates on corporations.

Tax proposals are no guarantee of how policy will unfold under a given administration, but the chatter is loud enough that small-business owners might want to pause before they commit to a business entity structure.

“There is no such thing as a permanent tax law,” said Tim Steffen, CPA and an advisor education consultant with PIMCO.

“Overall, you need to be careful about making long-term structural decisions in response to something that just pops up,” he said.

How it works

Rafael Ben-Ari

The qualified business income deduction can be a sweet deal — if you’re the right kind of taxpayer.

Business owners can claim it if they have taxable income that’s under $160,700 if single or $321,400 if married and filing jointly in 2019.

Beyond those thresholds, the IRS applies limits to what you can claim.

If you’re in a “specified service trade or business” — that is, you’re a doctor, a lawyer or an accountant — you can’t take the deduction if your taxable income exceeds $210,700 if single or $421,400 if married.

If you’re not in a “specified service trade or business,” the IRS will allow you to take a reduced deduction if your income exceeds the $160,700/$321,400 threshold, but is still below the $210,700/$421,400 threshold.

Finally, if you’re not in a specified service trade or business and your taxable income exceeds $210,700/$421,400, then the deduction you can claim is capped as a percentage of W-2 wages you pay to your employees.

The Tax Cuts and Jobs Act put an expiration date on the deduction: It sunsets at the end of 2025.

Choose your entity

PeopleImages | E+ | Getty Images

Political dialogue around the pass-through deduction is forcing entrepreneurs to think more deeply about making changes to their structure.

“Do you weigh the cost benefit of doing it or do you want to deal with the headache of changing entity structure down the road?” asked Dan Herron, CPA and principal of Elemental Wealth Advisors in San Luis Obispo, California.

Here are a few considerations for entrepreneurs who are weighing an entity change. Work with your tax professional to figure out what works best for your business.

Tax treatment: S-corporations and other pass-through entities are known as such because income “passes through” to the owner and is taxed at their individual rate, which can be as high as 37%.

C-corporations file their own income tax returns and are assessed a corporate tax rate of 21%.

Payments to owners: Owners of S-corps can pay themselves a salary, which is subject to a 15.3% self-employment tax to cover Social Security and Medicare.

They can also take distributions from the S-corp, which is tax-free up to the shareholder’s basis or the amount he invested in the company.

Meanwhile, taxes apply twice when owners take distributions from a C-corp.

More from Personal Finance:

This profession aims to fill a gap in the financial services world

Despite coronavirus fears, a fast market recovery is in the wings

Want to save on your 2019 taxes? Here’s how

“The C-corp is less efficient if you’re passing cash flow out,” said Steffen. The corporation pays a 21% tax on the income and the owners pay a tax of up to 20% on distributions received.

That double-tax also applies if you’re selling your C-corp.

Growth prospects: The kind of business you’re in is also a driving factor in finding the right entity.

If your company intends to reinvest its profits – rather than give distributions to the owners – a C-corp might make sense. This way, owners avoid the double-tax treatment.

“If you become more established and want to make distributions to the owner, an S-corp might make sense,” Steffen said.

Compliance: Both S-corps and C-corps offer liability protection to their owner, keeping them from having their personal assets seized by the business’s creditors.

Expect to keep things formal and hire the appropriate tax professionals to maintain your preferred tax status and liability protection. You’ll need an operating agreement, books and records, and meeting minutes.

“Going the corporate route, you’ll need a formal set of books and you’ll have to pay payroll taxes,” said Herron. “You need the cash flow to sustain it.”