For investors in lidar startups, this has been a long time coming.

After years of talk — and a SPAC boom in the sensor sector — automakers have finally started incorporating lidar units into their vehicles. And many more lidar-equipped models are expected over the next few years.

Lidar, short for light detection and ranging, is a sensor technology that uses invisible lasers to create a detailed 3-D map of the sensor’s surroundings. Lidar sensors are considered important components of nearly all autonomous-vehicle systems currently under development. They’re also finding increasing applications with advanced driver-assist systems as well as many other areas of robotics.

Playing into investors’ intense interest in self-driving technology, many lidar startups went public via mergers with special-purpose acquisition companies, or SPACs, over the last few years. Valuations for those companies have since fallen sharply, but a few — namely Innoviz, Luminar and Ouster — could finally be poised for major growth, and soon, as automakers rush to adopt more advanced hands-free driving systems.

While the big money is still a few years away, a few of those startups are already separating themselves from the pack with growing order books, fast-evolving technology, and revenue — right now, or soon — in the tens of millions of dollars.

Market share up for grabs

Israel-based Innoviz, which went public via a SPAC merger in late 2020, will soon see its units on the road: A hands-free highway-driving package on BMW’s new 7 Series, set to launch in Germany by the end of the year and elsewhere in 2024, will include an Innoviz lidar sensor nestled in the big sedan’s front grille.

That sensor, together with software that Innoviz developed for BMW, gives the vehicle’s computer brain a constant look at what’s in front of the car, out to about 250 meters.

Innoviz CEO Omer Keilaf thinks that new BMW will be followed by a wave of vehicles equipped with lidar sensors.

“The technology is safety critical, there are very high levels of tech differentiations, and the player that wins the most business is ultimately going to have a scale and cost leadership advantage that is likely going to be difficult to match,” Keilaf said during Innoviz’s earnings call earlier this month.

“We believe that a major portion of the industry market share is going to be determined in the next 12 to 18 months,” he said.

