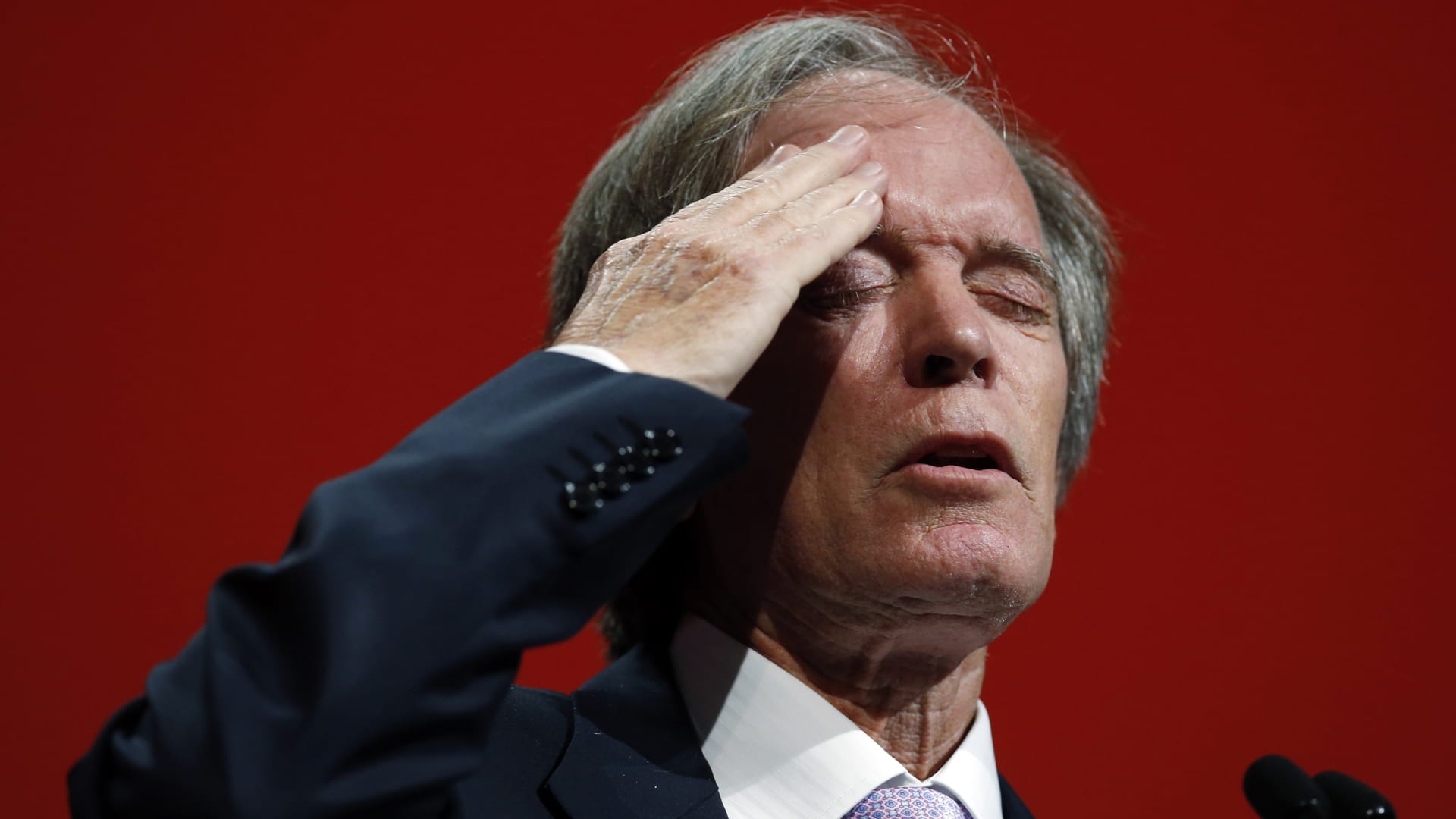

Famed investor Bill Gross said he expects big trouble ahead should the Federal Reserve keep hiking interest rates.

“The economy has been bolstered by tremendous amounts of trillions of dollars in fiscal spending, but ultimately when that is used up, I think we’ve got a mild recession, and if interest rates keep going up, we’ve got more than that,” Gross said Tuesday on CNBC’s “Halftime Report.”

related investing news

“We’ve got potential chaos in financial markets,” he said.

A tightening of monetary policy would further roil the capital markets, according to Gross. The so-called bond king and co-founder of Pimco pointed to Tuesday’s move in global bond yields following the Bank of Japan’s decision to widen the yield on its 10-year Japanese government bond.

Meanwhile, a rise in interest rates spells trouble ahead for commercial real estate, which could face “potential defaults” ahead, Gross said. However, he expects that residential real estate will fare somewhat better, and will not be hit to the degree that it was during the Great Recession.

“I do think, going forward, if the Fed continues to raise rates, that the ability to equitize some of your housing, which is moving down in price, is going to be severely limited, and so that’ll serve as a caution for the housing market,” Gross said. “But in terms of a debacle, as in ’07, ’08, I don’t think we’re headed there.”

While at Pimco, Gross helped run the world’s largest mutual fund. He then ran a fund at Janus Henderson until he retired in March 2019.