See where you fit on the money accumulation curve.

If you are curious about whether you are keeping up with the Joneses, our calculator will help.

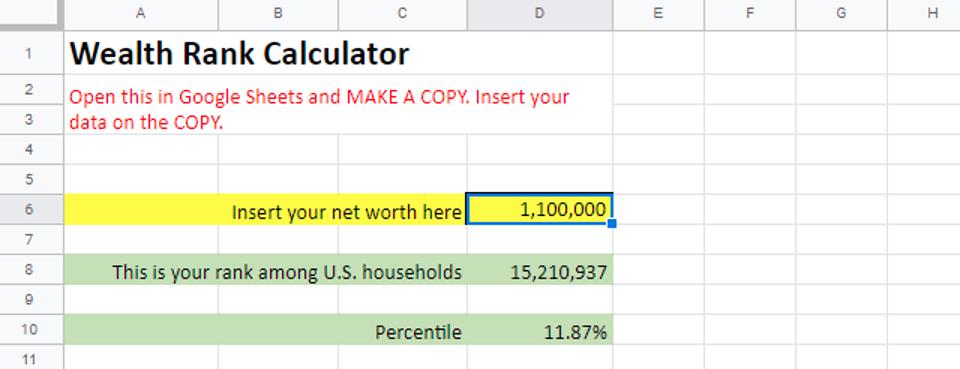

Open the Google Sheet document. Make a copy. Insert your net worth. The spreadsheet will tell you where that ranks you among 128 million U.S. households.

Google Docs

Wealth Calculator

Forbes

You need just shy of $1.4 million to be in the top 10%. To be a one-percenter, accumulate $10.2 million.

In this ranking, wealth includes home equity (often excluded in discussions of millionaires). It does not include the value of pensions, annuities or future Social Security benefits.

The calculations are based on: the 2016 Survey of Consumer Finances; estimates of population growth, asset appreciation and inflation in the past three years; the pattern of wealth distribution uncovered in the Forbes Billionaire and 400 reports, and hunches about how many rich people escape detection by our Rich List investigators.

Understand that there is a fair amount of uncertainty in this or in any assessment of wealth. The fed surveyors may or may not get an honest figure for how much a $400,000 household has in home equity and 401(k) accounts. They assuredly do not get representative and candid answers from $40 milllion households, especially about the value of artwork and offshore investments.

As for the missing billionaires, there are probably none at the $20 billion level but enough at the low end to affect the shape of the wealth curve. Bear in mind that mere suspects do not make it onto published lists and that sometimes a sale or stock offering causes a previously unsuspected candidate to pop into view.

The calculator is valid only for net worths in the upper half. Below the median, the pattern of wealth distribution is entirely different, not least because there are a lot of households with negative worths. Negative numbers simply don’t fit into the power-law trends seen at the high end of the distribution.

To land in the upper half, you must have a net worth of at least one microBeze. That’s defined as one-millionth the loot of the Amazon founder, or $114,000.

While we don’t offer a way to compare wealth numbers inclusive of pensions and Social Security, you should pay attention to them in assessing your retirement readiness. Either of those things could be your biggest asset.

For a calculator that tells you how much a pension is worth, go to Maximize Your Pension With This Calculator.

To evaluate your Social Security asset—it could easily be worth $1 million—go to Social Security Claiming Strategy for High Incomes.