Fullerton Police officer wears his Axon body camera on his chest while on patrol in Fullerton, California, on February 16, 2017. A proposed bill in the California legislature would ban law enforcement in the state from using facial recognition software and biometric scanners in body cameras. Axon body cameras do not use facial recognition software.

MediaNews Group/Orange County Register via Getty Images | MediaNews Group | Getty Images

For Axon Enterprise, having its new chief software executive accompany police officers on midnight ride-alongs and sit inside a 911 dispatch center isn’t just part of his job initiation. It’s also an indicator of where the company, known for Tasers, body-worn cameras and, more recently, enterprise software for law enforcement, is headed.

In September Jeff Kunins joined Axon from Amazon, where he was vice president of Alexa Entertainment. “He’s my software soulmate,” says Rick Smith, co-founder and CEO of the Scottsdale, Arizona-based company, which also has a Seattle office and has been drawing employees from big tech firms for the past few years.

“I came up building Taser weapons in my garage. As we extended into software and cameras, things I didn’t personally come up with, I didn’t have that level of personal expertise — that’s where Jeff fits in,” said Smith.

Kunins now oversees Axon’s software road map, the list of technologies Axon thinks will be big over the next decade. While this might include Alexa-like voice interaction for police — “For anyone handling a gun, the more we can get them hands-free, the better,” Smith said — it definitely includes leveraging artificial intelligence to make police work easier.

AI applications Axon has already developed include technology that automatically populates an officer’s police report after it captures driver’s license info with a body cam, and software that knows to instantly blur civilian faces on dash-cam video.

These types of applications, if they work well, will go a long way in bolstering Axon’s status as a market maker for law enforcement, a title it earned in the early 2000s when it started selling the Taser.

Axon is more interesting now than ever.

Keith Housum

Northcoast Research

Smith, with Kunins’ help, is ready for Axon’s next big thing: Scaling its new software-as-a-service offerings so Axon can compete with legacy rivals and dominate every conduit connecting law-enforcement agents and their hardware to the back office.

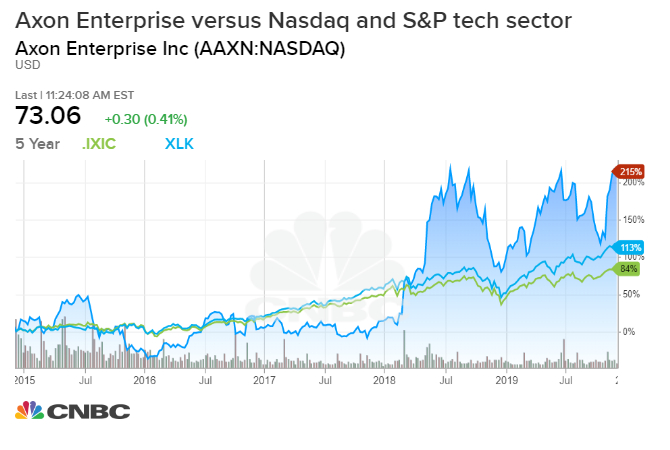

“Axon is more interesting now than ever, given the growth potential and overall prospects for profitability,” says Keith Housum, an equity research analyst with Northcoast Research who holds a buy rating on Axon stock. “If you look at the incremental profit margin of an SaaS company vs. a hardware company, they’re pretty impressive.”

Axon formally became a technology provider in 2009 when it launched Evidence.com (now Axon Evidence), a cloud-hosting service where police departments store digital assets — namely, video from Axon body cameras. And though Taser sales, at $72 million for the third quarter of 2019, made up the largest share of Axon’s record quarterly revenue of $131 million, the company is betting long-term growth on its Officer Safety Plan, a bundled product that includes hardware devices, storage and records management software for a recurring monthly fee.

The entrance to Axon Enterprise’s Seattle office location. The maker of law enforcement technology like the Taser recently hired an Amazon Alexa executive as it pushes further into cloud offerings.

Axon Enterprise

The evolving business model at Axon is very Amazon- and Apple-esque: Having customers already locked into its subscription-based ecosystem will make it much easier to sell them new products down the road.

