KM4 | Getty Images

They brew beer, make musical instruments, publish children’s books and design headphones.

Their industries are diverse, but they all have something in common: They represent American small and medium-sized businesses that rely on China either for production or essential equipment.

And they are dreading President Donald Trump’s latest round of tariffs in a trade war that reached new intensity on Friday.

The trade fight erupted more than a year ago, but past rounds of import duties have mostly affected parts and components that are not obvious to the average U.S. consumer.

It’s this latest round that could impact everything from the craft beer you drink on the weekend to the musical instrument you play or the book your kid reads.

While some industries were granted a reprieve until Dec. 15 in the midst of the holiday shopping season, others will face higher tariffs as soon as Sept. 1, just before Labor Day.

Trump said on Friday that he “hereby ordered “ American companies to find an alternative to China and make their products in the United States.

The president also raised the tariff rate on $300 billion of Chinese imports from 10% to 15% in response to Beijing imposing tariffs on $75 billion worth of U.S. goods.

Small and medium-sized companies are now scrambling to adjust their business plans in response.

‘It’s an unjustified tax’

Adrian Sawczuk has a passion for beer. He’s been a home brewer for a decade now, so when he and his wife, Dara, decided they wanted to open a business together, a brewery was a natural fit.

They’ve have had plans in the works for two years now. Tidal Creek Brewhouse is slated as a 10-barrel operation that will make craft beverages in house and serve the community and tourists in Myrtle Beach, South Carolina.

The couple leased a property last year and is currently in the contracting and permitting process. They were even on the verge of ordering $300,000 of brewing equipment from China.

Then came the Trump’s Aug. 1 post on Twitter, in which he made good on his threat to raise tariffs on virtually all remaining imports from China. Then he increased those tariffs from 10% to 15%.

Brewery machinery is one of the many categories of goods that will be hit. Now, the Sawczuks’ plans are in limbo. A 15% tariff on $300,000 of equipment is significant for a small business.

“That money in my mind is just an unjustified tax,” Sawczuk said.

.1566594925939.png)

He would order the equipment from a domestic manufacturer — the problem is there just aren’t that many in the U.S. that offer the equipment he needs at a price that makes sense for the business. And it would create a supply problem if breweries suddenly started sourcing all their equipment domestically, Sawczuk said.

Instead, he’s planning on placing a smaller order to take a smaller hit from the tariffs and possibly even delay the brewery’s opening. Originally they were planning on the fall of 2019; now the first quarter of 2020 seems more realistic. He is also scaling back plans for a staff of up to 15 employees by a few positions.

One one way or another, the cost from the tariffs has to be absorbed.

“There’s a day either my shareholders are going to make less money, I’m going to pay my employees less, or I’m going to charge my customers more,” Sawczuk said.

‘Impossible to plan’

Sawczuk isn’t alone in his frustration. Win Cramer, CEO of JLab Audio, is facing similar challenges.

JLab began as a start-up in Tucson, Arizona, in 2005 and has grown into a brand whose earbuds and headphones compete with the big guys, Cramer said.

The company’s products are carried by retailers across the country — Kohl’s, Best Buy, Walmart and Home Depot.

JLab’s products were originally on a tariff list in 2018, but Cramer petitioned the government to get the products removed. But now, the products are on Trump’s Sept. 1 tariff list — a reversal Cramer doesn’t understand.

“For our business it’s impossible to plan,” he said. “We’re making shorter and shorter decisions based on the uncertainty we’re dealing with.”

As with Sawczuk’s South Carolina brewery, Cramer says the production he needs just isn’t available in the United States. JLab designs its products in California and has them manufactured in China.

“It’s misleading the public to assume that we can just build this stuff in America,” Cramer said. “The supply chain never existed for it and certainly doesn’t exist today… We can’t just flip that script.”

JLab already ordered its inventory for the fourth quarter and the shipment is on the water, en route right now — but the delivery will not arrive until after Sept. 1 when the tariffs go into effect.

“Losing 10% of our gross profit overnight is a tough pill to swallow,” he said, referring to the original tariff rate before Trump raised it to 15% on Friday.

