BlackRock, the world’s biggest asset manager, announced Friday it is buying Global Infrastructure Partners for about $12 billion in cash and stock.

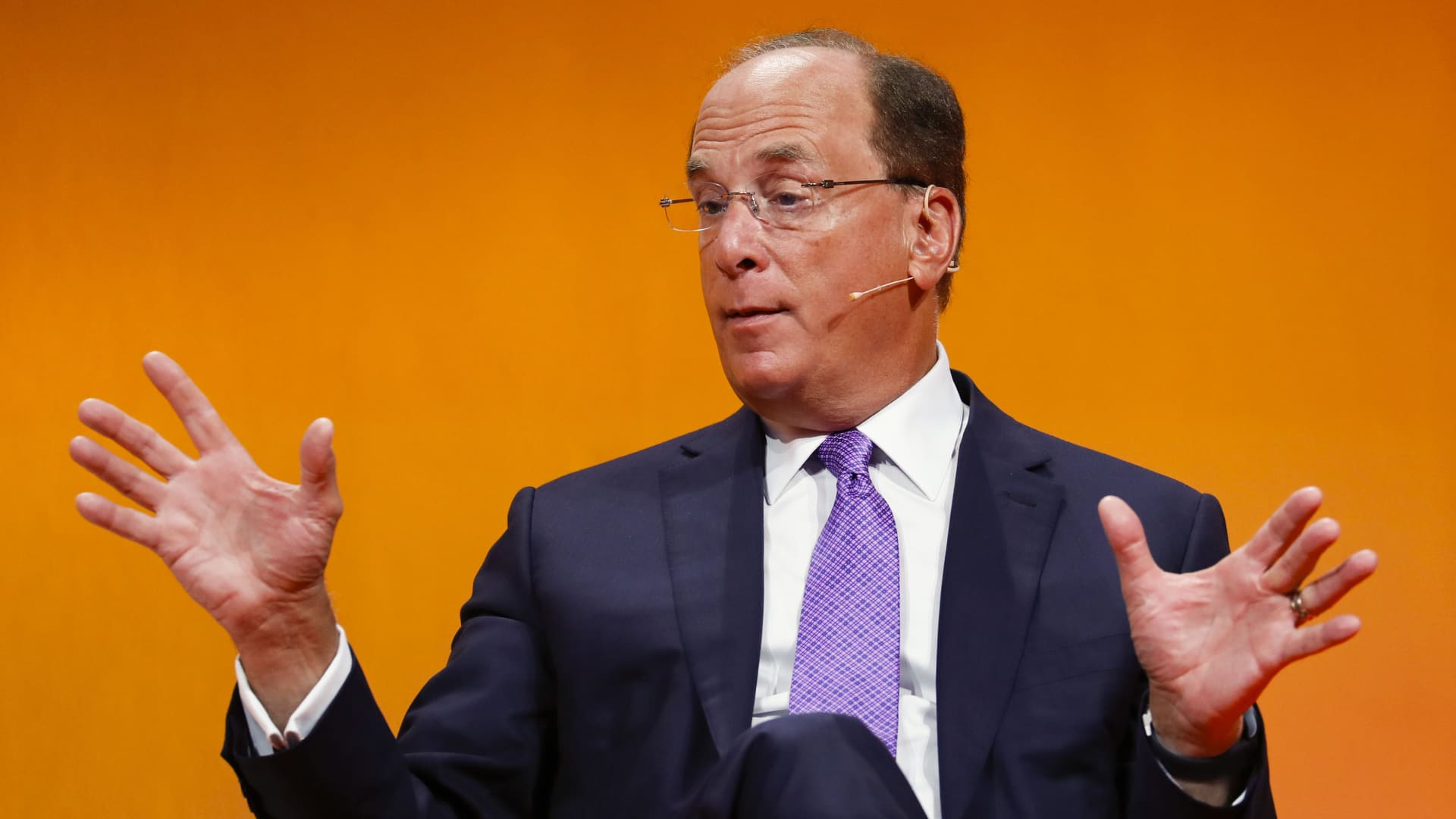

The acquisition is part of the firm’s increased focus on infrastructure, which CEO Larry Fink said is “one of the most exciting long-term investment opportunities.” As part of the deal, GIP’s management team will lead a combined infrastructure private markets investment platform at BlackRock.

The deal is expected to close in the third quarter of this year.

BlackRock also announcing it will embed its ETF and Index businesses across the entire firm with the creation of a new strategic Global Product Solutions business.

“This platform is set to be the preeminent, one-stop infrastructure solutions provider for global corporates and the public sector, mobilizing long-term private capital through long-standing firm relationships,” said GIP CEO Bayo Ogunlesi.

The firm is also creating a new International Business structure that will unify its leadership across Europe, the Middle East, India and Asia-Pacific.

Don’t miss these stories from CNBC PRO:

- There’s one stock Wall Street loves so much for 2024 that five analysts in one day picked it as their favorite

- Morgan Stanley names its top stocks for 2024, including this streaming giant

- Investing tips from Warren Buffett to start the new year on the right foot

- Goldman sees a 50% gain ahead for this Chinese electric vehicle stock, initiates with buy rating

- ‘Twice as cheap’: These stocks’ discount to the S&P 500 is double its average, Ritholtz’s Brown says