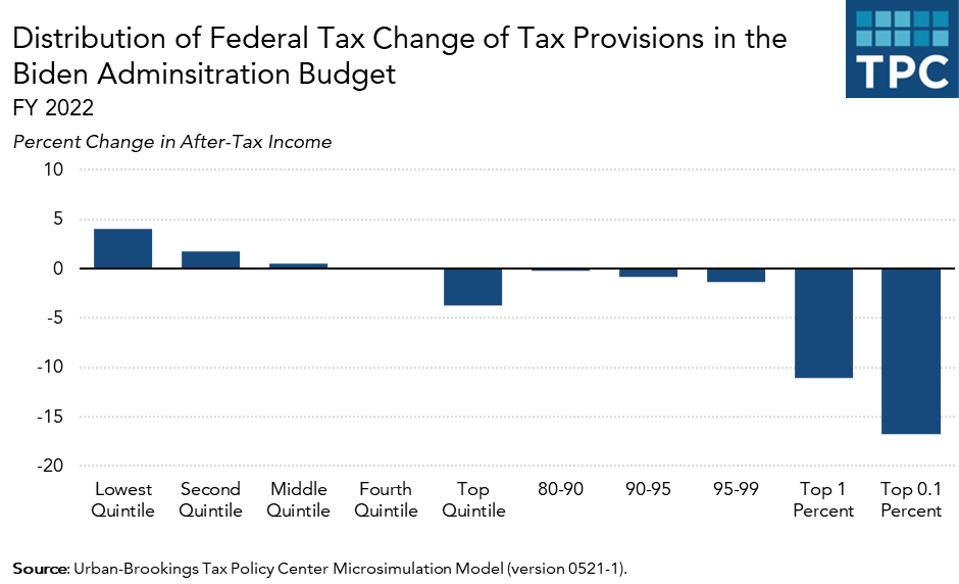

Nearly all of President Biden’s proposed tax increases would be borne by the highest income 1 percent of households—those making about $800,000 or more—according to a new analysis by the Tax Policy Center. At the same time, Biden would cut taxes for many low- and moderate-income households and reduce them substantially for those with children.

TPC projects that low-income households (making about $26,000 or less) would receive an average tax cut of about $600 or 4 percent of their after-tax income. Middle-income households (making between about $52,000 and 92,000) would pay on average about $300 less in taxes, or 0.5 percent of their after-tax income.

However, the story would be very different for high-income households. Those in the top 1 percent would pay an average of about $213,000 more in federal taxes in 2022 while those in the top 0.1 percent (who will make $3.6 million and above) would pay an average of nearly $1.6 million more, or almost 17 percent of their after-tax income.

How President Biden’s tax proposals are distributed

Tax Policy Center

Biden’s tax proposals

TPC analyzed the tax changes in Biden’s fiscal year 2022 budget, including proposals in his American Jobs Plan and American Families Plan—all of which were outlined in the Treasury Department’s explanation of his tax proposals, known as the Green Book.

Biden’s proposals include extending recent temporary increases in the Child Tax Credit (CTC), the Child and Dependent Care Tax Credit (CDCTC), and the Earned Income Tax Credit (EITC)—all of which primarily would benefit low- and middle-income households. For high-income households, he’d raise individual income tax and capital gains tax rates, and tax unrealized capital gains at death. Finally, Biden’s tax agenda includes a wide range of corporate tax increases, including a 28 percent corporate income tax rate, two corporate minimum taxes, and many other business tax changes.

There are many ways to look at the distribution of Biden’s tax changes. But the basic story doesn’t change much, no matter the lens.

Different lenses

For example, TPC allocates corporate taxes to individuals, mostly as shareholders but also as workers. By excluding Biden’s corporate tax hikes and looking just at individual income and payroll taxes, TPC’s distributional estimates change a bit.

If you look at just individual income and payroll taxes, the lowest-income households get a slightly larger increase in average after-tax incomes (since they no longer would bear the burden of the workers’ share of those corporate rate cuts). Middle-income households also would benefit from not bearing the shareholders’ slice of Biden’s corporate rate hikes.

The impact is even more dramatic for high-income households who benefit most of all as shareholders. For example, excluding their share of corporate tax would reduce the average tax increase of the top 1 percent from about $213,000 to about $174,000, or from 11 percent of after-tax income to 9 percent.

Biden’s pledge

For those looking to see if Biden kept his promise to not raise taxes for those making $400,000 or less, the answer is: Mostly, but not entirely.

Unfortunately, TPC doesn’t break out the exact income levels Biden targets, but its tables do show households with income of $500,000 or less.

Including corporate tax increases, most households would pay more in 2022. About three-quarters of middle-income households would face a tax increase averaging about $300. But nearly all would be a result of those higher corporate taxes.

However, if you look just at personal income and payroll taxes, which seems a fair reading of Biden’s pledge, the story is quite different. Among those making less than $200,000, only a few thousand would pay higher taxes in 2022. Nearly all would be wealthy decedents who would pay Biden’s tax on unrealized capital gains.

About 0.6 percent of those making $200,000 to $500,000 would pay more in taxes, averaging about $22,000. Some, of course, would be making between $400,000 and $500,000.

Other perspectives

Another way to look at Biden’s plan is to split households into those with children and those without. Biden’s tax agenda is skewed heavily towards parents. For example, while all low-income households would get an average tax cut of about $620 in 2022, taxes for such families with children would plunge by an average of $3,200. This is a feature, not a bug, of Biden’s plan. But the difference is striking.

Finally, there is one more way to look at Biden’s tax agenda: How would his proposals affect various income groups in 2031?

It is helpful to think of 2026 as an inflection point. That’s because all the individual tax changes in the 2017 Tax Cuts and Jobs Act expire at the end of 2025.

Thus, tax rates would rise for many households and many business owners would lose the benefit of the TCJA’s special 20 percent deduction for pass-throughs such as partnerships. At the same time, the state and local (SALT) tax deduction and miscellaneous individual income tax deductions would be fully restored. High-income households could use those deductions to lower their taxable income and protect some or all of their capital gains from Biden’s plan to tax them at the top 39.6 per cent rate.

On net, tax increases for higher income people would be somewhat smaller in 2031 than in 2022. For example, looking only at individual tax provisions, the top 1 percent would face a tax increase of about $156,000, or 6.8 percent of after-tax income, in 2031. That compares with a 2022 tax hike of 9 percent of after-tax income.

Low- and moderate-income households would see somewhat smaller tax cuts in 2031 than in 2022. For example, taxes for middle-income households would fall by only about $90 in 2031, compared to $640 in 2022. For the most part, those more modest 2031 tax cuts are because Biden’s CTC expansion is scheduled to expire in 2025.

Biden is proposing major changes in the US tax code. And, as he has been saying for a year, they largely are split between tax cuts for families with children and tax increases on high-income households and corporations. TPC’s analysis quantifies how those tax changes affect different households.