For Charlie Munger, living in a relatively modest house wasn’t an accident — it was a conscious choice.

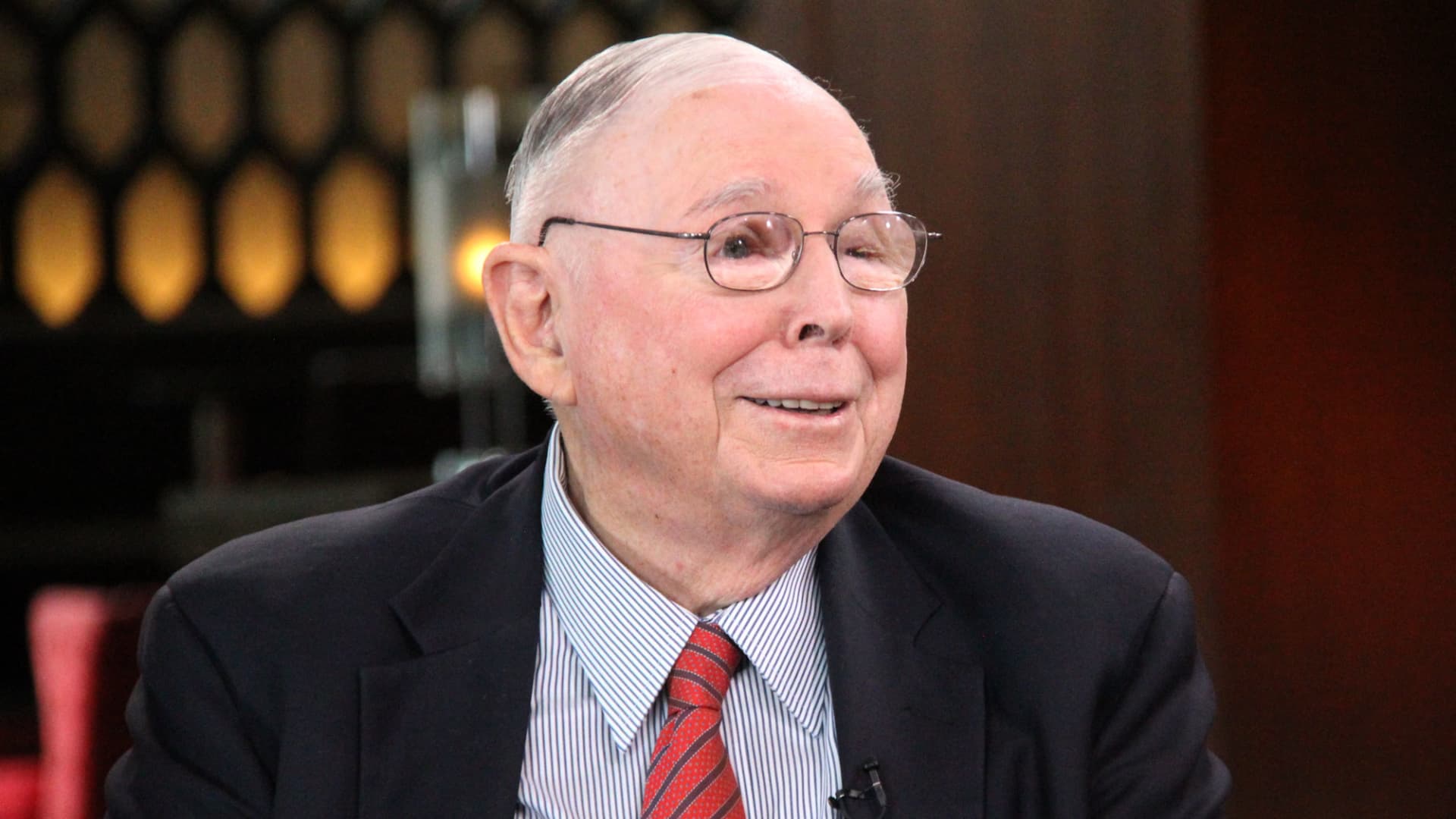

Munger, the billionaire investor and longtime business partner to Warren Buffett, died on Tuesday at the age of 99. He’d previously filmed a wide-ranging interview with CNBC’s Becky Quick, which aired on Thursday evening, and discussed his rationale for living in the same California home over the past 70 years.

“[Buffett and I] are both smart enough to have watched our friends who got rich build these really fancy houses,” Munger said. “And I would say in practically every case, they make the person less happy, not happier.”

A “basic house” has utility, said Munger, noting that a larger home could help you entertain more people — but that’s about it. “It’s a very expensive thing to do, and it doesn’t do you that much good.”

Another drawback to owning a mega-mansion, he added: Such an ostentatious display of wealth could spoil his kids by encouraging them to “live grandly.” Munger had nine children across two marriages, including two step-sons and a son who died of leukemia at age 9.

“[Buffett and I] both considered bigger and better houses,” Munger said. “I had a huge number of children, so it was justifiable even. And I still decided not to live a life where I look like the Duke of Westchester or something. And I was going to avoid it. I did it on purpose … I didn’t think it would be good for the children.”

As Munger alluded to, Buffett lives similarly: The 93-year-old billionaire bought his house in Omaha, Nebraska, for $31,500 in 1958, and has lived there ever since. Buffett’s quality of life would “be worse if [he] had six or eight houses,” he reportedly said at Berkshire Hathaway’s 2014 shareholder meeting.

Munger often preached the merits of living modestly, giving advice like “don’t have a lot of envy” and “don’t overspend your income.” In the Thursday interview, he credited his success and longevity to a long-held sense of caution and an ability “to avoid all standard ways of failing.”

“Avoid crazy at all costs,” said Munger. “Crazy is way more common than you think. It’s easy to slip into crazy. Just avoid it, avoid it, avoid it.”

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts, and three key investing principles into a clear and simple guidebook.