The company, which has about 50 employees worldwide, is looking at ways to cut costs. Cramer was planning on hiring three people for the fourth quarter, but the company has decided to put that on hold.

“Everything is on the table,” he said.

‘There are no trade secrets here’

While JLab Audio has put a hold on hiring several positions to save on costs, the publisher Holiday House is shifting some book printing out of China.

Founded in 1935, Holiday House was the first American publisher to focus exclusively on children’s books. Today, the Manhattan-based company has about 35 employees and publishes 120 new books a year.

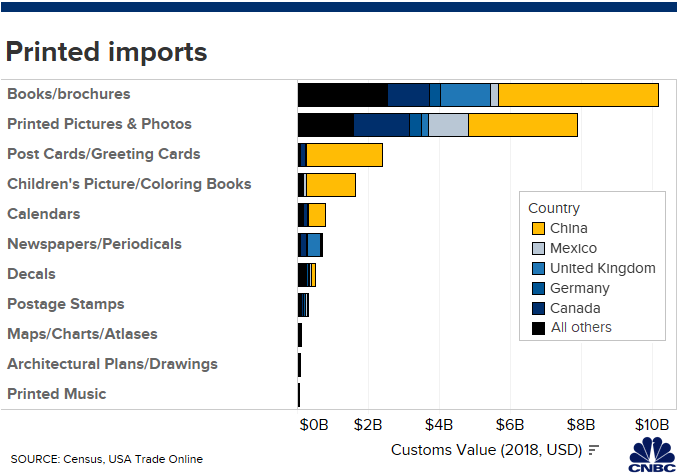

Over the many years since Holiday House’s founding, much of the printing industry has moved overseas. And the four-color printing that is essential for Holiday House’s children’s book titles is now centralized in China.

Though the Trump administration agreed to postpone tariffs on children books until Dec. 15, the industry is facing disruption right now as publishers scramble to shift some printing out of China to other countries in Asia.

“There are good color printers in the U.S. and Canada, but they don’t have the capacity to service the entire industry and their prices are usually twice what you might pay,” said Derek Stordahl, Holiday House’s executive vice president.

Holiday House is moving some of its four-color printing to a partner in Malaysia, but it is facing delays as publishers big and small compete for slots with printers outside of China, he said.

“We’re going to miss print dates on some seasonal books that should be in the warehouse for Christmas and Hanukkah because of this chaos in the market, ” Stordahl said.

Stordahl doesn’t understand why books are caught in the middle of a U.S.-China trade war that is largely a battle over the future of high-tech industries. Washington has a long-standing policy of not imposing tariffs on education materials.

“None of this is high tech,” Stordahl said of book printing. “There are no trade secrets here.”

‘China is not paying for it’

Eastman Music Co., a musical instrument manufacturer and wholesaler, has an intimate understanding of U.S.-China trade relations. Eastman’s CEO, Qian Ni, came to the U.S. from China in 1986 to study at the Boston University School of Music.

His dad helped him source violins from China, which he began selling to music shops. After seeing the demand, he decided to open a company in the U.S. and set up a workshop in Beijing to manufacture instruments. The company has since grown to a little over 1,000 employees worldwide.

Eastman acquired Boston-area companies in 2004 and 2014 along with their U.S. manufacturing and is investing in growing its American production. But a majority of the company’s production still comes from its four factories in China.

.1566508427531.png)

The instruments Eastman produces are handcrafted by craftsmen who take years to hone their skills. Simply shifting production to avoid tariffs really isn’t an option, according to Zachary Maltzman, the company’s CFO.

“This isn’t an assembly line production that you can move to lower cost countries like Vietnam or Indonesia,” Maltzman said.

Eastman will have to increase prices on some products when the tariffs kick in, Maltzman said, but it’s unclear how big the impact will be for consumers. That’s because Eastman isn’t a retailer — it sells instruments to music shops and school districts across the country.

If a price increase is passed down the line to the end user, it’s also unclear how much more consumers are willing to pay before they stop buying instruments and demand drops off, Maltzman said.

But one thing is clear about the tariffs for him: “China obviously is not paying for it,” he said.