With the Consolidated Appropriations Act, 2021 (the Act) finally signed into law, we can start to take a deep dive into the more impactful changes found within the 5,500-page piece of spending and stimulus legislation. We may have jumped the gun a bit in publishing Part 1 of this two-part series on the expanded Employee Retention Credit (ERC) before the law was finalized, but with the ink now dry on the President’s signature, we can confidently move on to the sequel.

Photo by: John Nacion/STAR MAX/IPx 2020 12/23/20 Nancy Pelosi to seek unanimous consent for $2,000 … [+]

John Nacion/STAR MAX/IPx

But first, a bit of required reading…

Naturally, before we get into Part 2, you’ll want to read Part 1, which deals with the changes made by Section 206 of Division NN of the Act. These changes were RETROACTIVE to March 12, 2020, and do NOTHING to change the computational aspects of the credit. Rather, Section 206 opens the ERC – for 2020 AND 2021 – to borrowers of a Paycheck Protection Program (PPP) loan, and walks through, however clumsily, how a PPP borrower retroactively claims the credit for 2020.

Then, you’ll want to devote some time to reading this. It’s a detailed analysis of the original ERC as enacted by the CARES Act, and walks through the computational aspects of the credit as they existed before last week, and as they CONTINUE to exist for 2020. This analysis will be vital to your understanding of the changes made to the ERC FOR 2021 ONLY by Section 207 of the latest relief bill. It is these changes that are the subject of this Part 2.

Done with all that reading? OK, then let’s move on…and we’ll do exactly as we did in Part 1: break down a section of the new Act – this time Section 207 – paragraph by paragraph.

Extension of the ERC Program

Section 207 doesn’t wait long to do what it’s designed for: Section 207(a)(1) extends the ending date for the ERC from December 31, 2020 to June 30, 2021.

As we discussed in Part 1 – and as I repeated above, but cannot stress enough — the purpose of Section 206 of the Act was to expand the eligibility rules for the ERC to include borrowers of a PPP loan. Those changes – and only those changes – were retroactive to March 12, 2020. The computational changes we will discuss throughout Part 2 only apply from January 1, 2021 through June 30, 2021; they are NOT retroactive to 2020.

MORE FOR YOU

Computational Changes from 2020 to 2021

Let’s take a look at what’s new for 2021, and how those rules compare to the rules for 2020.

Old: For 2020, Section 2301(a) of the CARES Act allowed an employer to claim a credit of 50% of qualified wages.

New: For 2021, Section 207(b) amends Section 2301(a) of the CARES Act and increases the credit percentage from 50% to 70%.

Old: For 2020, Section 2301(b)(1) of the CARES Act capped the “qualified wages” that could be paid to any one employee at $10,000 for ALL quarters.

New: For 2021, Section 207(c) amends Section 2301(b)(1) of the CARES Act and increases the maximum amount of creditable, qualified wages to $10,000 for ANY quarter. Thus, in 2020, if A were paid $10,000 in Q3 and $10,000 in Q4, the resulting credit would be $5,000 (capped at 50% of $10,000 in wages TOTAL). In 2021, however, if A were paid $10,000 in Q1 and $10,000 in Q2, the resulting credit would be $14,000, 70% of $10,000 wages for EACH QUARTER).

Old: As discussed in Part 1, to be eligible for a credit, an employer needed to experience at least one quarter in 2020 in which 1) operations were fully or partially suspended by government order, or 2) the business experienced a precipitous drop in gross receipts. More specifically, Section 2301(c)(2)(A)(ii)(II) provided that the latter requirement was met if during 2020, the business experienced a quarter in which gross receipts were less than 50% of the receipts in the same quarter in 2019. From that point on, every subsequent quarter was also an eligible quarter until the END of the first quarter in which gross receipts exceeded 80% of the receipts from the same quarter in 2019.

New: Section 207(d)(1) makes significant changes to the gross receipts test of Section 2301(c)(2)(A)(ii)(II). For 2021, the test is satisfied for any quarter of the first half of 2021 in which gross receipts is less than 80% of the same quarter in 2019. Thus, in the first quarter of 2021, a business would compare its receipts in that quarter to the first quarter of 2019, NOT the first quarter of 2020. The comparison to 2019 rather than 2020 makes a lot more sense when we move on to Q2 of 2021, because in all likelihood, gross receipts for Q2 of 2019 will be significantly higher than those of Q2 of 2020, such that a comparison to 2019 will make it much easier to establish an eligible quarter.

If, however, a business did not exist at the beginning of the same quarter of 2019, the same quarter in 2020 is substituted.

