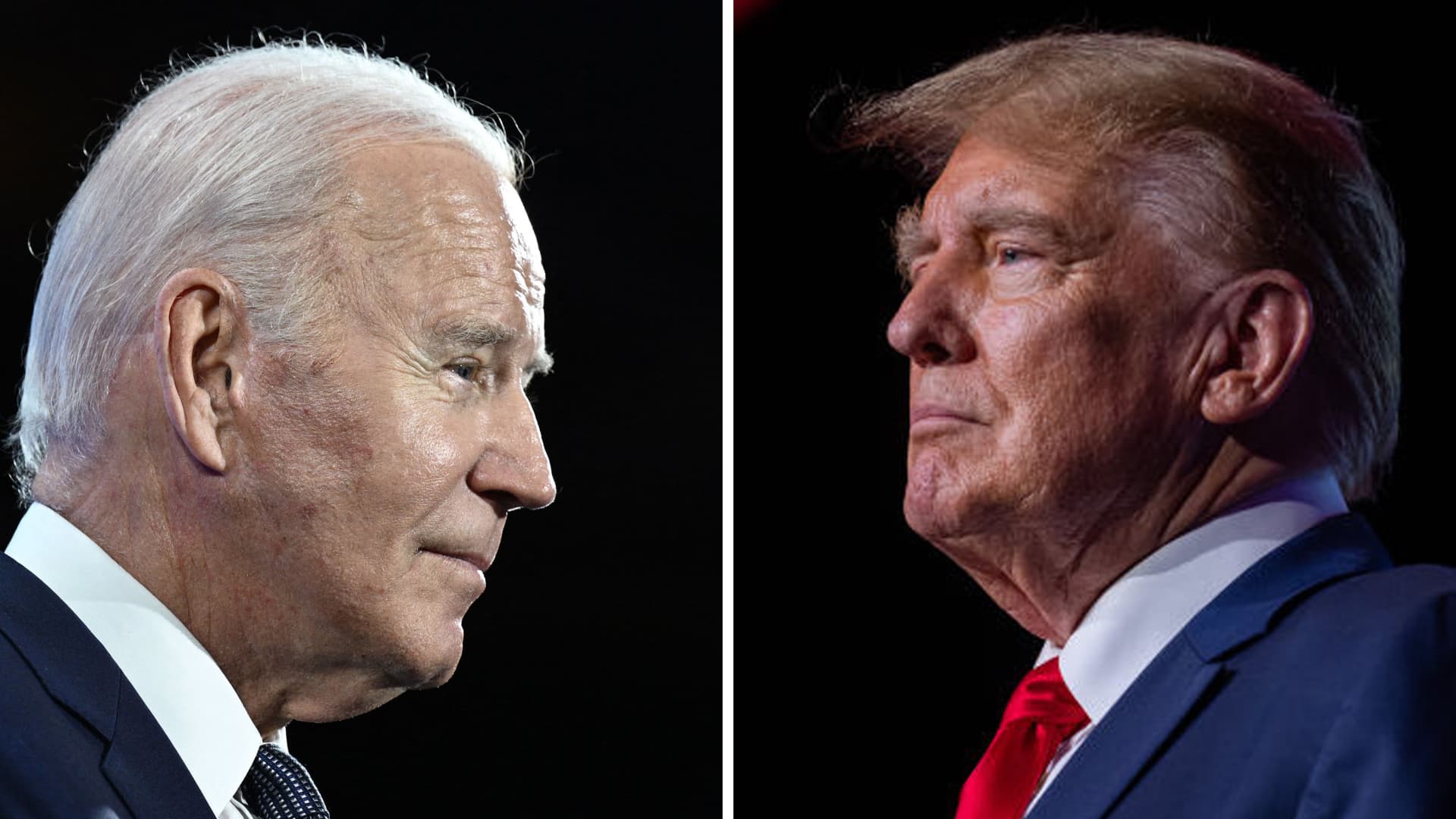

Presumptive nominees President Joe Biden and former President Donald Trump have both pledged to extend expiring tax breaks for most Americans — but questions remain on how to pay for it.

Trillions in tax breaks enacted by Trump via the Tax Cuts and Jobs Act of 2017, or TCJA, will expire after 2025 without action from Congress. This would increase taxes for more than 60% of filers, according to the Tax Foundation.

Expiring individual provisions include lower federal income brackets, higher standard deductions, a more generous child tax credit and more.

But the federal budget deficit will be a “huge sticking point” as the 2025 tax cliff approaches, said Erica York, senior economist and research manager with the Tax Foundation’s Center for Federal Tax Policy.

More from Personal Finance:

Here’s how much homeownership costs annually

Home equity is near a record high. Tapping it may be tricky

Is it a great wealth transfer or retirement savings crisis? It can be both, expert says

Fully extending TCJA provisions could add an estimated $4.6 trillion to the deficit over the next decade, the Congressional Budget Office reported in May.

The cost of extending major parts of the TCJA has grown about 50% since initial estimates in 2018, according to the Committee for a Responsible Federal Budget.

In 2018, the Congressional Budget Office estimated economic growth from the TCJA would cover about 20% of the cost of tax cuts. But the effects were smaller, studies have shown.

“There’s no serious economist who thinks that the Tax Cuts and Jobs Act remotely came close to paying for itself,” said Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center. “And nobody thinks that extending it or making it permanent is going to pay for itself.”

There’s no serious economist who thinks that the Tax Cuts and Jobs Act remotely came close to paying for itself.Howard GleckmanSenior fellow at the Urban-Brookings Tax Policy Center

Some TCJA supporters again say the 2025 extensions would pay for themselves via faster economic growth. But analyses from four organizations, including the Yale Budget Lab, Tax Foundation, Penn Wharton Budget Model and American Enterprise Institute, estimate only a 1% to 14% offset, the Committee for a Responsible Federal Budget reported in June.

Proposals from Biden and Trump

Trump wants to extend all TCJA provisions and Biden plans to extend tax breaks for taxpayers who make less than $400,000, which is most Americans.

Biden’s top economic advisor, Lael Brainard, in May called for higher taxes on the ultra-wealthy and corporations to help fund TCJA extensions for middle-class Americans. By comparison, Trump has renewed his support for tariffs, or taxes levied on imported goods from another country.

However, these policy proposals are uncertain, particularly without knowing which party will control the White House and Congress.