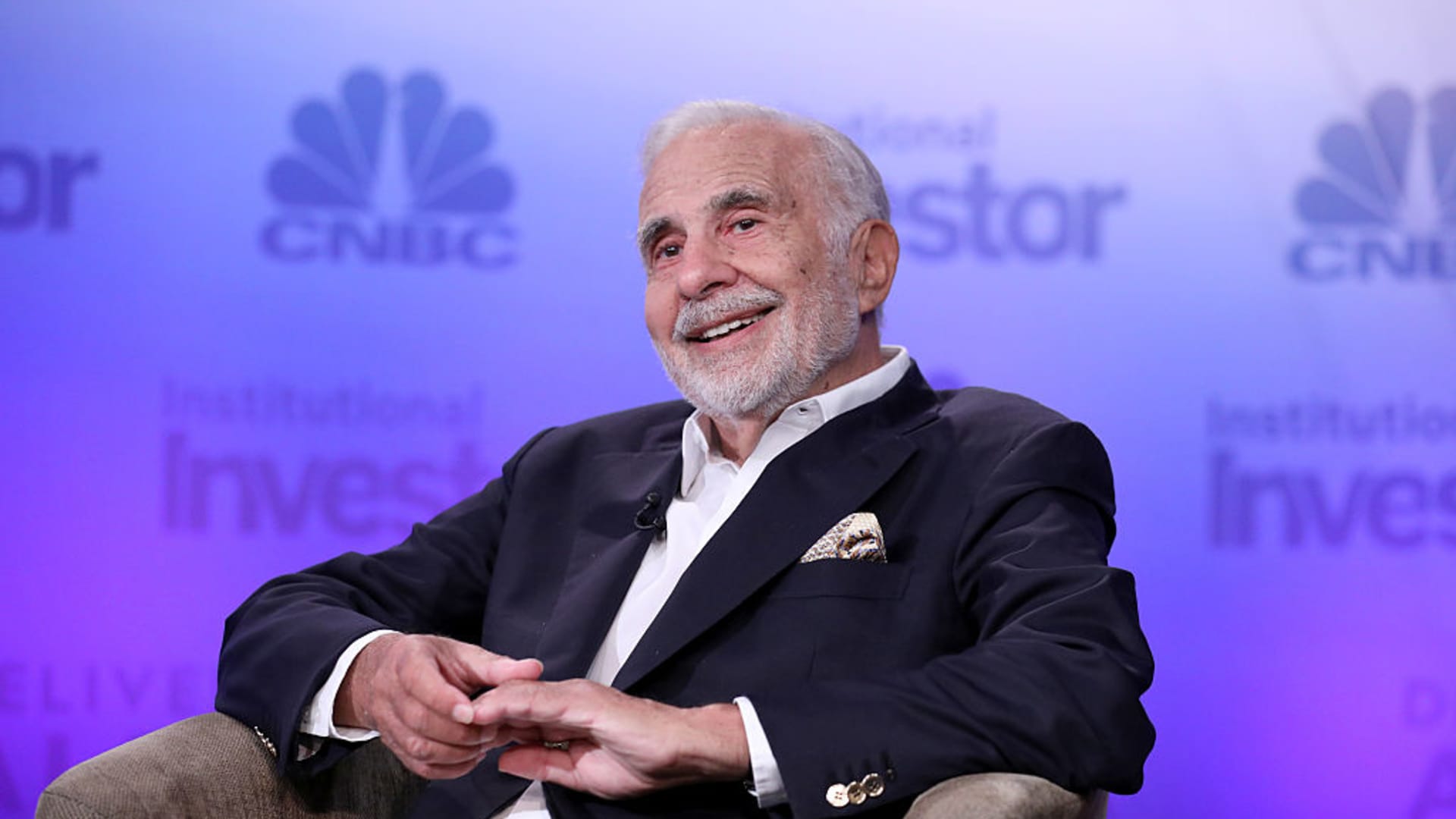

Shares of Carl Icahn’s conglomerate Icahn Enterprises experienced a sharp sell-off Friday after the firm slashed quarterly dividend in half amid notable short seller Hindenburg Research’s campaign.

IEP announced Friday it issued a $1 per depositary unit distribution, which represents a 12% annualized yield. That compared to a $2 dividend in the previous quarter. The stock tanked a whopping 30% following the news.

related investing news

Icahn’s company has been on a rollercoaster ride since the Nathan Anderson-led short seller took a public short position in May, alleging “inflated” asset valuations, among other reasons. Shares of IEP, a holding company that is involved in a myriad of businesses including energy, automotive and real estate, tumbled nearly 44% in the second quarter. The stock is down 54% year to date.

Loading chart…

Hindenburg took issue with IEP’s high dividend yield, saying it’s “unsupported” by the company’s cash flow and investment performance.

“The payment of future distributions will be determined by the board of directors quarterly, based upon current economic conditions and business performance and other factors,” 87-year-old investor Icahn said in a statement Friday. ”We do not intend to let a misleading Hindenburg report interfere with this practice.”

Icahn Enterprises reported a net loss of $269 million in the second quarter, more than doubling the loss of $128 million from the same quarter a year ago. Icahn attributed the disappointing quarter to the short-selling activity in his controlling companies and investments.

“I believe the second quarter partially reflected the impact of short-selling on companies we control or invest in, which I attribute to the misleading and self-serving Hindenburg report concerning our company. It also reflected the size of the hedge book relative to our activist strategy,” Icahn said.

In the aftermath of Hindenburg’s comments, federal investigators sought information regarding IEP’s corporate governance, capitalization, securities offerings, dividends, valuation, marketing materials, due diligence and other materials.

Icahn, the most well known corporate raider in history, made his name after pulling off a hostile takeover of Trans World Airlines in the 1980s, stripping the company of its assets. Most recently, the billionaire investor has engaged in activist investing in McDonald’s and biotech firm Illumina.