Section 207(d)(2) then gives businesses – for 2021 only – the option to elect to satisfy the gross receipts test by looking at the immediately preceding calendar quarter, and comparing that quarter to the corresponding quarter in 2019. To illustrate, an employer who could not satisfy the gross receipt test in Q1 of 2021 could nonetheless have an eligible quarter for that stretch of time by electing to compare gross receipts in Q4 of 2020 to Q4 of 2019. If there is a drop of more than 20% quarter-over-quarter, Q1 of 2021 will be an eligible quarter. At this time, it is not clear if the election is permanent; requiring the employer to then determine whether an eligible quarter exists for Q2 of 2021 by looking to Q1 receipts, but that seems illogical, as in the example above, had Q1 been an eligible quarter in its own right, the need would not have arisen to make the election for that quarter. In all likelihood, the election will be made quarter-by-quarter.

Old: For 2020, under Section 2301(c)(3)(A) of the CARES Act, the definition of “qualified wages” hinged on whether the business had more than 100 full-time equivalent employees in 2019 as determined under Section 4980H. If the business had MORE than 100 FTEs, only wages paid to employees not to provide services during an eligible quarter were “qualified wages.” If the business had fewer than 100 FTEs, however, then ALL wages paid to employees during an eligible quarter (or eligible part of quarter if the business were only shut down for a portion of the quarter) were “qualified wages.” For examples of this differing treatment, please read the link from the beginning of this article.

New: For 2021, Section 207(e) increases the threshold number of employees before a change in treatment arises from 100 to 500. Importantly, Section 207(e)(2) then strikes Section 2301(c)(3)(B) of the CARES Act, which had previously capped qualified wages paid to any one employee at what the employee would have been paid for working an equivalent duration during the 30-day period immediately before the eligible quarter in which wages were paid. Stated in English, this rule prevented an employer from artificially inflating the ERC by increasing pay to an employee during an eligible quarter. That rule no longer exists, meaning an employer could pay bonuses to an employee and increase the credit, subject to the $10,000 per quarter cap, of course.

New Rules for 2021

Section 207(g) then adds an entirely new component to the ERC regime for 2021: the ability for small employers to receive the credit – which is typically taken by reducing required payroll tax deposits — in ADVANCE.

It works like so: if an employer has fewer than 500 FTEs, it may elect for any calendar quarter to receive an advance payment of the credit for that quarter in an amount not to exceed 70% of the average quarterly wages paid by the employer in 2019.

As one would expect, the advance credit would then need to be reconciled against the actual credit, a process we’ve gotten used to with the premium tax credit received when acquiring health insurance on a state exchange. If the advance payments end up exceeding the actual credit due, the employer’s payroll tax is increased for the calendar quarter by the excess.

Let’s look at two examples to illustrate how the computational aspects of the law change from 202o to 2021.

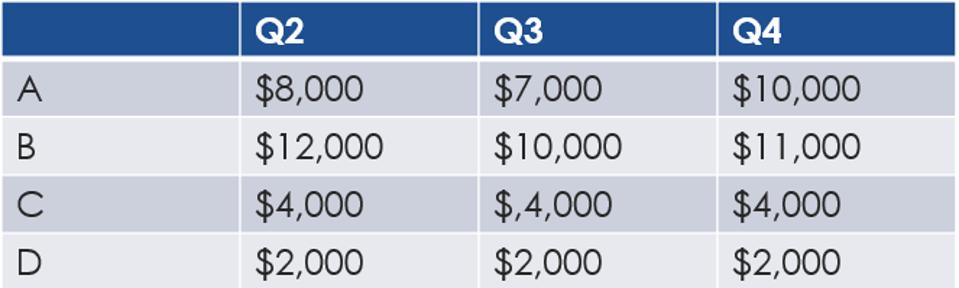

Example: In 2020, X Co. has gross receipts for Q2, Q3 and Q4 of $100,000, $120,000 and $150,000. In 2019, X Co. had gross receipts for Q2, Q3 and Q4 of $210,000, $155,000 and $180,000. Gross receipts in Q2 dropped by more than 50% when compared to Q2 of 2019, and were then at 77% for Q3 and 83% for Q4. Because eligible quarters for 2020 start once receipts drop by more than 50% and continue until the END of a quarter in which receipts exceed 80% of the receipts for the same quarter in 2019, each quarter is an eligible quarter. X Co. has fewer than 100 FTEs, and during those quarters, paid salary to employees in the following sums:

ERC wages

nitti

In Q2, X Co. has $24,000 in qualified wages ($8,000 + $10,000 + $4,000 + $2,000). B is topped out and disqualified for the rest of 2020, because in 2020, the maximum amount of qualified wages for any one employee is $10,000 for ALL quarters.

In Q3, X Co. has $8,000 in qualified wages ($2,000 + $0 + $4,000 + $2,000). A is now topped out and disqualified for the rest of 2020.

In Q4, X Co. has $4,000 in qualified wages ($0 + $0 + $2,000 + $2,000). C was topped out during the quarter.

The total credit is $18,000 (50% * $36,000).

2021

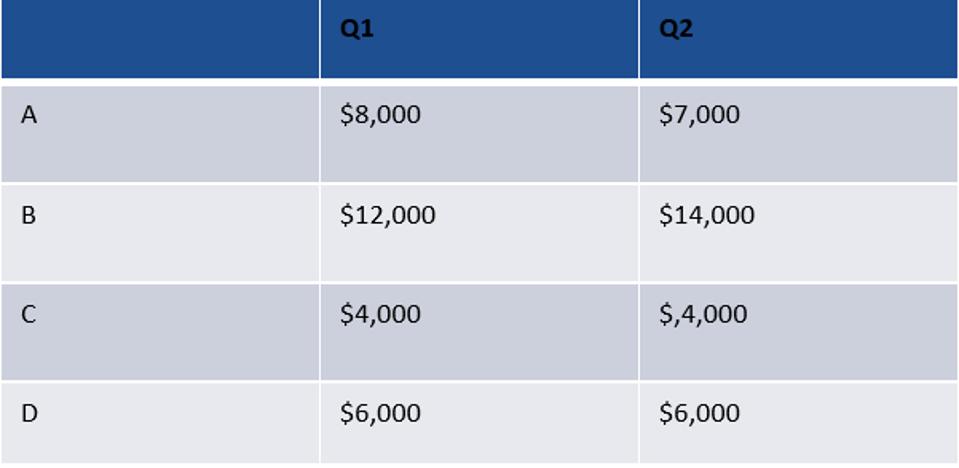

In 2021, X Co. has gross receipts in Q1 of $140,000 in Q1 and Gross receipts in Q1 and Q2 of 2019 were $180,000 and $210,000 respectively. Because gross receipts for each of Q1 and Q2 in 2021 were less than 80% of the receipts for the same quarters in 2019, both quarters are eligible quarters. During Q1 and Q2, X Co. paid its employees as follows:

2021 wages

nitti

In Q1, X Co. has $28,000 in qualified wages ($8,000 + $10,000 + $4,000 + $6,000).

In Q2, X Co. has $27,000 in qualified wages ($7,000 + $10,000 + $4,000 + $6,000). As opposed to 2020, B has eligible wages even after being paid $10,000 in a previous quarter, because the limit is now $10,000 per employee PER QUARTER.

The total credit is $38,500 (70% * $55,000). The credit is DOUBLE what it was for 2020, despite the fact that 2021 has only two qualifying quarters, while 2020 had three.

There are three big changes to note that took effect when the calendar moved from 2020 to 2021:

First, if Section 207 of the Act had not changed the law, Q1 of 2021 would NOT have been an eligible quarter for X Co. In Q4 of 2020, gross receipts exceeded 80% of the receipts for Q4 of 2019; thus, in order to “restart” a run of eligible quarters, gross receipts for Q1 of 2021 would have needed to be less than 50% of the receipts for Q1 of 2019, which was not the case. Section 207 provides that for 2021 only, however, to be an eligible quarter, the gross receipts must be less than 80% of the receipts for the same quarter in 2019. Because that was the case for both Q1 and Q2 of 2021, both quarters are eligible quarters.

Next, the change in the limit on qualified wages is hugely impactful. In 2020, the cap was $10,000 per employee for ALL quarters, causing A, B and even C to eventually have their wages capped out. Fast forward to 2021, however, and the limit increases to $10,000 per employee for ANY quarter; as a result, only B is subject to any limitation at all.

Finally, Section 207 of the Act increases the credit rate from 50% to 70%. It is worth noting that if X Co. were so inclined, it could elect to receive the 2021 in advance, up to 70% of the average quarterly wages for 2019.

Let’s take a look at one other example to drive home the consequences of a different change in the computational aspect of the law from 2020 to 2021:

Example. Employer P is a local chain of full service restaurants in State X that averaged 250 FTEs in 2019. State X forced P to discontinue sit-down service to customers for Q2 and Q3 of 2020. P continues to pay its kitchen staff to come in and prepare food every day. It also pays its wait staff to stay at home and not work. Even though P had its operations partially suspended, because P has more than 100 FTEs for 2019, only those wages paid to employees NOT TO WORK are eligible for the credit. The amount P pays its kitchen staff to cook are not eligible for the ERC. The wages paid to the wait staff, however, are eligible wages.

Fast forward to 2021, however, and the wages paid to BOTH the wait staff and the kitchen staff are eligible wages, because beginning in 2021, the change in treatment of wages does not kick in until P has more than 500 FTEs.

Let’s close with this important reminder: for all of 2021, borrowers of a PPP loan –either an original loan or a second round of borrowing as blessed by the Act – are eligible to claim an ERC credit. But as we discussed in Part 1, careful consideration is necessary to ensure that wages are not duplicated – i.e., both eligible for the ERC and forgiven as part of the PPP process – and that the tax benefits from both programs are maximized.