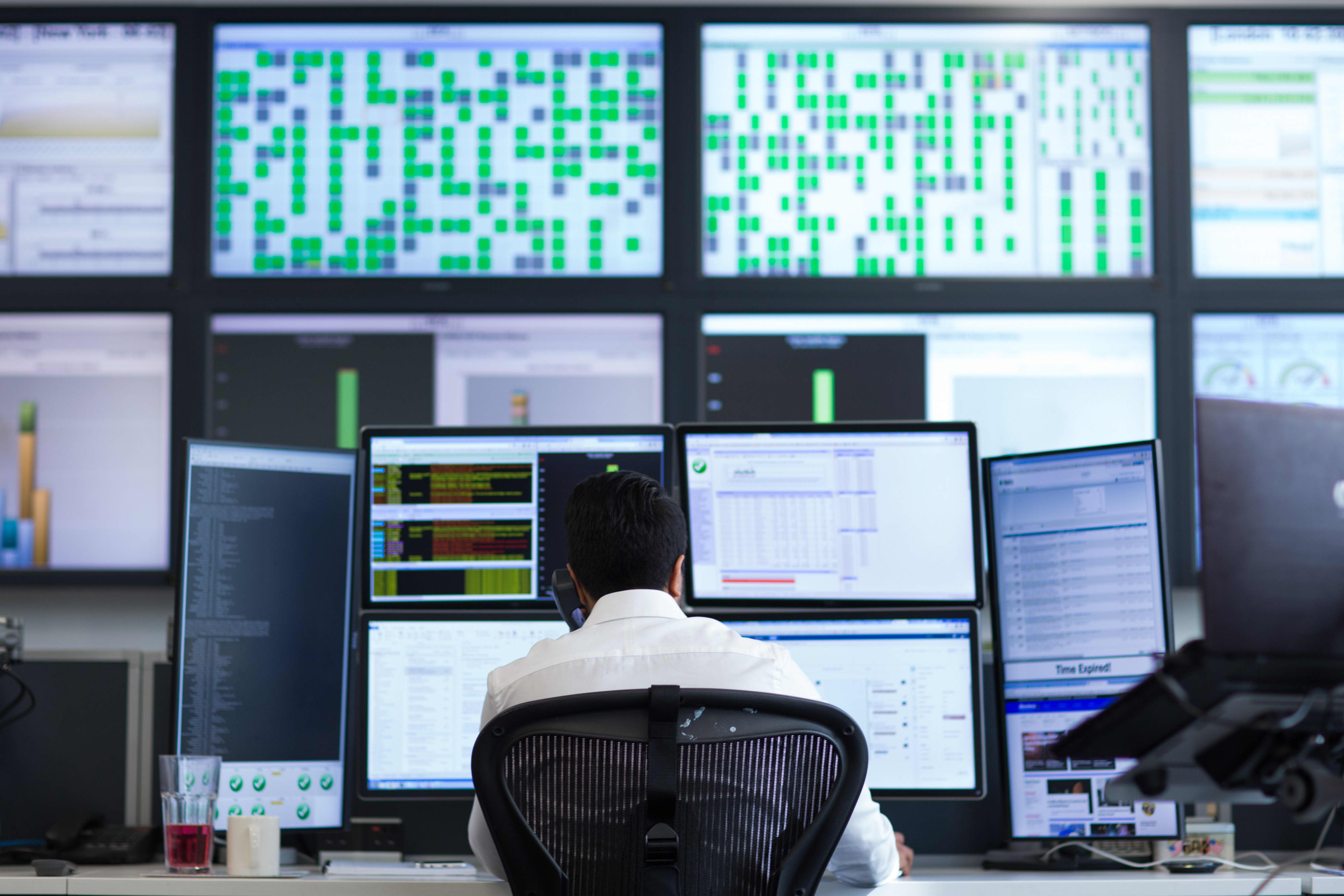

A member of exchange staff uses a fixed-line telephone while looking at financial data on computer screens on the trading floor of Bats Europe, the European arm of Bats Global Markets Inc., in London, U.K..

