Peter Dazeley | Photographer’s Choice | Getty Images

Here’s an awkward question for your spouse: Would you be willing to get divorced to save a few dollars?

Proposed wealth taxes from presidential candidates Sens. Elizabeth Warren and Bernie Sanders are stirring up chatter around so-called strategic divorce to avoid the levy.

The Tax Cuts and Jobs Act, which went into effect in 2018, has also spurred similar discussion among the highest earners, as the new law still subjects them to the so-called marriage penalty.

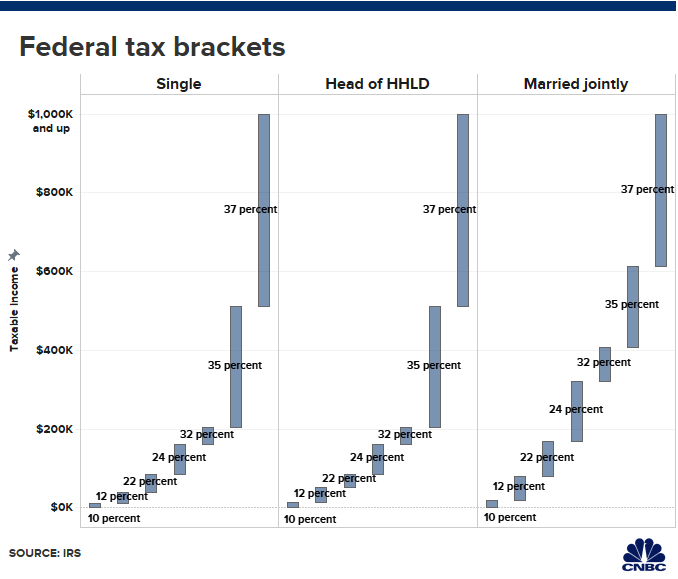

The marriage penalty — that is, a higher tax liability after a high-income couple files jointly — kicks in for taxpayers with taxable income in the 37% tax bracket.

These are joint filers with at least $612,350 in taxable income during 2019.

In that case, you might be better off being single, at least in the eyes of the IRS.

While breaking up might make sense on paper, financial advisors warn that the move could have unexpected ramifications that will dent couples’ financial security.

“It’s the unforeseen consequences of these things that surprise people,” said CPA and certified financial planner Tim Steffen, director of advanced planning at Baird Private Wealth Management in Milwaukee. “We’re talking about the financial side, but you have the social aspect of it, too.”

Why a strategic divorce

Getty Image

There are a handful of situations, especially for those who are not mega-rich, why a couple might want to divorce on paper.

For instance, an ailing spouse in need of nursing home care might have too much in assets to qualify for Medicaid.

“The couple has a choice, where they can slowly draw down their assets, exhaust their retirement accounts and pay down the bills,” said Stacy Francis, a CFP and founder of Francis Financial in New York.

“Or they can get a divorce that will allow the sick partner to have assets that are so low they can potentially qualify for Medicaid,” she said.

Even if it’s on amicable terms, are you going to do something that gives away your control of that business from a voting power perspective when you get divorced?

Jeffrey Levine

CPA and director of financial planning at BluePrint Wealth Alliance

Another reason why spouses might split is to help a child qualify for financial aid.

That’s because the custodial parent is the one who is responsible for filling out the Free Application for Federal Student Aid

“If that custodial parent has the lower income and lower assets, you could walk away with more federal aid for college than you would as a married couple,” said Francis.

Finally, another possible upside of splitting: Assuming both partners are high earners, such that their taxable income is in the 37% tax bracket, the two might end up in lower brackets if they aren’t married.

A couple filing jointly with income of $1 million – each spouse earning $500,000 — would pay nearly $900 more in taxes, compared to what they’d owe if each partner were single, according to the Tax Foundation.

What’s at stake

Splitting up might fix one problem, but it may trip up plenty of financial landmines. Here are a few.

Your retirement benefits. A breadwinner who has access to a defined benefit pension might have access to joint and survivor benefits — an income payout to his or her spouse upon retirement.

In a divorce, both parties will have to decide how to split the pension, as it may be considered a marital asset. A qualified domestic relations order details the way retirement benefits are to be split.

Further, if a couple splits up, the non-working spouse loses the advantage of getting contributions to his or her spousal individual retirement account and spousal Roth IRA.

Currently, a working spouse can put away up to $6,000 in an IRA for a non-working spouse, plus $1,000 if he or she is 50 or older. The two must file jointly and be married.

Here’s another surprise: Spouses are generally the automatic beneficiary for a 401(k) plan; they need to sign a waiver in order allow someone else to receive those funds.

“If we’re divorced, I can change the name to whomever I want,” said Steffen.

“Say you get divorced, get into a fight and that person takes you off the account,” he said. “It’s easier to make changes on a whim.”

Health insurance. Often, one working spouse is carrying the health-care coverage for the whole household. Amid a divorce, the other spouse could either join their employer’s plan or go searching for coverage elsewhere.

Worst case, the spouse who loses coverage may end up paying the full cost of insurance at his or her ex’s employer through the Consolidated Omnibus Budget Reconciliation Act or COBRA.

More from Personal Finance:

Despite tax overhaul, marriage penalty hits many couples

Medicare open enrollment is underway. What’s new

A major tax deadline hits today

“We see people pay upward of $12,000 a year just for health insurance premiums,” said Francis. “Whatever financial reasons they’re thinking of for divorce, that reasoning will be wiped out if you have to pay for a whole new private insurance policy.”

Business interests. If a business winds up being split in a divorce settlement, the spouse who founded it could give up full control of it.

“Even if it’s on amicable terms, are you going to do something that gives away your control of that business from a voting power perspective when you get divorced?” asked CFP Jeffrey Levine, CPA and director of financial planning at BluePrint Wealth Alliance in Garden City, New York.

“That’s a lot of leverage to give someone: ‘You’ll do this or I’ll vote against you at the next shareholder’s meeting,'” he said.