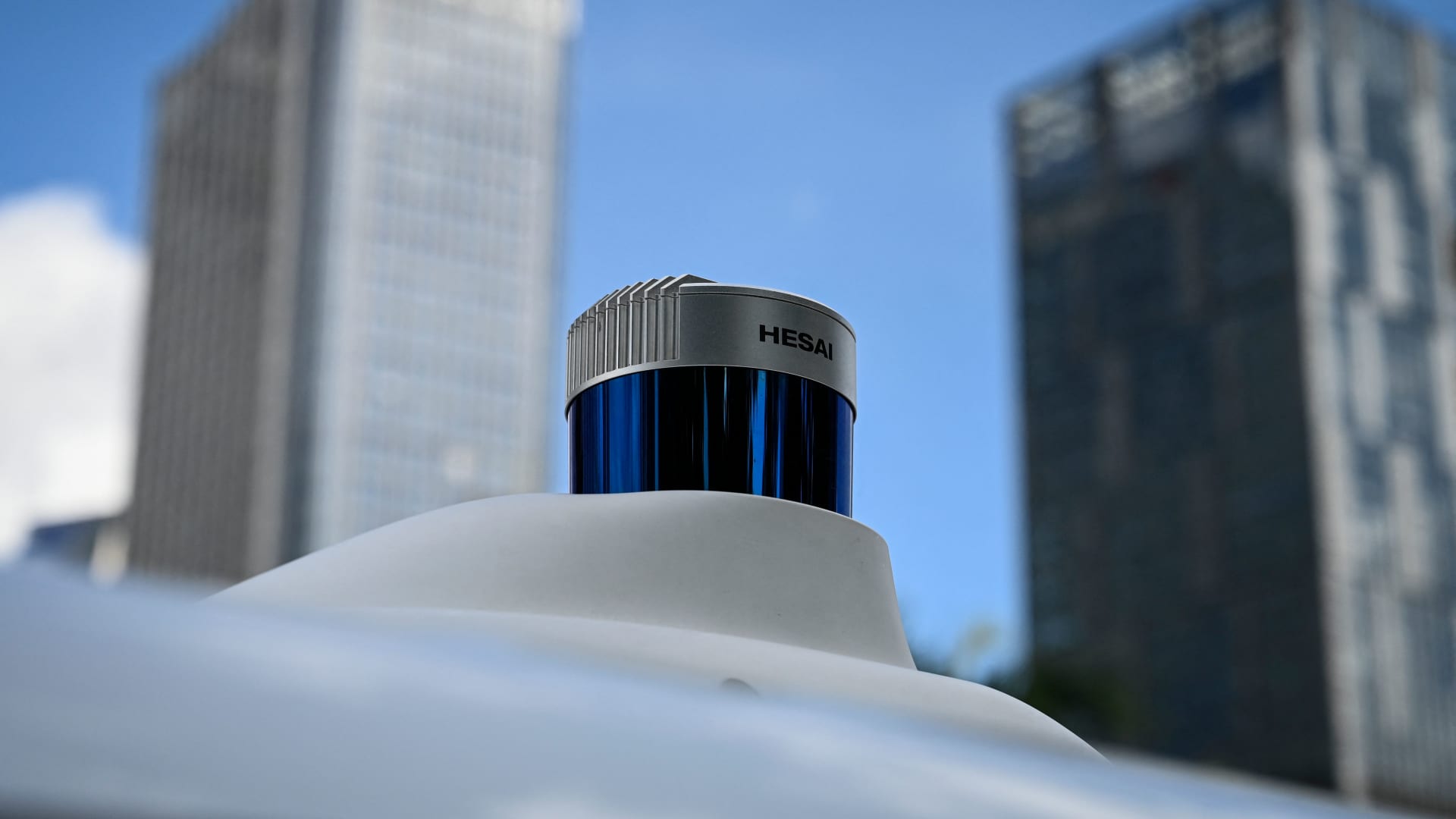

Not all of that market share will be claimed by Innoviz, of course. Some will go to existing global auto suppliers, which may or may not turn to startups for the technology. In China, the market is already led by local lidar maker Hesai, which generated $123.2 million in revenue in the first half of 2023.

But the worldwide addressable market is likely to be large enough to leave significant opportunities for a few of the post-SPAC U.S. startups.

Aside from its work with BMW, Innoviz has a big contract with Volkswagen and is deep in talks with several other global automakers.

Analysts polled by Refinitiv expect Innoviz to report just $6 million in revenue in 2023, but they see it growing to $17.1 million in 2024 once its shipments to BMW get up to full speed.

That’s more than most of the company’s post-SPAC cohort is expected to generate, but it’s well behind forecasts for the two emerging leaders of the group, Luminar and Ouster.

Building to scale

Luminar, based in Orlando, Florida, has perhaps the most name recognition of the group among U.S. investors. It has the largest market cap as well, at around $2.2 billion.

Luminar is focused entirely on automotive lidar, designing its own silicon chips and offering related software as well.

Led by CEO Austin Russell, Luminar has locked up deals to supply lidar and software to Volvo Cars, EV maker Polestar, Mercedes-Benz, and Israeli automotive visual sensing giant Mobileye, among others. The deals cover more than 20 upcoming new vehicles from major automakers in total.

Luminar, which began shipping its lidar units in November, has big ambitions, but as Russell pointed out during its most recent earnings call, it doesn’t need huge market share to make money.

“Our target market penetration by the end of the decade is only 3% to 4%,” Russell said. “Because we think even with that, we’ll be able to achieve around $5 billion revenue and $2.5 billion EBITDA with as much as a $60 billion forward-looking order book at that point.”

Russell sees Luminar growing its forward-looking order book, which stood at $3.4 billion at the end of 2022, by at least another $1 billion in 2023. But most of that revenue is years away, and the company still has a long way to go before it starts reporting profits.

Luminar CFO Tom Fennimore said earlier this month that investors shouldn’t expect Luminar to hit breakeven until the end of 2025.

Wall Street thinks Luminar has the cash to stick around until then, and it likes the look of the lidar maker’s pipeline: Analysts expect Luminar to deliver $84.5 million in revenue this year, growing to $268.4 million in 2024, according to Refinitiv.

Looking outside autos

Ouster is arguably Luminar’s closest rival, but it has a somewhat different focus – and a much smaller market cap, at around $250 million.

While waiting for the auto industry to adopt lidar at scale, CEO Angus Pacala has sought out opportunities beyond autos. Ouster’s lidar units can be found in automated mining trucks and forklifts, in drones used for mapping, and even in cities, helping to improve pedestrian safety.

But Pacala agrees that the market for automotive lidar is about to grow significantly. He said earlier this month that Ouster is about to begin shipping samples of a new low-cost solid-state lidar sensor called DF to automakers. A more advanced version – incorporating a new custom chip – is set to follow next year.

Wall Street doesn’t expect Ouster’s revenue to grow quite as dramatically as Luminar’s, but it’s still likely to see significant growth – from $82 million in 2023 to $136.3 million in 2024, per Refinitiv.

Unlike Luminar and Innoviz, Ouster hasn’t yet announced big orders from automakers. But Pacala thinks DF could bring in a lot of new business.

“You don’t need to be first as long as you’re building the thing that’s going to be sustainable long term, and that’s an integrated solid state digital technology,” he said. “And so the DF shines because it’s low cost, it’s solid state, it’s digital. There’s really nothing like it in the world other than this device, and we’re putting it in the automakers’ hands this quarter.”