Jason Alden/Bloomberg | Bloomberg | Getty Images

Trading floors in banks have been immortalized in countless Hollywood movies. Chaotic scenes of financial professionals, often on the phone, and often screaming; rows of desks and endless monitors all convey highly stressful situations in an industry where time is literally money.

While there’s some fiction to this stereotype, the images of densely populated, cavernous spaces are grounded in the truth. And in the era of Covid-19, of course, all that frenetic activity and tightly-packed bodies pose a big challenge — even more so than in the typical group office. As banks begin to think about bringing employees back to work, trading floors could soon get a dramatic makeover.

“We do believe—and we think we will see—a little relaxing of the rigidity of the planning and the shape of trading floors,” Rocco Giannetti, managing director at architecture firm Gensler, told CNBC. “Maybe trading floors don’t need to be as large. Maybe they don’t need to be as dense. Maybe the configurations don’t have to be so linear, so we’re starting to study what that could look like,” he added.

Gensler is an expert in designing office spaces for the financial services industry. The firm has worked with a number of banks, including designing the Bank of America tower in New York City’s Bryant Park, which was completed in 2009. Gensler’s other clients include JPMorgan, Deutsche Bank, Citigroup, Nomura and Societe Generale.

Ease of communication has always been pivotal when thinking about the design and layout of trading floors. But in more recent years, banks have also focused on providing enhancements around the trading floor, such as greenery and coffee bars, as a way to counteract the day-to-day stresses for traders. This trend is likely to accelerate in the wake of Covid-19, especially as banks look to recruit and retain talent in the hyper-competitive industry.

A broker looks at financial data on computer screens on the trading floor at ETX Capital, a broker of contracts-for-difference, in London, U.K., on Friday, June 9, 2017.

Jason Alden | Bloomberg | Getty Images

Giannetti and his colleague Marisol DeRosa, strategy director at Gensler, recently hosted a roundtable with representatives from the top financial institutions to discuss work-from-home policies and possible ways to brings traders back into the office. One key theme that emerged was the smoother-than-expected adoption of remote technology, and how this might play a role in more flexible work policies going forward.

“Before this, there was a lot of trepidation or hesitation to be the first financial institution to move forward with untested technology on the trading floors,” Giannetti said. “They’ve learned that you know what [happens when] they’ve ripped off the band aid and technology works, and that’s no longer a limitation.”

DeRosa added that more recently, as work from home stretches on, the conversations with executives have shifted to focus on what flexibility over the longer term might look like. This includes such things as de-risking trading-from-home policies, as well as testing different work-station configurations on the trading floor, rather than long rows of desk after desk.

The majority of bank employees were sent home in mid-March as the country went into lockdown. This included traders, in a move that was previously thought impossible due to a host of factors, including regulatory concerns and specialized software that could only be accessed from the trading floor. But Wall Street was forced to adapt. And banks’ trading revenue during the second quarter — including JPMorgan’s record number — shows that adapt they did.

An employee watches a news broadcast on the trading floor at Panmure Gordon & Co. in London, U.K.

Matthew Lloyd I Bloomberg via Getty Images

The head of JPMorgan’s corporate and investment bank recently told CNBC that in the near future a rotational model will be in place in which workers will cycle between days spent at the office and at home while keeping the ability to work remotely on a part-time basis. In New York, the firm’s buildings are at roughly 10% capacity over all, while trading businesses are closer to 30% capacity.

As more traders head back to the office, DeRosa noted that short-term fixes such as employees divided into different “teams” that are in the office at different times, as well as plexiglass screens placed between work stations, could pop up. A hub-and-spoke strategy could also be implemented, in which traders are based at multiple office buildings around a central city. Similar to other office spaces, longer-term changes will likely include more touchless technology like automatic doors and contactless lights.

While trading from home has proved successful and more flexible policies could be in place going forward, Giannetti ultimately believes that people will want to head back to the office once the pandemic abates.

“When we do have a choice, we feel people will want to return to the office, want to return to the trading floors, because there’s no way to recreate that connection to culture, the community building, and the brand, other than by the in-person experience,” he said.

– CNBC’s Hugh Son contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.