“We’re very successfully building a high-margin SaaS business on top of our existing hardware business,” said Axon CFO Jawad Ahsan on the company’s most recent earnings conference call. For the past six quarters, revenue grew nearly $10 million on average per quarter. “We expect this trend to accelerate in 2020,” the Axon CFO said on the call.

Cloud revenue grew 42% year-over-year, to $34 million in Q3, and with higher gross margins than Taser sales.

While the Taser market has shown continued growth — with sales up 18% in the most recent quarter and near 13% in the past year — cloud and sensor businesses have grown 40%-plus year-over-year. The company also has been migrating many Taser customers to a recurring payment plan, with 55% of Taser sales in Q3 made on a subscription basis, up from 33% a year ago.

Much of Axon’s growth over the past few decades evolved from some of its own pain.

Around 2005, after the less lethal selling point of its conducted electrical Taser weapon hit big with police departments, “we found ourselves in a confluence of controversy,” Smith said.

Sales were gangbusters, but Axon — then Taser International — became mired down by product liability litigation stemming from its weapon use in high-risk situations, antipolice and anticorporation sentiment, and lots of shortselling of its stock.

“We had to reevaluate our business model, and we started from a position of defense,” Smith said. “A big part of that was moving into transparency around how our product was being used.”

Axon started attaching tiny cameras to the bottom of its weapons so agencies could see how officers were using Tasers. It eventually shifted to making body-worn cameras, and as demand soared, the company noticed that police departments were struggling with storing and managing all the video.

“The body camera gave us a reason for the cloud to exist at law enforcement — it allowed us to become a deeper tech partner for our customers,” Smith said.

After launching the cloud-based service Evidence.com, the company started looking more closely into the challenges that police departments face. “As the biggest cloud software stack in law enforcement, we saw that we could become a disruptive force across all of our customers’ software technology.”

Police budgets are tight

With more than half of the largest North American law-enforcement agencies using its body-worn cameras and/or cloud software — Motorola’s WatchGuard holds some market share, too — Axon is the largest player by revenue in the half-billion-dollar industry, according to research firm IHS Markit. But as Axon looks to expand its hardware streams by pushing into the state corrections market and further into federal agencies, dominance of public safety software might be more elusive.

First there’s competing against legacy firms like Motorola Solutions, Niche Technology and Tyler Technologies, who have been providing police departments with records management software for years, but Axon’s deep experience with law enforcement will keep it competitive.

“Axon has so much experience dealing with law enforcement culture from its Taser side of the house and has historically demonstrated an ability to be pretty nimble in changing its technology to best utilize the feedback they receive,” said Thor Eells, executive director of the National Tactical Officers Association.

A bigger hurdle relates to the budget size of the most of the nation’s police departments. Of the nation’s 18,000-plus police departments and 3,000 sheriff’s departments, 80% have fewer than 50 officers and their budgets are significantly less than the spending budgeted to the largest 20% of police department, according Eells. “Very few agencies have big record management systems — they can’t afford it.”

For agencies that do have such software, the costs of migrating to a new department-wide system could be prohibitive. So could being locked into five-year contracts, which is how Axon’s Officer Safety Plan, which costs from $109 to $199 per officer per month, works. “Everything might be great when you sign the dotted line, but what happens if the bottom drops out of the economy next year?” says Eells. “Now the agency is obligated to this cost and that budget is going to take a huge hit.”

Civil liberties and technology

There are also contentious issues revolving around how some of Axon’s new technology could impact civil liberties.

To address things like how law enforcement should be allowed to use facial recognition technology and license plate recognition software without comprising our privacy rights, Smith created the Axon AI and Policing Technology Ethics Board, a mix of police veterans, privacy experts and civil libertarians including Barry Friedman, a law professor and director of the Policing Project at New York University School of Law.

Initially founded as a sounding board for how Smith could prepare to defend Axon’s technology, the board’s insight has become part of Axon’s product development. In its first report, which came out over the summer, the board urged Axon to forgo selling facial recognition technology on its body cameras, arguing it’s not yet reliable enough to be deployed ethically.

Axon assented. The company decided to hold off on investing in further development of face-matching technology until it can figure out how to make it more accurate. Axon also wants to establish the necessary privacy and accountability safeguards to prevent police misuse when it comes to surveilling people, says a company spokesperson.

