Hemant Shah has built a three-decade career working exactly two jobs — both in an area called risk management. Shah founded RMS, a catastrophe risk modeling company for the insurance industry in 1989 while in grad school at Stanford University. From RMS, Shah learned that commercial property owners didn’t have much control over their risk insurance, which required an arduous annual process of documentation, taking photos, and sharing records for insurers to verify, despite it being their risk at the end of the day. He thought it was time to improve the system from the otherside.

“They do this every year like Groundhog Day,” Shah tells Forbes. “It’s a very challenging process, very laborious. Not only is it inefficient, it’s very difficult to integrate these data sets to produce a picture in the way that underwriters can use.” Information that could help commercial real estate owners lower their costs was easily lost amidst the shuffle. His new company, Archipelago, is looking to make the process easier for the property owners using AI. With co-founder Roger Bodamer, Shah spent two years in research and development, emerging from stealth in August with $780 billion in property already on the platform.

San Francisco-based Archipelago announced an oversubscribed $34 million Series B round on Tuesday as originally reported in the Midas Touch newsletter. The round was led by Scale Venture Partners, with participation from Canaan Partners, Ignition Partners, Zigg Capital, Stone Point Capital Partners and Prologis Ventures, valuing the company at $184 million. The startup plans to use the funding like many do: hire a bunch to keep up with demand and expand its footprint. Less than a year after launch, Archipelago covers more than $2.3 trillion worth of real estate and counts among its clients real estate giants Prologis and JLL. The service is designed for businesses across commercial real estate including data centers, office buildings and hospitals, among others. Shah says the insurers actually like them, too, with more than 1,000 insurance brokers and underwriters on Archipelago already.

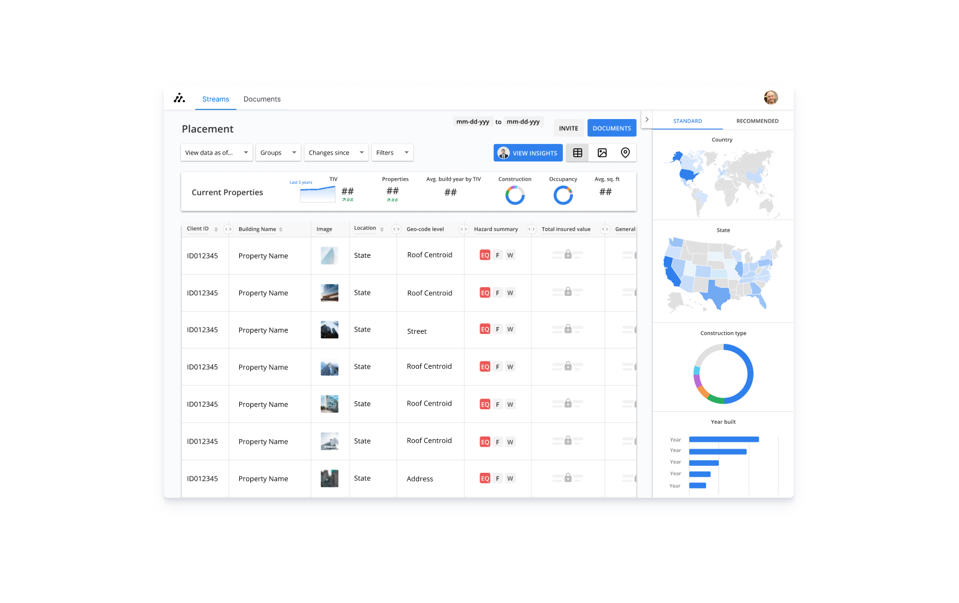

Archipelago allows commercial real estate owners to be manage and apply for risk insurance.

Courtesy of the firm.

Commercial real estate companies sign up for a subscription and upload any documents they need to apply for risk insurance, like a recent roof inspection certificate or engineering structural drawings, and Archipelago does the rest. “There is a tremendous amount of data that owners need to gather to then share that is locked inside of documents, photographs and semantics,” Shah says. “We make it easy by enabling these owners not to fill out forms but to upload documents into smart folders, where our machine learning can extract all the critical information that is needed to describe the underlying risk.” The service operates similar to Zoom in the sense that the insurers don’t need to use or pay for the software in order to join and process the documents.

At Prologis, a real estate investment trust, senior vice president Jeff Bray says he was hooked from the moment the Archipelago team reached out to Prologis for feedback during development. “I was really frustrated with the fact that for the last 14 years this process has not changed much, even as I and others have tried,” Bray says. “The information I have available to make business decisions today is much different from what I had 15 years ago and yet the process is the same.” Bray adds that Shah’s proven track record in the risk management space didn’t hurt either.

Archipelago is focused on North America, with plans to break into Europe and Asia. The startup is currently testing pilots with sensor and property tech providers with the future goal of integrating their data on its platform. Bray adds that this service comes at a time when the risk management sector is at an inflection point due to climate change. The variability of the weather — and mega-storms increasingly the norm — is changing the risk profiles of buildings yearly. It’s not the most immediate concern for property managers mindful of Covid-19 protocols; but it could be the next big one.

“The insurance industry is a very large business and it also plays a fundamental role in the economy,” Shah says. “I’m a big believer that a more data-driven transparent insurance market can unlock more abundant coverage at more cost-effective pricing.”