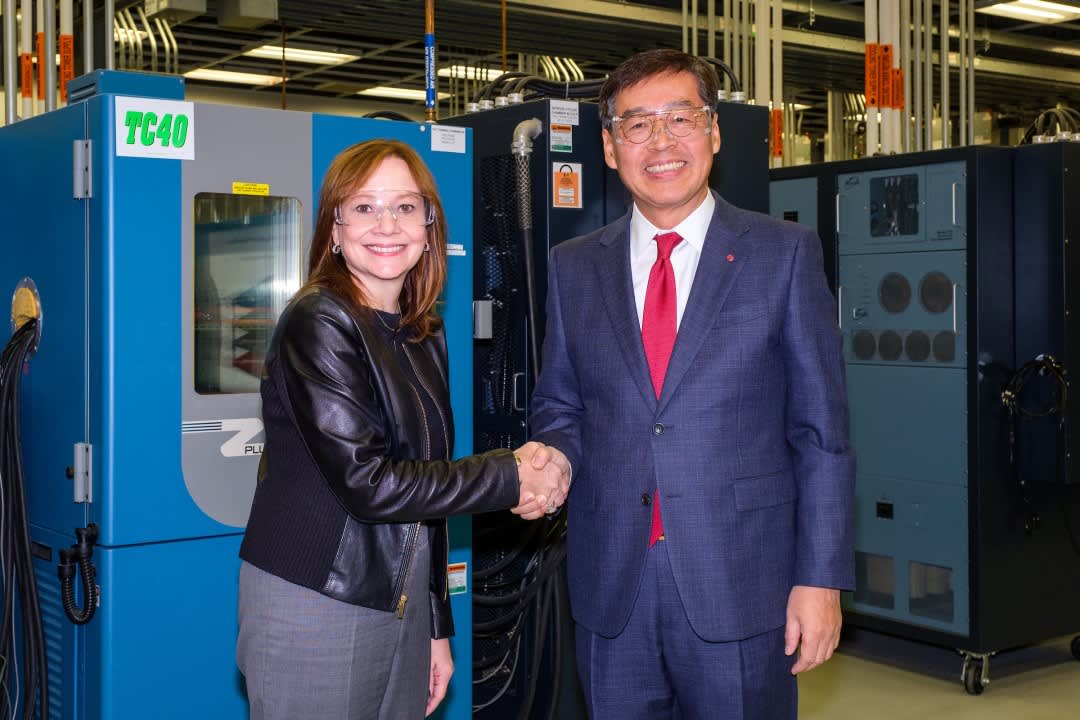

GM CEO and Chairman Mary Barra and LG Chem Vice Chairman and CEO Hak-Cheol Shin at the automaker’s battery lab in Warren, Mich., where the companies announced a new $2.6-billion joint venture on Dec. 5, 2019.

GM

DETROIT – General Motors’ $2.3 billion joint venture with LG Chem for production of battery cells for electric vehicles is “more than a collaboration,” it’s a necessity in today’s rapidly changing automotive industry.

The announced joint venture between America’s largest automaker and the South Korean chemical giant adds to a growing list of tie-ups for the auto industry as companies attempt to share in the monumental costs of electric and autonomous vehicles.

Automakers such as GM are annually spending billions on the emerging technologies in an attempt to gain an upper hand on the potential multitrillion-dollar businesses, which many believe will transform transportation as we know it and assist in lowering global carbon emissions. But, for the moment, remain unprofitable.

Mark Wakefield, global co-leader of the automotive and industrial practice at AlixPartners and a managing director at the firm, said the “tricky balance” of investing in new technologies while keeping traditional business operations profitable is one of the main drivers for the uptick in auto industry partnerships.

“All these things take this tremendous investment and aren’t going to pay off with a top-end profit next year or the year after or the year after that,” he told CNBC on Friday. “But they are somewhat existential if you want to be in the game 10 years from now. That’s where partnerships come into play.”

A report by AlixPartners earlier this year estimated the industry’s annual spending on autonomous driving and electric vehicles will reach a cumulative $85 billion by 2025 and $225 billion by 2023, respectively.