The board seems satisfied with its relationship with Axon: “So far, Axon has been extremely receptive to the board’s input and has followed it carefully,” says Friedman, who receives a stipend for board meetings.

Amazon, which is the largest cloud services provider in the U.S., has marketed its facial recognition software to law enforcement around the U.S. and has faced pushback from its own employees and public criticism.

Police officers using Axon Evidence, a cloud hosting service where police departments store digital assets — namely, video from Axon body cameras. Cloud revenue is growing at 40%+ for Axon Enterprise, once known primarily for creating the Taser.

Axon Enterprise

Axon is currently receiving guidance from its ethics group about license plate readers. Smith said it’s about “how to build the right controls and oversight so a department can be transparent in their community.” He noted that police admins will be able to limit and prohibit certain searches for certain personnel. “Cities will want to choose our technology because we’re building these thoughtful controls in place,” Smith said.

Even with his deep connection to law enforcement culture, Smith is a proponent of moving away from excessive use of force by police. (His new book, The End of Killing, calls for a complete revamp of the security of society.)

At this particular moment in history, the specter of gun violence and threat to social justice around the world have created the need for millions of people to both feel more safe and be more safe.

Jeff Kunins

Axon chief software executive

In his first earnings conference call with analysts in November, Kunins cited a shooting just a few miles from his children’s elementary school where a teacher was shot, and a meeting between Seattle tech leaders and a father of one of the Parkland Florida shooting victims at which they were all challenged to do more, among the reasons he decided to leave Amazon. He also read Smith’s book after an Axon board member first put the company on his radar. “At this particular moment in history, the specter of gun violence and threat to social justice around the world have created the need for millions of people to both feel more safe and be more safe,” Kunin said on the call.

The board nudging Axon to think about how its products impact the customers of its customers — the general public — will likely help position the company to better weather the broader fights it’s up against regarding how society today views policing. With little regulation guiding things like facial recognition technology, having a product that’s been vetted by prominent civil rights experts might also give Axon a leg up as bigger competitors like Amazon move into the space. Amazon CEO Jeff Bezos has said the company’s public policy team is working on proposed regulations around facial recognition. Its Rekognition system has been used by law enforcement in Oregon, among other places. Orlando’s police department stopped its use of the Amazon facial recognition technology in 2018 after a pilot phase ended.

“As a society we need a way to get control over technologies used by police that implicate civil rights, liberties and racial justice,” says Friedman. “Working with a vendor who is so prominent in this space seemed an intriguing possibility.”

Virtual reality for critical situations

Axon recently starting rolling out empathy training scenarios within Axon Academy, its network of in-person and online instruction. Inspired in part by the ways some international aid organizations have been using virtual reality to create empathy for Syrian war refugees, Axon offers VR headsets that immerse officers in situations that present three different mindsets: someone suicidal, someone with autism and extra sensitivity to lights and noise, and someone with schizophrenia.

“It shows them what it’s like when an officer shows up, yells, points a gun and there are bright lights streaming from a car,” Smith said. “It shows officers that in this situation, that activity may be counterproductive and could trigger someone who has a mental health condition to do something where you might shoot them.”

These offerings were developed based on feedback from police agencies. Because the majority of police calls for service involving someone in crisis entails a person with schizophrenia, Axon introduced that module first. Racial sensitivity training may come in the future as Axon builds out its training catalog.

This commitment to a more compassionate approach to public safety is something investors might like these days, too. “From an investor standpoint you like to hear that there’s a citizen review committee independently reviewing how police are working,” said Northcoast Research’s Housum. “They want to know there are tools to document; that also could be an opportunity for Axon to make another sale down the road.”

Ultimately, Axon maintaining its status as one of the biggest growth stories in the law enforcement technology market will come down to an old law enforcement adage: Politics dictate tactics.

“What’s unique about Axon is not only do we get to work on interesting technology, we’re working on really impactful social problems,” Smith said. “There’s something rewarding about working on things you see in the news every night, things that can be very divisive. These are issues for us as a tech company to be squarely running into.”