©Ðндрей ЯланÑкий – stock.adobe.com

The fixed income portion of your portfolio needs a hard reboot

Interest rates have fallen recently. And by recently, I mean for the last 40 years! There are many ways I can show you what that looks like, to help you see what I see and why it is so important to you as an investor.

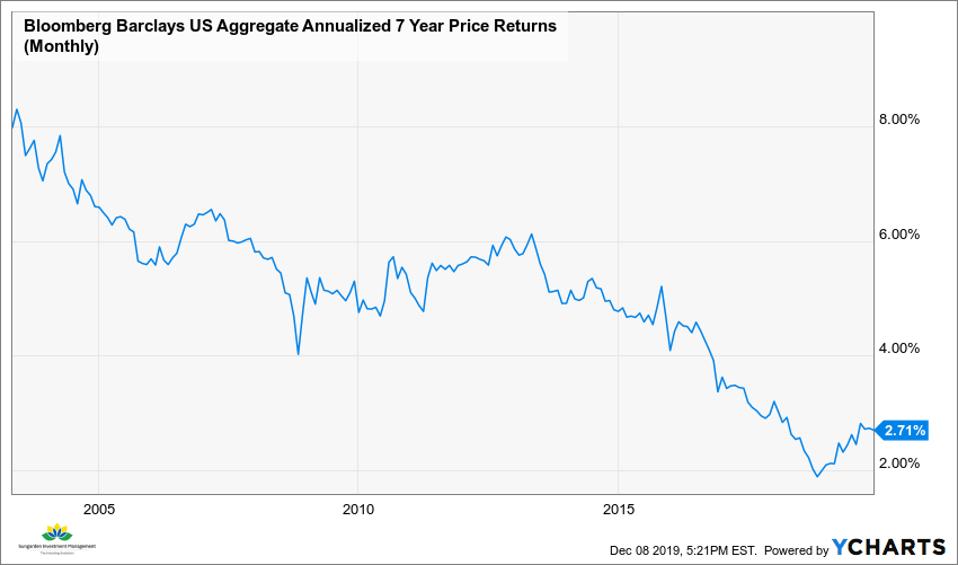

First, here is the recent history of 7-year annualized returns on the popular price index for U.S. Bonds. This says that about 15 years ago, if you asked an investment pro what the annual return was on bonds, generally speaking, the answer would have been about 8% (see far left side of chart).

^BBUSATR_chart

If you had asked that same question 5 years ago, the answer would have been around 6%. The answer to that question today? 2.7%. That’s too low for most retirees. Will it get better? Not likely any time soon. What can you do about it? Read on, starting with the chart below. It shows the yield history of the 10-year U.S. Treasury Bond. Note that the yield is the value shown, divided by 10, such that a reading of 20.00% equals a bond yield of 2.00%.

AGG_^TNX_chart (1)

This shows us why the answer to the first question was a disappointing 2.7% per year, when we are used to 6-8% being the norm when we were just a bit younger.

This is a serious issue for retirees and “pre-tired” investors

They probably have a projection from a financial advisor from years ago, showing them what their retirement would look like if they just followed the plan, and lived off of the 4-6% return they would have in retirement. They may only be realizing now that they can’t just “push a button” like you could 10 or 15 years ago. Rates are too low to start, with the 10-year U.S. Treasury Bond sitting around 1.8%.

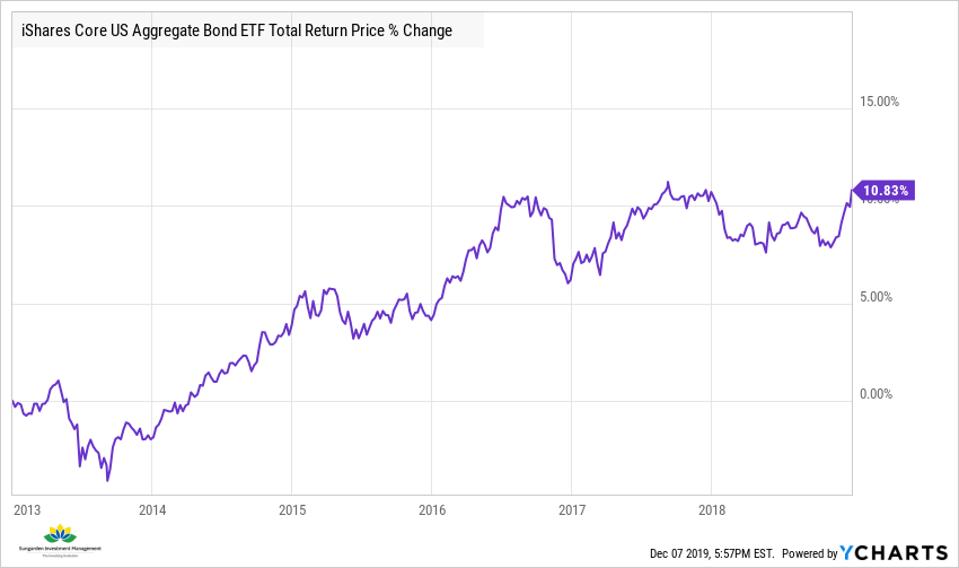

You will also notice that the yield on 10-year U.S. Treasury Bonds currently sits at around the same level it did about 7 years ago, in early 2013. Given how bond returns and interest rates work together, it would sure help to see how things played out for bond investors from 2013 on. Here is another picture, with the explanation below.