The capital being spent on electric vehicles alone is roughly equal to the massive amount that all automakers globally combined spend on capital expenditures and research and development in a year, according to the firm.

“To invest in these electric vehicles and CASE (connected, autonomous, shared, electric vehicles) in general, you’re taking one years’ worth of investment out of every five out of the picture,” Wakefield said. “That’s an extraordinary amount to take out and keep the trains running on time of your vehicle programs and traditional business.”

Billions in tie-ups

Some of the most prominent collaborations this year have been between automakers and tech companies, however many have been automakers deciding to share costs with traditional competitors.

The largest announcement thus far this year is the planned merger between Fiat Chrysler and French automaker PSA Group. It would create the fourth-largest automaker by sales in the world with a roughly $50 billion valuation.

Fiat Chrysler CEO Mike Manley described it as a “potentially industry-changing combination,” while PSA CEO Carlos Tavares said the “convergence brings significant value to all the stakeholders and opens a bright future for the combined entity,” including autonomous and electric vehicles.

Major non-merger deals included: Hyundai Motor and auto supplier Aptiv creating a $4 billion autonomous vehicle joint venture; Volkswagen agreeing to invest $2.6 billion in Ford Motor-backed autonomous vehicle startup Argo AI as part of a global alliance; Amazon, Ford and others investing hundreds of millions in startup EV manufacturer Rivian; and German automakers Daimler and BMW jointly investing more than $1 billion in mobility services.

Jim Hackett (r), CEO of Ford, and Herbert Diess, CEO of VW, at the Detroit auto show last January.

Boris Roessler | picture alliance | Getty Images

“These companies, especially on the autonomous side, they’re finding it’s harder to develop this stuff than they thought it was going to be, so they’re teaming up to spread those costs and share the expertise that they have across a broader range of vehicles to try and get some scale,” said Sam Abuelsamid, principal research analyst at Navigant and an engineer.

AlixPartners reports the number of automaker partnerships increased 43% from 2017 to 2018 to 543, led by a 122% increase in autonomous vehicles tie-ups to 115.

The partnerships are separate from mergers and acquisitions, which AlixPartners said were “down a bit” last year from 2017. However, the firm reports the portion of closed deals last year related to connected, autonomous, shared, electric vehicles rose five percentage points to 55%, worth $21 billion, in 2018.

Other high-profile deals this year included: Toyota Motor taking a 4.9% stake, valued at more than $900 million, in Suzuki; Ford creating a $275 million joint venture with Mumbai-based Mahindra & Mahindra; and Honda Motor and Hitachi announcing plans to combine car parts businesses to create a $17 billion components supplier. In September, Toyota announced plans to raise its stake in Subaru from 17% to more than 20%, expanding their partnership to invest more efficiently in new technologies.

Seeking profits

Executives from several automakers, including GM and Ford, have said their next-generation electric vehicles will be profitable — a challenge the industry has faced for nearly a decade.

“For competitive reasons and also for regulatory reasons, everybody has to have EVs in their lineup. The challenge is selling them profitability,” Abuelsamid said. “That’s something everybody has struggled to do so far.”

GM CEO Mary Barra on Thursday confirmed the joint venture with LG Chem will assist in the company’s plans for profitable electric vehicles, which are expected to begin rolling out in 2021.

“The new facility will help us scale production and dramatically enhance EV profitability and affordability,” she told reporters when announcing the joint-venture with LG Chem. “Ours is a long-lead industry and having accelerated our product planning and production processes, we will develop a greater range of EV options that truly alter our product portfolio.”

The Ohio plant, according to GM, is expected to drive cost per kilowatt-hours, a key metric for making electric vehicles more affordable, to “industry-leading levels.” The GM-LG Chem collaboration also includes a joint development agreement to develop and produce advanced battery technologies.

“The joint venture that we are signing today is more than just a collaboration,” LG Chem Vice Chairman and CEO Hak-Cheol Shin said Thursday at the media event. “It marks the beginning of a great journey that will create an emission-free society and transform the global automotive market into an eco-friendly era.”