This year may bring sticker shock for publicly traded U.S. companies when they get their insurance bill.

The risks of being sued have skyrocketed and the price of insurance premiums is rising right alongside, especially for liability insurance to cover directors and officers, or D&O.

Insurance broker and consulting firm Woodruff Sawyer said D&O costs for many companies have quadrupled in the last two years. Aon, an insurance broker to Fortune 500 companies, said its clients are paying a median 24% more in premiums from a year ago.

The rate of suits filed against companies has soared an estimated 150% over the last decade. In 2018, nearly 1 in 10 S&P 500 companies was the target of a securities class-action lawsuit, according to research published by insurance giant Chubb.

Wildfires, data breaches, air crashes, concert shootings, opioid-related cases and sexual misconduct suits arising from the #MeToo movement have combined to form a trend of large, event-driven lawsuits, which can cost insurance companies hundreds of millions of dollars in settlement money.

“You can expect to see a securities class action filed whenever there is an event followed by a drop in stock price,” said Scott Meyer, division president of North America financial lines at Chubb, as quoted in a 2019 Chubb report titled “From Nuisance to Menace: The Rising Tide of Securities Class Action Litigation.”

“But now, even events that didn’t move the stock price are triggering securities class actions against the board,” Meyer said in the report.

Those derivative lawsuits accuse the directors and officers of failing in their fiduciary responsibility and the costs associated with this type of litigation are rising.

Wells Fargo settled a derivative lawsuit in 2019 for an astonishing $240 million. The suit accused then CEO Tim Sloan and his predecessor John Stumpf, along with 18 other executives and directors, of failing to stop the creation of millions of bogus customer accounts.

Insurance picked up the entire $240 million cost of the settlement.

In an insurance enigma, the derivative lawsuits are filed on behalf of the company against its directors and executives. The settlement, in part, gets paid to the very company paying insurance premiums.

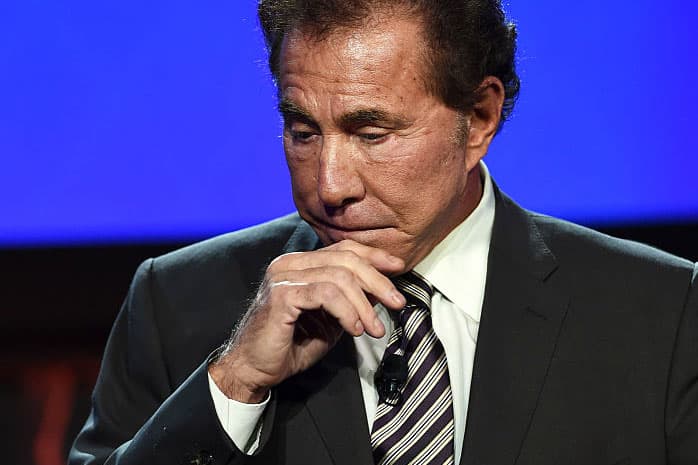

That’s what happened when Wynn Resorts settled a consolidated derivative lawsuit for $41 million that followed a #MeToo scandal involving founder and former CEO Steve Wynn. In the settlement, Steve Wynn agreed to pick up $20 million, but insurers — led by Allianz — will pay $21 million.

The settlement, which is still waiting for final court approval, credits Wynn Resorts with $49 million in corporate governance changes, including an overhaul of the board. That’s especially important to the plaintiffs’ attorneys who earn fees based on the total, including the value of the corporate reform.

“It drives insurers crazy,” said Mary McCutcheon, who advises D&O clients for the legal firm Farella Braun + Martel. “They’re paying settlements to the company. They were paid, for example, $1 million in premiums and have to pay back a $10 million derivative settlement to the company.”

Other kinds of lawsuits are also driving up the price of insurance. Merger objection lawsuits are filed when there are claims that the acquiring company paid too much, or that the target company sold for too little. According to Chubb’s report, 85% of mergers in 2018 were challenged with a merger objection lawsuit.

Lawsuits are frequently filed against companies following their initial public offerings, and almost always when share prices fall below the offer prices.

“Insurance carriers are realizing when it comes to IPO companies, they are very likely to be sued,” said Priya Huskins, senior vice president of management liability at Woodruff Sawyer. She estimates between 15% and 25% of businesses will see suits filed against them.

The risk of litigation is making insurance carriers squeamish. “When they get sued, they’re going to have to spend about $9 to $10 million to make this thing even begin to approach settlement,” Huskins said. “And they’re saying that the cost … they can’t charge enough to take on that kind of risk.”

Experts said the result has had a chilling effect on the IPO market. According to Aon, it’s especially tough for biotech, health care, retail, and younger tech companies who are finding it difficult to procure adequate D&O insurance.

“Overall, insurers were more disciplined in 2019 on risk selection and participation,” said Christine Williams, U.S. CEO of Aon Financial services, who notes insurers are publicly telegraphing their intention to reduce their exposure. ”Recent claim trends forced excess insurers to revisit pricing in response to higher claim costs and settlements.”

Prohibitive pricing may lead companies to opt for higher deductibles or lower caps, leading independent directors to balk at joining boards that have had difficulty procuring or paying for quality insurance.

The spike in lawsuits has been driven by the U.S. Supreme Court decision Cyan v. County Employees Retirement Fund. Before the decision, companies pointed to the 1998 Securities Litigation Uniform Standards Act (SLUSA) to insist Congress had removed state court jurisdiction over most securities class-action lawsuits.

But in 2018, the top court’s decision against telecommunications company Cyan, whose stock dropped after its IPO, cleared the way for more lawsuits to be filed in multiple states, as well as federal court. “It provided a clear pathway for plaintiffs to forum shop for friendly jurisdictions,” according to Chubb’s report.

There is, however, a glimmer of hope for companies pressured by spiking D&O premiums.

On Wednesday, the Delaware Supreme Court heard closing arguments in an appeals case involving Blue Apron, Roku and Stitch Fix, which, if successful, would allow companies to include in their charter documents — and potentially to amend their bylaws — wording that mandates shareholders file suit in federal court.

“Doing so would eliminate duplicative state court litigation, which should immediately bring down the cost of D&O insurance for IPO companies,” said Huskins. “But don’t make assumptions if you are planning an IPO or public offering. The carriers will want time to absorb the implications.”

The court’s opinion is expected in 60 to 90 days.