AGG_chart

Now, I already answered the question of how you did the past 7 years. Recall that this conversation started with the fact that bond returns the past 7 years have essentially crashed down to 2.7%, near the lowest in recent memory.

But wait, bond fans, there’s more

Still, one more peel back of the onion will hopefully allow you to see what I see. In the chart immediately above, you see that in the 6 years from the end of 2012 through the end of 2018, the return on bonds was under 11%…in total! So, under 2% per year.

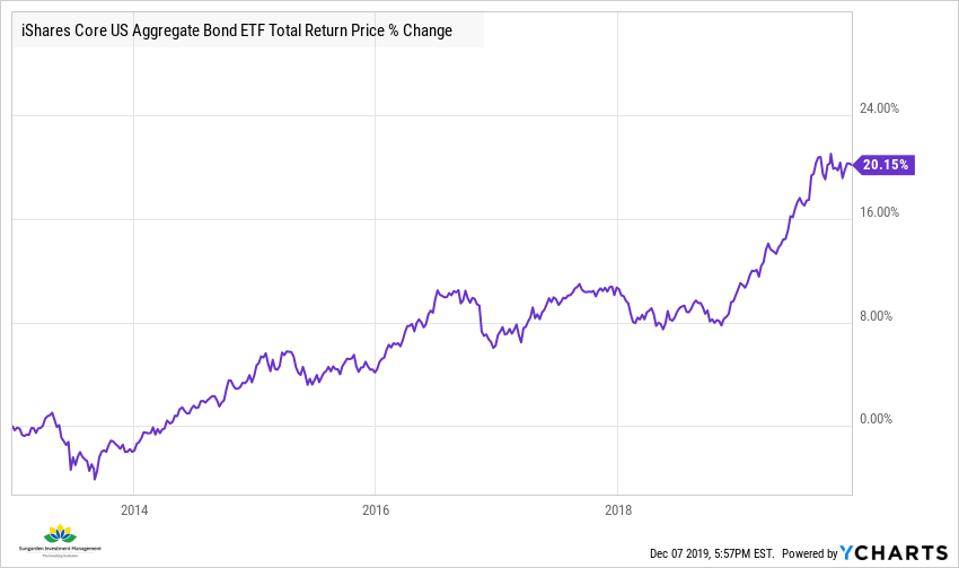

Now, in 2019, bond returns were strong. They were so strong that a 6-year return of under 2% a year vaulted to 2.7% over 7 years, since the end of 2012. But it took a crash in interest rates due to produce that. That, in turn, brought rates back down to those severely low levels we saw back in 2012.

AGG_^TNX_chart

This hurts retirees in two ways: their total return prospects on bond investing are dim, and their current yield stinks. And if we get a whiff of inflation, that may only make things worse.

It gets worse before it gets better

Here’s another issue: ee did not have an extended major decline in U.S. stock prices during the last 7 years. Instead, the stock market bailed out retirees. Going forward, we can’t hope to be so fortunate. And bonds are, again, not there to help.

As a result, I am concerned that way too many investors who need to realize how the odds are moving against them…don’t realize it at all. Instead, they have become WAY too reliant on buy-and-hold stock investing and buy-and-hold bond investing to fund their retirement. Bonds are not likely to be the buffer, or offset to your stock investment risk that they used to be. The past 7 years have offered a hint at that. The next 7 years will likely make those 7 look like a picnic.

How bonds can be used going forward

I am NOT telling you to avoid bonds. I am saying that you need to use them differently. This is like curbing your intake of red meat in your diet. You may get advice to change the role steaks and burgers play. They become a treat and not a staple. Bonds can be return-drivers and income-producers in your portfolio. However, you need to learn how to use them differently.

The main way I use bonds in my portfolios today is as a “tactical” weapon. That is, as a way to earn returns over shorter time periods. That could be months or even weeks. It will seldom be for years.

This year, U.S. Treasuries have done well. Particularly, long-term bonds (10-30 years in maturity) have produced very good returns. But they have yielded very little income. And that won’t change going forward. But, with the new era of investing comes opportunity. Long-term Treasury rates are more volatile today, and that means their prices are more volatile too.

A different approach to bonds

Since the markets naturally produce over-reactions by investors in both directions, that opens the door for us to use long-term bonds to earn a little income while their prices rise. Those prices rise when yields drop. This is easiest to do through Exchange-Traded Funds (ETFs) that invest in a basket of Treasury Bonds that you can examine daily.

Likewise, when interest rates go up, there are ETFs that essentially move in the opposite direction of Treasury prices. So, when rates rise, bond prices drop, but the price of the inverse Treasury ETF rises. This is potentially a good “hedge” against rising rates, either for a short period of time, or much longer.

Short-term bonds can help, too

The other way I have found bonds useful in the new era of investing is by using short-term Treasury ETFs. Their yields are about those of longer-term bonds, and their prices do not fluctuate nearly as much.

So, as a way to boost your cash yield and potentially tack on a little price gain if rates temporarily fall again, this is another way to go. And, its a lot better than sticking 40% of your portfolio in “bonds” for an extended period of time, when your returns are likely to be low or even negative.

Bonds are not dead. But using bonds the way most investors and financial advisors have done their entire lives? That is dead, at least for a while. Don’t get lulled into complacency by the way stocks bailed you out over the better part of the last 7 years.

Look beyond what has worked in the past. It will help you secure your future.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors